Affirm preps for UK launch

Payments Dive

MARCH 1, 2024

Beyond expansion to the U.K., the BNPL provider may seek to plant a flag where its large partners such as Amazon and Shopify have a presence, said Affirm’s Chief Revenue Officer Wayne Pommen.

Payments Dive

MARCH 1, 2024

Beyond expansion to the U.K., the BNPL provider may seek to plant a flag where its large partners such as Amazon and Shopify have a presence, said Affirm’s Chief Revenue Officer Wayne Pommen.

TheGuardian

MARCH 1, 2024

Thief went on £9,000 spree with the victim’s money before using her Uber account to travel to Stansted If you are one of those people who keeps their debit card in their mobile phone case, has a note of their pin on their handset, or only ever uses mobile banking, you may want to rethink your setup after you read the case of Sami Souret*. On a recent night out the 28-year-old healthcare professional was kind enough to help a man who asked to borrow her phone.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 1, 2024

FOBO or “fear of becoming obsolete” has long plagued workers concerned about AI replacing their jobs.

American Banker

MARCH 1, 2024

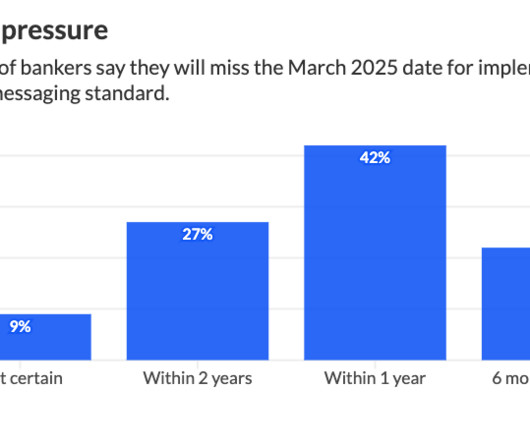

Some U.S. banks postponed taking action on ISO 20022, a new global financial messaging standard, while they were busy with preparations for FedNow's faster-payments launch last year. This may not leave them with enough time to meet a March 2025 deadline.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MARCH 1, 2024

The bureau seeks “to ensure that digital advertisements for financial products are not disguised as unbiased and objective advice,” CFPB Director Rohit Chopra said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

MARCH 1, 2024

JPMorgan is exploring the use of synthetic data to streamline its anti-money laundering and software engineering processes.

American Banker

MARCH 1, 2024

The community bank cites exposure to "heightened, and evolving, regulatory standards" in its decision to wind down banking-as-a-service operations.

CFPB Monitor

MARCH 1, 2024

The CFPB has released a supervisory order which establishes that the CFPB has supervisory authority over World Acceptance Corp. (WAC) based on the CFPB’s conclusion that it has reasonable cause to determine that WAC “is engaging in or has engaged in conduct that poses risks to consumers with regard to the offering or provision of one or more consumer financial products or services.” .

American Banker

MARCH 1, 2024

In this month's roundup of top banking news: The potential impact of Capital One's purchase of Discover, Citi's use of generative AI for its developers, the downfall of Heartland Tri-State Bank and more.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

CFPB Monitor

MARCH 1, 2024

On February 27, 2024, the U.S. Supreme Court heard oral argument in Cantero v. Bank of America, N.A. , a case involving the effect of the Dodd-Frank Act on scope of preemption under the National Bank Act (NBA). The specific question before the Court is whether, post-Dodd-Frank, the NBA preempts a New York statute requiring banks to pay interest on mortgage escrow accounts. .

BankInovation

MARCH 1, 2024

Citizens Bank’s virtual assistant, Digital Butler, was granted a patent this week for its “high degree of personalization,” Jo Wyper, executive vice president and head of operations at Citizens Commercial Bank, told Bank Automation News. Whereas retail solutions have personalized capabilities, commercial solutions often do not.

The Paypers

MARCH 1, 2024

NPCI International Payments Limited has signed an MoU with the Greek-based Eurobank in order to optimise cross-border payments using a UPI platform.

American Banker

MARCH 1, 2024

New York Community Bancorp faced new questions Friday after a flurry of disclosures led to a steep sell-off in its stock. The embattled Long Island-based lender beefed up its risk leadership, but Fitch cut its rating to "junk" status.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

MARCH 1, 2024

US-based Datos , supported by payments systems provider Finzly , has published a report that analyses the readiness of banks for the FedWire migration to the ISO 20022 standards.

ATM Marketplace

MARCH 1, 2024

Erik Halvorssen, head of distributor success at BitcoinATM.com shares how to use a Bitstop ATM to purchase bitcoin in a product demo.

TheGuardian

MARCH 1, 2024

Theatre Royal Sydney Directed by Sam Mendes, this Tony-winning corporate thriller whirls through 164 years of capitalism – yet still feels incomplete Almost 16 years after the collapse that triggered global financial panic, The Lehman Trilogy lands on Australian stages this month, to tell the story of the bank that was not, in fact, too big to fail.

American Banker

MARCH 1, 2024

Lisa Schirf, managing director and global head of data and analytics at Tradeweb, on using AI to build price prediction models for fixed income markets.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

MARCH 1, 2024

IDEX Biometrics has partnered with Accomplish Financial to introduce a new biometric programme designed for visually and memory impaired users.

ABA Community Banking

MARCH 1, 2024

ABA's Dan Brown and Sharon Whitaker discuss community bank exposures to commercial real estate and how community banks are managing shifts in the CRE sector. The post Podcast: The commercial real estate state of play appeared first on ABA Banking Journal.

The Paypers

MARCH 1, 2024

Mastercard has partnered with Loop , aiming to empower businesses and consumers in Saudi Arabia with access to advanced credit card offerings and innovative payment solutions.

American Banker

MARCH 1, 2024

Barry Sommers comes in for high praise amid his firm's attempts to move beyond the banking scandals of its past.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

MARCH 1, 2024

US-based fintech company Alloy has announced the launch of a new risk management solution for Embedded Finance partnerships.

American Banker

MARCH 1, 2024

The growing buy now/pay later industry requires regulations, but existing regulations for credit card lenders are not fit to the purpose. BNPL needs bespoke guidelines to protect consumers.

The Paypers

MARCH 1, 2024

Viva.com has announced the launch of Cartes Bancaire s, enabling France-based merchants to take contactless payments with Tap to Pay on iPhone.

American Banker

MARCH 1, 2024

The CEO of FirstBank in Colorado will retire at the end of the month, KeyCorp's chief accounting officer will depart, Fiserv pursues deal to buy Shift4 and more in the weekly banking news roundup.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content