30+ year mortgages – are these the new norm? What does this mean for financial stability?

BankUnderground

OCTOBER 17, 2024

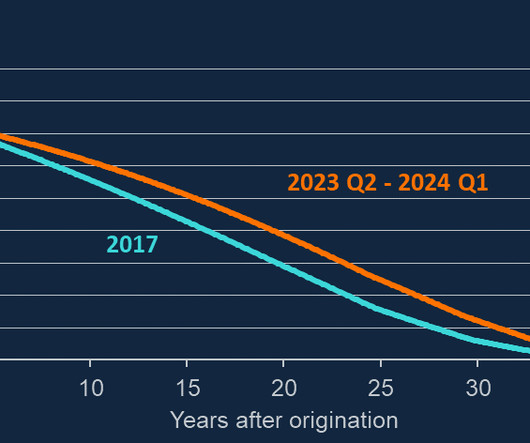

James Waddell and Meghna Shrestha An increasing number of households in the UK are opting for longer-term mortgages, with the share of borrowers taking out new mortgages with terms 30 years or longer tripling since 2005. But who are these households, why have they done so, and what could this imply for financial stability? This blog presents some analysis to answer these questions, and focuses on three potential risk channels which could affect financial stability.

Let's personalize your content