How Did Your ALCO Model Hold Up?

Jeff For Banks

DECEMBER 16, 2023

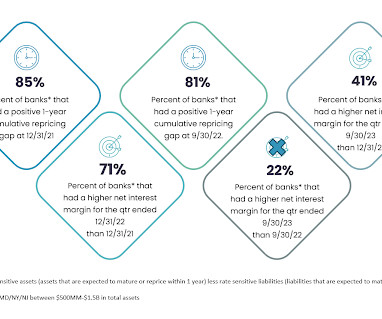

My firm did a sample data run for a client that included all commercial banks in NY, NJ, PA, and MD between $500 million and $1.5 billion in total assets to see how various banks did in balance sheet and income statement ratios during the course of the Fed tightening run from year end 2021 until the third quarter 2023. Some interesting insights relating to their 1-year cumulative repricing gap that the banks reported on their call reports: At 12/31/21, of the 68 banks that met the criteria, only

Let's personalize your content