Defend your bottom line with guaranteed fraud protection

Payments Dive

NOVEMBER 13, 2023

The holiday season is often a one-two punch of activity for online retailers: First comes the spike in purchases… and then comes the inevitable returns.

Payments Dive

NOVEMBER 13, 2023

The holiday season is often a one-two punch of activity for online retailers: First comes the spike in purchases… and then comes the inevitable returns.

South State Correspondent

NOVEMBER 13, 2023

Our article last week ( HERE ) discussed the “power of three” marketing rule and how to use it for loan proposals. The rule states that human brains make better decisions when given a small selection of appropriate options but not too many to become confused. One or two options are usually insufficient, and five or more options are too many, but successful banks present three (sometimes four options) that reflect what the lender understands as the borrower’s goals in financing

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 13, 2023

The EU would require big tech companies, like Apple and Google, to offer their customers payment services through the new digital identity wallet if the regulation is approved.

Abrigo

NOVEMBER 13, 2023

Streamline your annual review process Which loans need them, what processes to avoid, and how to save time working with borrowers' complex credit needs. Read the 2023 Loan Review Survey results for expert analyses of emerging trends WATCH WEBINAR Takeaway 1 Annual loan review is separate from covenant testing and underwriting, but many banks conflate these processes.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Payments Dive

NOVEMBER 13, 2023

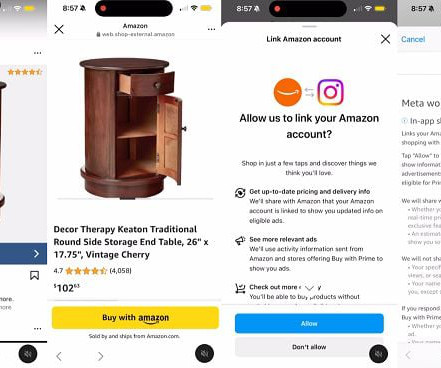

The new deal will enable Amazon merchants to connect with Facebook and Instagram users.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

NOVEMBER 13, 2023

Fierce competition, persistent losses and regulatory constraints are likely to push some players out of the buy now, pay later market, Moody’s predicted.

CFPB Monitor

NOVEMBER 13, 2023

A Nevada federal district court has stayed an action filed by the CFPB to enforce a civil investigative demand (CID) issued to a small-dollar lender pending the U.S. Supreme Court’s decision in Community Financial Services Association of America Ltd. v. CFPB. The issue in CFSA v. CFPB is whether the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

BankInovation

NOVEMBER 13, 2023

KeyBank is investing in AI throughout its operations and looking to third-party vendors for coding and compliance assistance. The $190 billion bank is investing in third-party solutions that utilize AI to transform complex code into low-code applications, Robbi Armstrong, vice president and group product manager of conversational AI at KeyBank, told Bank Automation News.

CFPB Monitor

NOVEMBER 13, 2023

In September 2023, the CFPB updated its UDAAP Examination Manual to remove the changes it made in March 2022 which provided that unfair acts or practices encompassed discriminatory conduct, even in circumstances to which federal fair lending laws, such as the Equal Credit Opportunity Act, did not apply. It has been suggested that this update means the CFPB has retreated from its position that discriminatory conduct can be the basis of a UDAAP violation. .

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

The Paypers

NOVEMBER 13, 2023

Xero has launched two new payment features powered by Open Banking and e-invoicing, in order to optimise the way UK-based SMEs manage their cash flow.

CFPB Monitor

NOVEMBER 13, 2023

On October 24, 2023, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency issued a final rule amending their regulations implementing the Community Reinvestment Act (“CRA”) (the “Final Rule”). The Final Rule marks the first substantial revision to the CRA regulations in nearly thirty years. .

American Banker

NOVEMBER 13, 2023

The bank was recently sued by customers who say they were misled into thinking that their savings accounts were earning competitive rates. Capital One responded with a series of arguments for why the case should be thrown out.

BankInovation

NOVEMBER 13, 2023

Financial institutions are using AI to mitigate fraud as fraudsters keep pace with evolving technology.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

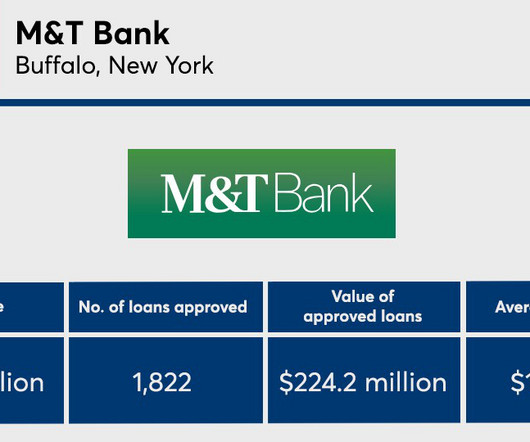

American Banker

NOVEMBER 13, 2023

Small Business Administration lending is an arena where community banks and nonbanks compete favorably with some of the largest U.S. financial institutions. Here are the biggest SBA 7(a) lenders based on the value of approved loans.

The Paypers

NOVEMBER 13, 2023

Mastercard has collaborated with Dubai Islamic Bank in order to introduce cross-border payment services through digital channels across multiple countries globally.

American Banker

NOVEMBER 13, 2023

The bank is adding fintech-style buy now/pay later lending to other recent payment upgrades at its merchant acquiring unit.

The Paypers

NOVEMBER 13, 2023

Financial Market Infrastructure (FMI) for cross-border settlements RTGS.global has partnered with Alif Bank , Bank Arvand , and Universal Capital Bank to simplify cross-border payments.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

American Banker

NOVEMBER 13, 2023

At first blush, the deal might provide evidence that the bank doesn't shun the oil and gas industry as the label suggests. In fact, Bank of America has been named by environmental groups as one of the biggest financiers of fossil fuels in the world.

The Paypers

NOVEMBER 13, 2023

Paytech company payabl. has announced its partnership with GonnaOrde r to provide its payment services and launch a referral scheme for the latter’s global customers.

American Banker

NOVEMBER 13, 2023

Since the end of the Small Business Administration's 2022 fiscal year, the average loan size in its flagship program has dropped more than six figures. The addition of three new nondepository lenders could further drive down this figure.

The Paypers

NOVEMBER 13, 2023

Alternative banking solution Suits Me has partnered with US-based identity proofing and compliance solutions provider Jumio to support the underbanked population in the UK.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

American Banker

NOVEMBER 13, 2023

For decades, farmers have relied on futures contracts to hedge their risk. The proposed new capital rules will make it more expensive for them to continue with this vital function.

The Paypers

NOVEMBER 13, 2023

UK-based payment orchestration provider BR-DGE has integrated Visa Instalments into Kenwood Travel , for an optimised customer checkout experience.

American Banker

NOVEMBER 13, 2023

A recent effort by Citigroup to nudge certain customers toward digital-only statements was well intended but too punitive, observers say. The key, they argue, for banks seeking to cut costs or achieve other goals is to offer incentives to those with ingrained habits.

The Paypers

NOVEMBER 13, 2023

The Financial Conduct Authority has announced the inclusion of the US-based Metro Bank to its financial crime watchlist, with plans to keep it under supervision.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content