Defend your bottom line with guaranteed fraud protection

Payments Dive

NOVEMBER 13, 2023

The holiday season is often a one-two punch of activity for online retailers: First comes the spike in purchases… and then comes the inevitable returns.

Payments Dive

NOVEMBER 13, 2023

The holiday season is often a one-two punch of activity for online retailers: First comes the spike in purchases… and then comes the inevitable returns.

South State Correspondent

NOVEMBER 13, 2023

Our article last week ( HERE ) discussed the “power of three” marketing rule and how to use it for loan proposals. The rule states that human brains make better decisions when given a small selection of appropriate options but not too many to become confused. One or two options are usually insufficient, and five or more options are too many, but successful banks present three (sometimes four options) that reflect what the lender understands as the borrower’s goals in financing

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 13, 2023

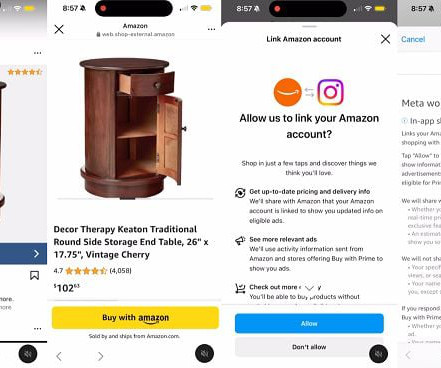

The new deal will enable Amazon merchants to connect with Facebook and Instagram users.

Abrigo

NOVEMBER 13, 2023

Streamline your annual review process Which loans need them, what processes to avoid, and how to save time working with borrowers' complex credit needs. Read the 2023 Loan Review Survey results for expert analyses of emerging trends WATCH WEBINAR Takeaway 1 Annual loan review is separate from covenant testing and underwriting, but many banks conflate these processes.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

NOVEMBER 13, 2023

The EU would require big tech companies, like Apple and Google, to offer their customers payment services through the new digital identity wallet if the regulation is approved.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

NOVEMBER 13, 2023

Fierce competition, persistent losses and regulatory constraints are likely to push some players out of the buy now, pay later market, Moody’s predicted.

American Banker

NOVEMBER 13, 2023

The bank is adding fintech-style buy now/pay later lending to other recent payment upgrades at its merchant acquiring unit.

CFPB Monitor

NOVEMBER 13, 2023

A Nevada federal district court has stayed an action filed by the CFPB to enforce a civil investigative demand (CID) issued to a small-dollar lender pending the U.S. Supreme Court’s decision in Community Financial Services Association of America Ltd. v. CFPB. The issue in CFSA v. CFPB is whether the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

The Paypers

NOVEMBER 13, 2023

Xero has launched two new payment features powered by Open Banking and e-invoicing, in order to optimise the way UK-based SMEs manage their cash flow.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

CFPB Monitor

NOVEMBER 13, 2023

In September 2023, the CFPB updated its UDAAP Examination Manual to remove the changes it made in March 2022 which provided that unfair acts or practices encompassed discriminatory conduct, even in circumstances to which federal fair lending laws, such as the Equal Credit Opportunity Act, did not apply. It has been suggested that this update means the CFPB has retreated from its position that discriminatory conduct can be the basis of a UDAAP violation. .

American Banker

NOVEMBER 13, 2023

The bank was recently sued by customers who say they were misled into thinking that their savings accounts were earning competitive rates. Capital One responded with a series of arguments for why the case should be thrown out.

CFPB Monitor

NOVEMBER 13, 2023

On October 24, 2023, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency issued a final rule amending their regulations implementing the Community Reinvestment Act (“CRA”) (the “Final Rule”). The Final Rule marks the first substantial revision to the CRA regulations in nearly thirty years. .

American Banker

NOVEMBER 13, 2023

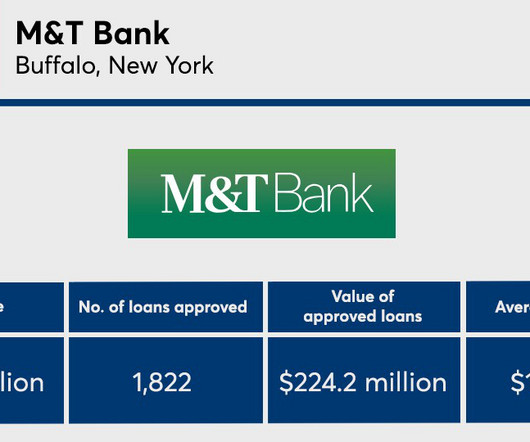

Small Business Administration lending is an arena where community banks and nonbanks compete favorably with some of the largest U.S. financial institutions. Here are the biggest SBA 7(a) lenders based on the value of approved loans.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

BankInovation

NOVEMBER 13, 2023

Financial institutions are using AI to mitigate fraud as fraudsters keep pace with evolving technology.

American Banker

NOVEMBER 13, 2023

Since the end of the Small Business Administration's 2022 fiscal year, the average loan size in its flagship program has dropped more than six figures. The addition of three new nondepository lenders could further drive down this figure.

BankInovation

NOVEMBER 13, 2023

KeyBank is investing in AI throughout its operations and looking to third-party vendors for coding and compliance assistance. The $190 billion bank is investing in third-party solutions that utilize AI to transform complex code into low-code applications, Robbi Armstrong, vice president and group product manager of conversational AI at KeyBank, told Bank Automation News.

American Banker

NOVEMBER 13, 2023

At first blush, the deal might provide evidence that the bank doesn't shun the oil and gas industry as the label suggests. In fact, Bank of America has been named by environmental groups as one of the biggest financiers of fossil fuels in the world.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

NOVEMBER 13, 2023

Mastercard has collaborated with Dubai Islamic Bank in order to introduce cross-border payment services through digital channels across multiple countries globally.

American Banker

NOVEMBER 13, 2023

A recent effort by Citigroup to nudge certain customers toward digital-only statements was well intended but too punitive, observers say. The key, they argue, for banks seeking to cut costs or achieve other goals is to offer incentives to those with ingrained habits.

The Paypers

NOVEMBER 13, 2023

Forty-eight countries have committed to a new tax transparency standard beginning in 2027 to eliminate crypto-related tax evasion.

American Banker

NOVEMBER 13, 2023

For decades, farmers have relied on futures contracts to hedge their risk. The proposed new capital rules will make it more expensive for them to continue with this vital function.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

NOVEMBER 13, 2023

Paytech company payabl. has announced its partnership with GonnaOrde r to provide its payment services and launch a referral scheme for the latter’s global customers.

American Banker

NOVEMBER 13, 2023

The Consumer Financial Protection Bureau, Federal Reserve and other banking regulators rolled out their annual adjustments for the thresholds that determine whether activities are eligible for enhanced standards.

The Paypers

NOVEMBER 13, 2023

Financial Market Infrastructure (FMI) for cross-border settlements RTGS.global has partnered with Alif Bank , Bank Arvand , and Universal Capital Bank to simplify cross-border payments.

American Banker

NOVEMBER 13, 2023

A filing for a BlackRock fund based on the cryptocurrency XRP showed up on the official Delaware website that registers investment trusts incorporated in the state. The only problem is that BlackRock wasn't the one who submitted it.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content