FDIC pushes regulators to address tokenization

Payments Dive

MARCH 12, 2024

Tokenization could be a "major leap" for the monetary system. FDIC Vice Chairman Travis Hill doesn't want the U.S. to be left out.

Payments Dive

MARCH 12, 2024

Tokenization could be a "major leap" for the monetary system. FDIC Vice Chairman Travis Hill doesn't want the U.S. to be left out.

South State Correspondent

MARCH 12, 2024

In a previous article ( HERE ), we discussed several factors that drive loan and bank profitability. We covered in detail how and why community banks can increase loan size to improve return on assets (ROA) /return on equity (ROE). In this article, we will consider how and why loan term is a significant driver of profitability for community banks and what community banks can do to improve performance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 12, 2024

On the fringes of the digital payment pioneer’s two main businesses are some in a third category that could be jettisoned this year, CEO Alex Chriss said last week.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MARCH 12, 2024

The digital payments company will power website and app-based reservations for the car rental business, along with providing a point-of-sale system.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 12, 2024

The buy now, pay later company seeks to be involved in more consumer spending opportunities, but finance chief Michael Linford all but ruled out auto lending.

BankUnderground

MARCH 12, 2024

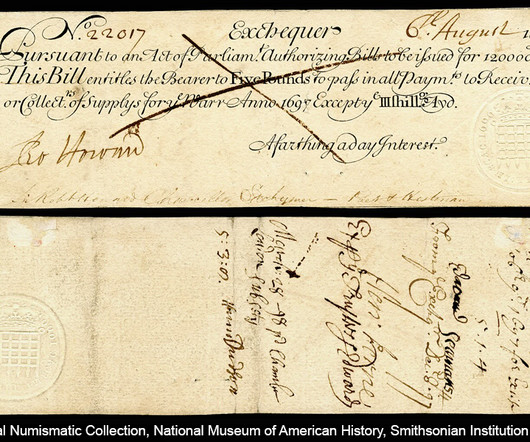

David Rule and Iain de Weymarn Technologies such as distributed ledgers create the possibility of new forms of digital money, whether privately-issued ‘stable coins’, tokenised commercial bank deposits, or central bank digital currencies. Authorities are considering a world where digital money circulates alongside existing forms of money. In the past, the nature of money has often changed.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

American Banker

MARCH 12, 2024

Silicon Valley Bank, Heartland Tri-State and Citizens Bank in Sac City, Iowa, were among bank failures in 2023. What's changed since?

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

William Mills

MARCH 12, 2024

In a time where information reigns supreme, the strategic use of proprietary data in PR and marketing is not just an advantage — it's essential. As data-driven storytelling has become a cornerstone for success, PR and marketing professionals must learn how to properly gather, analyze and derive this information to help create stronger messages, bring more credibility, and garner greater media attention for clients.

American Banker

MARCH 12, 2024

Through its integration with the auto manufacturer, Origence and its indirect lending subsidiary FI Connect aim to match buyers in need of auto loans to eligible credit unions.

TheGuardian

MARCH 12, 2024

Chief executive David Duffy would be biggest winner on £3.5m, with large paydays for about 12 other staff if deal goes through Banking bosses at Virgin Money are in line for a £6m windfall if Nationwide Building Society pushes ahead with a proposed takeover of the lender, with more than half of that sum to be pocketed by its longtime chief executive, David Duffy.

American Banker

MARCH 12, 2024

The stock prices of five of these banks fell by more than 7% on the day they announced their fourth-quarter results, including two with double-digit decreases.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

CFPB Monitor

MARCH 12, 2024

The CFPB recently published a notice in the Federal Register indicating that it is seeking approval from the Office of Management and Budget for two new surveys intended to identify factors that influence a consumer’s decision to file a complaint with the CFPB. Comments must be received on or before May 6, 2024.

American Banker

MARCH 12, 2024

Banks must work closely with technology companies, regulatory authorities and each other to develop comprehensive strategies to combat deepfake fraud.

BankInovation

MARCH 12, 2024

First Financial Bank has grown its operations and attracted new customers through implementation of an AI-driven digital assistant. The $4.8 billion FFB teamed up with AI-driven tech provider Kasisto toward the end of 2022 to launch a digital assistant, according to a Feb. 22 case study by Kasisto.

American Banker

MARCH 12, 2024

The attack is one of three major incidents the lender has suffered in the past three years.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

BankInovation

MARCH 12, 2024

Fintel Connect helps Live Oak Bank increase its deposit volume. The digital, FDIC-insured bank looked to affiliate marketing platform Fintel Connect nearly two years ago to expand its reach, Fintel Connect Chief Executive Nicky Senyard tells Bank Automation News on this episode of “The Buzz” podcast.

The Paypers

MARCH 12, 2024

Inpay has announced its plans to facilitate the European expansion of the global payment service provider (PSP) Tranglo by offering Instant SEPA across the region.

Cisco

MARCH 12, 2024

Take a look into the past and present of insurance claims and discover how AI and omnichannel communication are redefining customer experiences and opening doors for the next-gen workforce.

The Paypers

MARCH 12, 2024

A significant devaluation of Revolut , one of the UK's prominent fintech companies, has been indicated by a major shareholder.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Realwired Appraisal Management Blog

MARCH 12, 2024

Last week a new DataComp Suite customer bought our software but then found out he couldn’t get out of his contract with a competing product. He missed the deadline to give notice. He signed our contract and we already ran his credit card. What should we do?

The Paypers

MARCH 12, 2024

Banco do Brasil has partnered with Germany-based Giesecke+Devrient in a bid to make offline payments with digital money a reality in Brazil.

American Banker

MARCH 12, 2024

Powered by its data-aggregation arm Finicity, Mastercard is piloting a service giving consumers an analytical view of all the subscriptions they routinely pay via credit, debit or ACH with options to cancel, pause or resume them.

The Paypers

MARCH 12, 2024

Israel-based AI-enabled AML provider ThetaRay has announced that the Pan-Africa Payment and Settlement System (PAPSS) selected it as its AML and screening partner.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content