Avoiding banking transformation pitfalls

ATM Marketplace

SEPTEMBER 27, 2024

A panel at the Bank Customer Experience Summit addressed how to avoid banking transformation pitfalls

ATM Marketplace

SEPTEMBER 27, 2024

A panel at the Bank Customer Experience Summit addressed how to avoid banking transformation pitfalls

Payments Dive

SEPTEMBER 27, 2024

The venture between the payments processor and the bank will expire in April, prompting a cash payment from one to the other.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BankInovation

SEPTEMBER 27, 2024

Wells Fargo looks across all of its business lines when making investment decisions and selecting technology vendors. For the $1.7 trillion bank, working with vendors is “about the direction of the firm, our customer-forward focus and then thinking about intention and modernizing our core infrastructure,” Jazz Samra, head of strategic partnerships and innovation initiatives, told […] The post Wells Fargo applies vendor tech across business lines appeared first on Bank Automation News.

The Paypers

SEPTEMBER 27, 2024

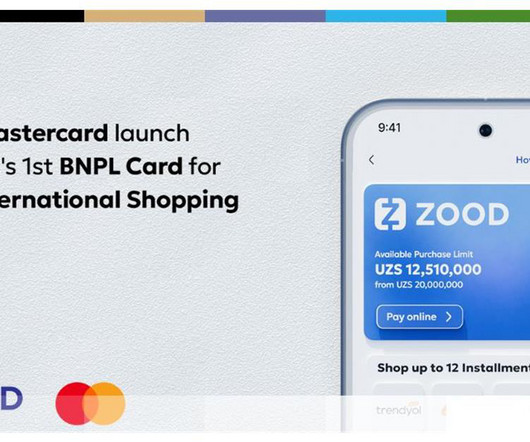

Mastercard has announced its partnership with ZOOD in order to launch the first virtual BNPL card for customers and clients in the region of Uzbekistan.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

BankInovation

SEPTEMBER 27, 2024

Banks have traditionally been the lenders of choice for small businesses, but there are alternatives — at least in the legal industry. Alternative asset management firm Legalist, which has $1 billion assets under management, is tapping AI within the origination process to offer litigation finance to its clients, Eva Shang, general partner and chief executive […] The post Lenders tap AI to serve niche market segments appeared first on Bank Automation News.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

SEPTEMBER 27, 2024

As the company bolsters artificial intelligence-powered point of sale and battles other fintechs and the card networks, getting a boost with distribution has become a major priority.

The Paypers

SEPTEMBER 27, 2024

Robinhood Markets has announced that it is exploring launching its own stablecoin, a type of crypto designed to maintain stable value.

American Banker

SEPTEMBER 27, 2024

A recent deal with a gourmet cookie franchise highlights the business that Ogden-based TAB Bank has built lending to companies other banks shy away from.

The Paypers

SEPTEMBER 27, 2024

Reports have surfaced that JPMorgan Chase and HSBC inadvertently processed payments for companies associated with Yevgeny Prigozhin, the former leader of the Wagner Group.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

SEPTEMBER 27, 2024

The Federal Deposit Insurance Corp.'s proposed rule on brokered deposits would be a step backwards for the agency and the industry it regulates.

Bussman Advisory

SEPTEMBER 27, 2024

This week’s must-know stories in the FinTech, AI and Digital Asset space. The latest edition of the FinTech Ecosystem Newsletter is here: Image Credits: shutterstock.com The post OpenAI projects $5B loss on $3.7B revenue | Meta unveils Orion AR glasses | Visa to acquire payment fraud firm Featurespace in $1B takeover appeared first on Bussmann Advisory AG.

American Banker

SEPTEMBER 27, 2024

As a public company, the neobank would have the capital support to keep growing quickly. It would also have to rein in costs and show a profit.

The Paypers

SEPTEMBER 27, 2024

Multinational payment card services corporation Visa has announced that it signed a definitive agreement to proceed with the acquisition of Featurespace.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

SEPTEMBER 27, 2024

Top banking trades have thrown their support behind the central bank's argument that it has discretion over access to its payments systems. Custodia is seeking to appeal a lower court ruling that affirmed that discretion.

The Paypers

SEPTEMBER 27, 2024

Kriya , a provider of B2B payment solutions, has launched an integration with Stripe , a financial infrastructure platform for businesses.

American Banker

SEPTEMBER 27, 2024

Blue Hill Advisors and former Bank of Hawaii CEO Landon up their per-share cash offer to buy Territorial Bancorp; Montreal-based payments firm Lightspeed Commerce puts itself on the market; Societe Generale hires ex-UBS banker Jansen as the bank's West Coast co-head; and more in this week's banking news roundup.

The Paypers

SEPTEMBER 27, 2024

Cloud-native core banking platform provider 10x Banking has published the findings of its new Core Banking without Compromise research report.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Financial Brand

SEPTEMBER 27, 2024

This article 9 Critical Leadership Lessons from Top META Marketing Exec appeared first on The Financial Brand. Tech marketing leader Eshan Ponnadurai shares insights from META, Google, and Uber, offering incisive perspectives for bank marketers in the digital age. This article 9 Critical Leadership Lessons from Top META Marketing Exec appeared first on The Financial Brand.

The Paypers

SEPTEMBER 27, 2024

Citigroup has announced a partnership with Apollo in an initiative to lend up to USD 25 billion to private equity groups and low-rated companies in the US.

American Banker

SEPTEMBER 27, 2024

First Republic's failure last year left its wine bankers available for poaching. The group joined Umpqua Bank, whose expansion in the wine business comes at a tricky time for the industry.

The Paypers

SEPTEMBER 27, 2024

Hilton, a global hospitality leader, has launched the Honors debit card and Hilton Honors Plus debit card in the UK in collaboration with Currensea.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

SEPTEMBER 27, 2024

The Federal Housing Finance Agency issued guidance to ensure the Federal Home Loan Banks are lending based on the credit worthiness of the member bank, not solely on the quality of the collateral.

The Paypers

SEPTEMBER 27, 2024

Ericsson has partnered with INFORM to integrate INFORM’s RiskShield with Ericsson’s Mobile Financial Services Platform.

The Financial Brand

SEPTEMBER 27, 2024

This article Amid Rising Delinquency Rates, Auto Lenders Seek Safe Growth appeared first on The Financial Brand. A slowing economy is impacting auto loan performance. Ally and Capital One discuss the worrisome trends. This article Amid Rising Delinquency Rates, Auto Lenders Seek Safe Growth appeared first on The Financial Brand.

The Paypers

SEPTEMBER 27, 2024

Justt , an AI-powered chargeback mitigation provider, has announced a partnership with Ravelin , a company specialising in AI-based fraud detection solutions.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content