The future of ATM software in 2025

ATM Marketplace

DECEMBER 5, 2024

A webinar hosted by ATM Marketplace and sponsored by KAL examined some of the key findings of the 17th annual 2024/2025 ATM Software Trends Report.

ATM Marketplace

DECEMBER 5, 2024

A webinar hosted by ATM Marketplace and sponsored by KAL examined some of the key findings of the 17th annual 2024/2025 ATM Software Trends Report.

Gonzobanker

DECEMBER 5, 2024

Will new infusions in the digital banking space translate to real innovation? This year has delivered many that wasnt on our digital 2024 bingo card moments for our industry. Two deals that were very much needed in the market were Candescents (the artist formally known as NCR Voyix) acquisition by Veritas Capital in September for $2.45 billion in cash (plus up to $100 million in contingent considerations) and Lumin Digitals growth equity raise of $160 million led by Light Street Capital, NewView

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

American Banker

DECEMBER 5, 2024

These regulatory announcements in the banking industry are currently open to public comment.

Gonzobanker

DECEMBER 5, 2024

Will new infusions in the digital banking space translate to real innovation? This year has delivered many “that wasn’t on our digital 2024 bingo card” moments for the team at Cornerstone Advisors. Two deals that especially took us by surprise were Candescent’s (the artist formally known as NCR Voyix) acquisition by Veritas Capital in September for $2.45 billion in cash (plus up to $100 million in contingent considerations) and Lumin Digital’s growth equity raise of $160 million led by Light Str

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

American Banker

DECEMBER 5, 2024

The Toronto-based bank's provisions for credit losses totaled CA$1.5 billion during its fiscal fourth quarter, more than three times what it set aside in the same quarter last year.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

DECEMBER 5, 2024

Premier Bank , a Kenya-based Islamic financial institution, has partnered with Mastercard to introduce a range of Shari'ah-compliant debit, credit, and prepaid cards.

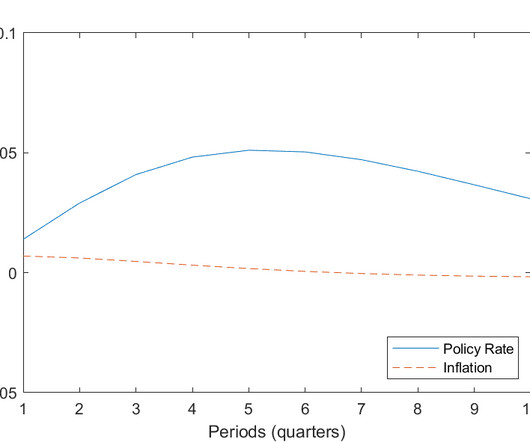

BankUnderground

DECEMBER 5, 2024

Nicolò Bandera and Jacob Stevens How should the central bank conduct asset purchases to restore market functioning without causing higher inflation? The Bank of England was faced with this question during the 2022 gilt crisis, when it undertook gilt purchases on financial stability grounds while inflation was above 10%. These financial stability asset purchases could have counteracted the monetary policy stance by easing financial conditions at a time when monetary policy was tightening them.

American Banker

DECEMBER 5, 2024

A collaboration with Booking.com is designed to encourage consumers to use the bank to manage airline tickets and hotels, a lucrative market that's drawing attention across the financial services industry.

The Emmerich Group

DECEMBER 5, 2024

Have you ever noticed it’s a whole lot easier to get top performance from somebody who has more capabilities to be a top performer? So here’s the challenge that I’ve been noticing recently for a lot of the banks that we’ve helped take to the top five percent of performers. Once they get there, they have a new problem that is mere mortals no longer fit into this organization because everybody else understands it, gets it, is moving fast, communicating properly about the ri

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

The Paypers

DECEMBER 5, 2024

WPS Advisory has announced its partnership with Moneyhub to launch an app that will make financial advice accessible and cost-effective for customers and employees.

American Banker

DECEMBER 5, 2024

Economic forecasts include the possibility of higher inflation and slower growth that could stall future cuts to the federal fund rates.

The Paypers

DECEMBER 5, 2024

Affirm , a payment network that supports consumer purchases and merchant growth, has announced the launch of new merchant partners just ahead of the peak of the holiday shopping season.

American Banker

DECEMBER 5, 2024

Lisa McGeough will be heading the global bank's U.S. operations. It's just the latest change at HSBC since Georges Elhedery took the reins in September.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

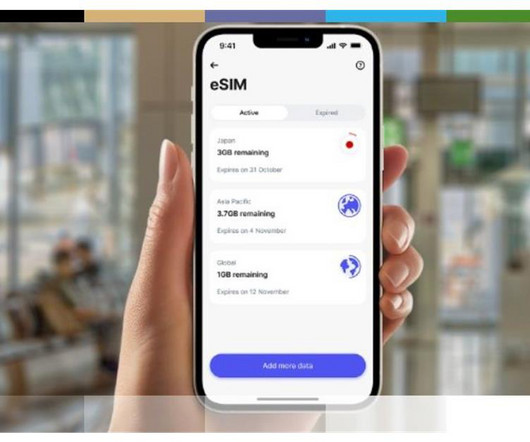

The Paypers

DECEMBER 5, 2024

Revolut has launched eSIMs in Singapore, aiming to offer customers a secure and efficient way to avoid unexpected data roaming charges while traveling in the region.

American Banker

DECEMBER 5, 2024

The Green Bay, Wisconsin-based bank will record a fourth-quarter loss after agreeing to sell $3 billion of low-yield loans and mortgages. The moves leave the bank well-positioned for 2025, CEO Andy Harmening said.

The Paypers

DECEMBER 5, 2024

FV Bank , a licensed US digital bank offering traditional and digital asset banking services, has introduced support for direct USDT stablecoin deposits.

American Banker

DECEMBER 5, 2024

The Toronto-based bank missed analyst expectations in its first quarterly results since it pleaded guilty to historic money-laundering-related crimes.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

DECEMBER 5, 2024

UK-based Gatehouse Bank has partnered with ColCap UK, a non-bank specialising in residential home finance, to originate over GBP 550 million worth of Shariah-compliant home finance over an initial period of two years.

American Banker

DECEMBER 5, 2024

Donald Felix, who spent a quarter century at some of the nation's largest banks, took the helm at Carver Bancorp last month. Felix is devising a plan to return the 76-year-old Black-managed company to profitability.

The Paypers

DECEMBER 5, 2024

Cloud-native payment infrastructure provider Gr4vy has introduced Gr4vy Pulse and welcomed JustGiving as its latest client.

American Banker

DECEMBER 5, 2024

The Consumer Financial Protection Bureau is giving the funds to more than 4.3 million consumers harmed by a defunct credit-repair conglomerate, the largest-ever distribution from the bureau's victim-relief fund.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

DECEMBER 5, 2024

Snowdrop Solutions has announced the expansion of its partnership with BigPay in order to improve the banking customer experience in Thailand.

American Banker

DECEMBER 5, 2024

A bot from nCino lets people in the commercial lending department quickly find information in loan documents and in policy manuals that are hundreds of pages long.

The Paypers

DECEMBER 5, 2024

Starpay , a financial technology firm in the Philippines, has announced a collaboration with OceanBase to upgrade its Relational Database Services (RDS).

The Financial Brand

DECEMBER 5, 2024

This article Why Old Marketing Models Will Fail in 2025 And What to Do Instead appeared first on The Financial Brand. Consumer behavior is changing, attention spans are dwindling. Marketers need new ways to attract audiences. TransUnion has the insights. This article Why Old Marketing Models Will Fail in 2025 And What to Do Instead appeared first on The Financial Brand.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content