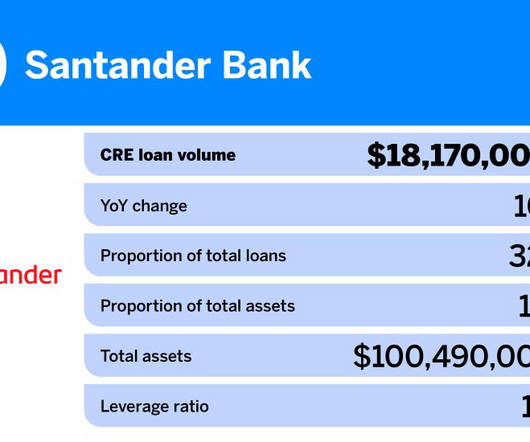

20 U.S. banks with the largest CRE loan volume

American Banker

MARCH 27, 2024

The top five banks had a combined commercial real estate loan volume of more than $500 billion at the end of the fourth quarter of 2023.

American Banker

MARCH 27, 2024

The top five banks had a combined commercial real estate loan volume of more than $500 billion at the end of the fourth quarter of 2023.

Payments Dive

MARCH 27, 2024

The social media platform is now nearly halfway to securing the state licenses needed to fulfill owner Elon Musk’s vision of a nationwide payments app.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Commercial Lending USA

MARCH 27, 2024

Assisted living construction loans are a type of loan that is meant to help build senior living communities.

Payments Dive

MARCH 27, 2024

The follow-on class actions are substantively similar to the federal government’s case, making them dependent on the agency’s lead in breaking the company’s smartphone stranglehold.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

ATM Marketplace

MARCH 27, 2024

CX expert Shelly Chandler of EvolveCX Consulting shares how banks can transition data into actionable insights in today's episode of CX Innovators.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

MARCH 27, 2024

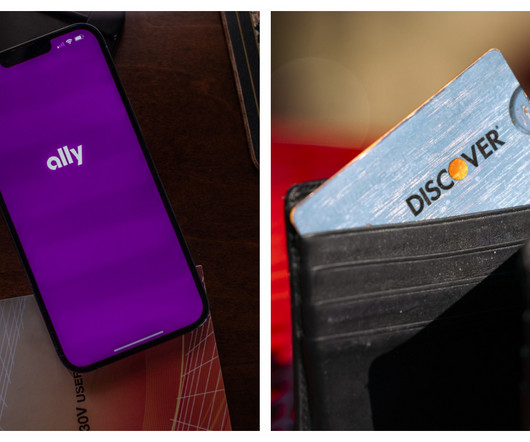

Ally Financial ended a six-month search for its next chief executive by hiring Discover CEO Michael Rhodes. The move adds a new wrinkle to Discover's pending sale, though Discover said that Rhodes hadn't been expected to have a long-term role at Capital One following the merger's completion.

Payments Dive

MARCH 27, 2024

Major credit card providers offset attractive rewards programs with fees and interest, costing consumers carrying balances, CFPB Director Rohit Chopra said.

TheGuardian

MARCH 27, 2024

Tom Hayes, first banker to be convicted in 2012 rate-rigging scandal, had his case rejected by UK court of appeal Business live – latest updates Tom Hayes, the first banker to be convicted over the Libor interest rate scandal, has said he is “not a quitter” and vowed to continue his near-10-year battle to clear his name after losing an appeal. Hayes and another former banker, Carlo Palombo, had their convictions considered by the court of appeal in London in a three-day hearing.

Payments Dive

MARCH 27, 2024

Michael G. Rhodes, who took the top post at Discover this year, is leaving to become the next CEO of the bank Ally.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

MARCH 27, 2024

The report seeks to help banks "disrupt rapidly evolving AI-driven fraud," according to Treasury's Nellie Liang. The report found banks have difficulties accounting for AI risks.

Payments Dive

MARCH 27, 2024

A New York assemblymember has introduced a buy now, pay later bill, countering one introduced in the governor’s budget bill.

The Paypers

MARCH 27, 2024

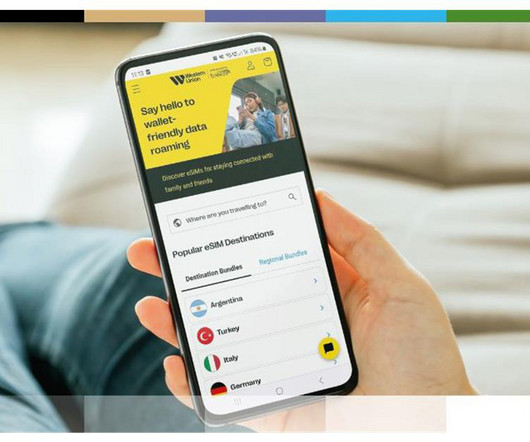

Western Union has launched its global eSIM mobile data service, which will enable customers to have full control over their connectivity needs and finances.

BankInovation

MARCH 27, 2024

Visa Inc. is adding three new AI-powered fraud-prevention tools to its suite of products for business clients as the credit-card giant uses the technology to improve security.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

MARCH 27, 2024

A panel at CBA Live explored the contract provisions banks need to consider before embarking on new banking-as-a-service relationships and what catches their eyes in consent orders from banking regulators.

BankInovation

MARCH 27, 2024

Swindon, U.K.-based Nationwide Group has offered to acquire U.K.-based financial institution Virgin Money for 2.9 billion pounds ($3.7 billion) in cash, according to a March 21 Nationwide release. The acquisition, which must be approved by the Financial Conduct Authority, would help Nationwide grow its customer base, deposits and operations organically, the release stated.

American Banker

MARCH 27, 2024

Harmonizing standards for liquidity coverage ratios and discount window pledges could prevent the type of strains that led to last year's bank failures, according to a new paper whose authors include former Federal Reserve Govs. Dan Tarullo and Jeremy Stein.

BankInovation

MARCH 27, 2024

Technology provider nCino is looking to create a single platform in the cloud that offers deposits, business loans and personal loans, while meeting regulatory demands and increasing overall efficiency.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

MARCH 27, 2024

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

BankInovation

MARCH 27, 2024

Financial institutions should expect to fail when exploring new technologies, Ami Iceman Hauter, chief research and digital experience officer at Michigan State University Federal Credit Union, said at the recent Bank Automation Summit U.S. 2024 in Nashville, Tenn.

TrustBank

MARCH 27, 2024

We are well into March which means tax filing time is upon us. Now would be a good time to securely send your tax information to your tax preparer (if you haven’t already). It is also an especially high time to be alert and vigilant to scams and fraud regarding your personal information. Fraudsters are looking to take advantage of mailings and emails from financial institutions regarding tax info.

American Banker

MARCH 27, 2024

U.S. financial markets are stronger and more resilient because of the contributions of international banks. But many aspects of the U.S. Basel III endgame proposal threaten to tilt the playing field against them.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

MARCH 27, 2024

Latvia-based multi-asset firm Mintos has announced its intentions to introduce a crowdfunding campaign on Crowdcube , a European private market investment platform.

BankInovation

MARCH 27, 2024

Financial institutions should expect to fail when exploring new technologies, Ami Iceman Hauter, chief research and digital experience officer at Michigan State University Federal Credit Union, said at the recent Bank Automation Summit U.S. 2024 in Nashville, Tenn.

The Paypers

MARCH 27, 2024

US-based payment technology corporation Mastercard has entered a collaboration with Worldpay aiming to improve the transaction experience by reducing payment fraud.

The Financial Brand

MARCH 27, 2024

This article Before You Boldly Go into Partner Banking, Focus on Data and Compliance appeared first on The Financial Brand. BaaS and embedded banking depend on the banking partner getting compliance and risk management right. You can't outsource responsibility. This article Before You Boldly Go into Partner Banking, Focus on Data and Compliance appeared first on The Financial Brand.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content