Payments funding slips further

Payments Dive

OCTOBER 18, 2023

While investments in payments startups dropped during the third quarter, U.S. companies attracted the most funding, according to a CB Insights report.

Payments Dive

OCTOBER 18, 2023

While investments in payments startups dropped during the third quarter, U.S. companies attracted the most funding, according to a CB Insights report.

South State Correspondent

OCTOBER 18, 2023

Grid-based pricing is typically used to set the applicable margin of a loan based on specific performance measures, such as credit rating or cash flow coverage. However, grid-based pricing can also be used to increase deposit balances. The average borrower does not calculate their cost of borrowing and return on deposits on the economic value as determined by fund transfer pricing (FTP).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 18, 2023

The company is being penalized for unauthorized withdrawals, and attempted withdrawals, from mortgage customer accounts in April 2021.

BankInovation

OCTOBER 18, 2023

U.S. Bank invested in digital capabilities within its payments business during the third quarter of 2023 as it shifted toward a more tech-led revenue approach. Tech spend at the $668 billion bank was up 20% year over year to $511 million, according to the bank’s Q3 earnings presentation.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

OCTOBER 18, 2023

The new council is tasked with providing “strategic guidance” to the San Francisco-based card giant’s Washington think tank, but none of the initial members are based in the U.S.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

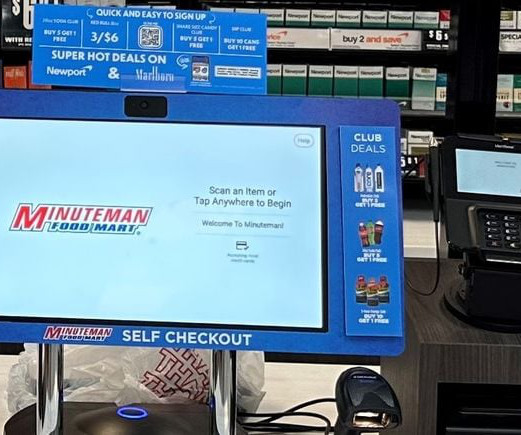

Payments Dive

OCTOBER 18, 2023

After a retrofit at a high-volume store failed, the North Carolina-based convenience store company went back to the drawing board and improved the design.

The Paypers

OCTOBER 18, 2023

UK-based X-Press Legal has added Open Banking to its online banking system, X-Press Pay, via Ordo , enabling consumers to directly pay for disbursements.

American Banker

OCTOBER 18, 2023

The bank suffered its third breach in three years, this time by virtue of a vulnerability in Progress Software's file-transfer system. But Flagstar is only one of many such victims.

CFPB Monitor

OCTOBER 18, 2023

At its open Board meeting scheduled for October 24, 2023, the Federal Reserve Board is expected to approve its final rule amending its current regulation implementing the Community Reinvestment Act. In May 2022, the Federal Reserve Board, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation issued a joint notice of proposed rulemaking setting forth proposed amendments to their regulations implementing the CRA. .

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

OCTOBER 18, 2023

Credit unions are seeing tepid growth at best, due in part to banks using online offerings to win over consumers.

BankInovation

OCTOBER 18, 2023

Ally Bank will continue to invest in technology to gain a competitive advantage over its peers.

American Banker

OCTOBER 18, 2023

The Tennessee bank said a $72 million charge-off tied to a borrower in bankruptcy shaved 10 cents per share off its earnings. Management downplayed the issue, calling it "idiosyncratic," and emphasized that it was growing its loan portfolio.

BankInovation

OCTOBER 18, 2023

Citizens Bank reiterated its commitment to migrating all operations to the cloud by 2025 to create a modern banking platform during today’s third-quarter earnings presentation.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

OCTOBER 18, 2023

The Federal Reserve, which currently faces a Supreme Court case related to the fees, will vote on a proposal next week that will likely open up a rulemaking process to lower debit card interchange fees.

BankInovation

OCTOBER 18, 2023

Bank of Nova Scotia will dismiss 3% of its employees and take a writedown on its investment in a Chinese bank in a broad restructuring that underscores new Chief Executive Officer Scott Thomson’s focus on cutting costs. The reductions amount to about 2,700 jobs, based on the Canadian bank’s staff count as of July 31.

The Paypers

OCTOBER 18, 2023

Poland-based financial technology solutions provider Verestro has announced the integration of the Quicko Wallet money transfer service within the Slack application.

American Banker

OCTOBER 18, 2023

Texas Attorney General Ken Paxton's office said it's reviewing whether 10 financial companies, including Bank of America and JPMorgan Chase, violate a state law that punishes firms for restricting their work with the oil-and-gas industry because of climate-change concerns.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

OCTOBER 18, 2023

US-based J.P. Morgan has announced its partnership with Trovata in order to develop a new suite of solutions for treasury management improvement.

American Banker

OCTOBER 18, 2023

Worried about the economy and new Fed rules on capital, the bank wants to hang onto its money just in case, CFO Daryl Bible told investors as he outlined second-quarter earnings.

The Paypers

OCTOBER 18, 2023

Global card issuing platform Marqeta has announced its partnership with Motive in order to launch the Motive Card and deliver clients up to 10 percent savings.

American Banker

OCTOBER 18, 2023

The Rhode Island-based bank is bolstering its cash position in the face of worries about office loans, stricter capital requirements for regional lenders and the possibility of economic shock from overseas conflicts.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

OCTOBER 18, 2023

Philippine-based digital bank Tonik has partnered with life insurance company Sun Life Grepa Financial to roll out insurance for the former’s customers.

American Banker

OCTOBER 18, 2023

Because instant settlement is irreversible, companies like Orum expect to see demand for systems that can vet recipients within seconds.

The Paypers

OCTOBER 18, 2023

Global modern card issuing platform Marqeta has partnered with European BNPL provider Scalapay to issue cards both online and in-store.

American Banker

OCTOBER 18, 2023

NCR has completed the spinoff of its ATM business, Revolut doubles its number of fraud-fighters in two years, China builds a zone for digital yuan users, and more.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content