BNPL to shift toward larger-ticket expenses: CEO

Payments Dive

JUNE 25, 2024

The short-term financing option, which already costs more than cards for merchants, will eventually retreat from daily purchases, Priority CEO Tom Priore predicted.

Payments Dive

JUNE 25, 2024

The short-term financing option, which already costs more than cards for merchants, will eventually retreat from daily purchases, Priority CEO Tom Priore predicted.

Perficient

JUNE 25, 2024

On June 6, Acting Comptroller of the Currency, Michael J. Hsu, addressed the 2024 Conference on Artificial Intelligence (AI) and Financial Stability, providing critical regulatory insights on AI. Hsu discussed the systemic risk implications of AI in banking and finance using a “tool or weapon” approach. He noted that while both tools and weapons pose threats to financial stability, they do so in different ways, necessitating distinct analyses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 25, 2024

On Tuesday, Judge Margo Brodie denied a preliminary settlement proposal made by the card networks Visa and Mastercard, and merchants who sued them in federal court nearly two decades ago.

South State Correspondent

JUNE 25, 2024

In a previous article [ here ] we discussed why community banks need product managers to ensure that financial products and services are effectively developed, launched, and managed to meet customers’ evolving needs and the bank’s risk and profitability goals. In this article, we provide a concrete example of how product management in lending might work.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

BankInovation

JUNE 25, 2024

Point-of-sale financing as an alternative payment method is a growing opportunity for lenders, technology company Pagaya’s President Sanjiv Das says on this episode of “The Buzz” podcast. According to auto lender and Pagaya partner Ally Financial, POS financing is expected to reach a value of more than $81 billion by 2030.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JUNE 25, 2024

Nvidia is spearheading the AI industry’s growth with its latest data centers focused on developing and deploying models for the financial services industry.

American Banker

JUNE 25, 2024

Ransomware group LockBit threatened on Sunday to publish the stolen data Tuesday evening. Ransomware experts said it was likely that the group was bluffing.

TheGuardian

JUNE 25, 2024

Other lenders likely to follow suit as analysts say cuts of up to 0.31 percentage points could fuel ‘summer of savings’ Business live – latest updates HSBC and Barclays are cutting rates on their fixed mortgage deals in what some brokers claim could be the start of a “summer of savings” for homebuyers and those looking to remortgage. Barclays has reduced rates by more than 0.25 percentage points in some cases from Tuesday, and its cuts led to a quick response from HSBC, which said it would be cu

American Banker

JUNE 25, 2024

Investors are keeping a close eye on recent banking news, including Mastercard's latest plan for crypto, Comerica's proposed settlement of a class action, employment gains and skeptical shareholders.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

The Paypers

JUNE 25, 2024

1KIN Labs has unveiled GR1D, a new Layer-2 blockchain designed to unify decentralized gaming ecosystems.

American Banker

JUNE 25, 2024

The two financial institutions are testing a combination of machine learning and blockchain to catch errors and block fraud on international transactions.

Jack Henry

JUNE 25, 2024

The future of Enterprise Content Management (ECM) is upon us. In order to get the most out of the new technology and processes, you must take your legacy data and reinvent it. You won’t need any plutonium, a flux capacitor or Doc Brown to correct the data of the past. Here are some things you can do now to explore your past data and blaze into the future with your ECM data archives.

American Banker

JUNE 25, 2024

The head of data and digital at Ally Bank came up with protective measures governing the use of generative AI and organized "AI Days" for employees to learn about Ally's progress.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

JUNE 25, 2024

Bank payment company GoCardless has entered a collaboration with Celigo , an integration and automation platform, to advance its development via indirect channels.

American Banker

JUNE 25, 2024

The bankruptcy of fintech middleware provider Synapse has left thousands of customers unable to access their savings, with seemingly no one empowered to put it back in their hands. Regulators and lawmakers need to do something about it, but first they need to talk about it.

The Paypers

JUNE 25, 2024

PagBrasil , a fintech company processing payments in Brazil for ecommerce businesses globally, has announced the launch of two new Pix instant payment solutions.

American Banker

JUNE 25, 2024

By adopting more inclusive lending practices and actively seeking to support minority-owned businesses, banks can help bridge the financing gap that often stifles the growth of these businesses.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

JUNE 25, 2024

UK-based payments company myPOS has announced the launch of Tap to Pay on iPhone for merchants and businesses in the region of Germany.

American Banker

JUNE 25, 2024

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

The Paypers

JUNE 25, 2024

Digital risk intelligence company Trustfull has launched Silent Onboarding, a product aimed to defend against synthetic identity fraud.

American Banker

JUNE 25, 2024

Four large banks were dinged in their resolution plan reviews for shortcomings in their plans to unwind their derivatives positions in times of stress. But whether the problem is with the banks' plans or the regulators' expectations for a legally ambiguous product is a matter of debate.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

JUNE 25, 2024

The European payment solution Wero has announced its partnership with Computop in order to deliver cross-border payment methods to its customers and merchants.

American Banker

JUNE 25, 2024

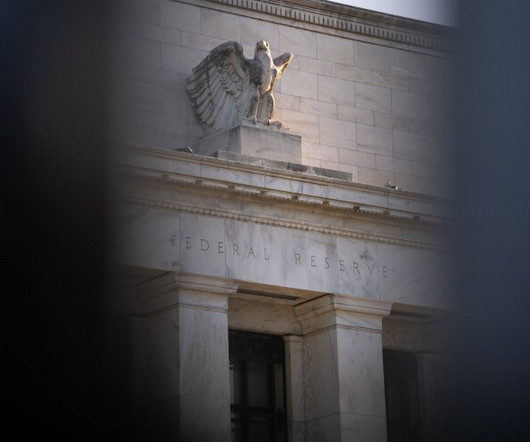

The Federal Reserve Board of Governors issued a cease and desist order against Indiana-based United Fidelity Bank over concerns that the bank was deficient in its board oversight policies.

The Paypers

JUNE 25, 2024

Pyypl , a consumer fintech company in the Middle East and Africa region, has announced its partnership with Visa and its Principal Licence Membership.

American Banker

JUNE 25, 2024

A federal judge in Brooklyn formally rejected a $30 billion settlement between Visa, Mastercard and retailers to cap credit-card swipe fees after telegraphing earlier this month that such a setback in the two-decade long litigation could be expected.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content