Synchrony to sell pet insurance subsidiary for $750M gain

Payments Dive

NOVEMBER 28, 2023

As part of the sale, Synchrony will also acquire an equity interest in Independence Pet Holdings.

Payments Dive

NOVEMBER 28, 2023

As part of the sale, Synchrony will also acquire an equity interest in Independence Pet Holdings.

CFPB Monitor

NOVEMBER 28, 2023

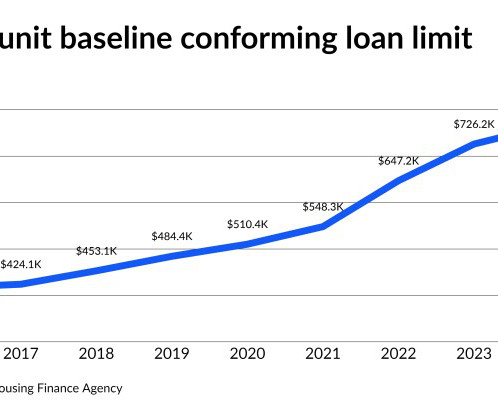

The Federal Housing Finance Agency (FHFA) recently announced the conforming loan limits for residential mortgage loans acquired by Fannie Mae and Freddie Mac in 2024. Fannie Mae addresses the limits in Lender Letter 2023-09. As was expected based on the continuing increase in housing prices, the limits increased significantly. The standard loan limit for a one-unit home increased from $726,200 in 2023 to $766,550 for 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 28, 2023

The biggest bank in the U.S. erroneously declined some credit card users’ purchases on Black Friday, the busiest shopping day of the year.

CFPB Monitor

NOVEMBER 28, 2023

On November 27, 2023, the California Privacy Protection Agency (CPPA) published proposed Automated Decision-Making Rules to be discussed by the CCPA board at its upcoming meeting on December 8, 2023. While the proposed rules are far from final—indeed, they are not even official draft rules—they signal that the CPPA is considering rules that would have significant impact on businesses subject to the California Consumer Privacy Act (CCPA).

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

ATM Marketplace

NOVEMBER 28, 2023

In the U.S., automated cash recycling is just now emerging as a compelling solution that provides substantial benefits to financial institutions.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Realwired Appraisal Management Blog

NOVEMBER 28, 2023

When your bank says “no new initiatives” does that mean all productivity ideation halts? Reframe “no new initiatives” into a “train in the off-season” mindset. Be a leader for your team. Limited resources can curb banks’ innovation and competitiveness. Your appraisal management technology partner is potentially key to bridging the gap.

Jeff For Banks

NOVEMBER 28, 2023

I asked Google Bard, a large language model tool, the following: "Describe the future of banking in the United States in buzzwords." Here is what it came up with. ∞ Sure, here is a description of the future of banking in the United States in buzzwords: Hyperpersonalization : Banking services will be tailored to the individual needs and preferences of each customer, using data analytics and artificial intelligence.

TheGuardian

NOVEMBER 28, 2023

CEO Charlie Nunn calls for measures such a windfall tax to be ruled out before next general election The chief executive of Lloyds Banking Group has fired a warning shot at UK policymakers, saying measures such as a windfall tax on banks should be ruled out before what is expected to be a hard-fought election year. With Labour largely silent on its plans for City regulation despite its current commanding lead in the polls, Charlie Nunn said City firms and investors alike were “looking for more c

CFPB Monitor

NOVEMBER 28, 2023

The CFPB recently approved an application ( Application ) from the Independent Community Bankers Association (ICBA) for alternative disclosures under the Truth in Lending Act (TILA)/Real Estate Settlement Procedures Act (RESPA) Integrated Disclosure (TRID) rule for construction-to-permanent loans. The Application is for a Trial Disclosure Program Waiver Template (TDP Waiver Template).

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

BankInovation

NOVEMBER 28, 2023

Scotiabank reduced its headcount and branch footprint in its fiscal fourth quarter as part of its restructuring initiatives to pull back on costs. The Canadian bank’s headcount fell 2% year over year to 89,483 and total branches also fell 2% YoY to 2,379, according to the bank’s earnings supplement for the quarter ended Oct. 31.

CFPB Monitor

NOVEMBER 28, 2023

The U.S. Supreme Court has scheduled oral argument for January 17, 2024 in the two cases in which the question presented is whether the Court should overrule its 1984 decision in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc. That decision produced what became known as the “Chevron framework”–the two-step analysis that courts typically invoke when reviewing a federal agency’s interpretation of a statute.

American Banker

NOVEMBER 28, 2023

Diverse employee resource groups and skill set development programs for identifying rising professionals are key methods for enticing — and retaining — the next generation of tech and business experts, said executives.

CFPB Monitor

NOVEMBER 28, 2023

In October 2023, the FTC issued a proposed “Rule on Unfair or Deceptive Fees” targeting so-called “junk fees.” Our special guest is Stacy Cammarano, Staff Attorney in the FTC’s Bureau of Consumer Protection, Division of Advertising Practices, and a lead attorney on the proposal. After reviewing how the FTC has previously used its enforcement authority to address “junk fees,” we discuss some of the key issues identified in comments received by the FTC on its October 2022 Advance Notice of Propo

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

ATM Marketplace

NOVEMBER 28, 2023

Wanting to grow, ATMs 4 Sale turned to DPL, a leading global managed IoT connectivity provider whose portfolio management platform leverages the power of artificial intelligence (AI) to help operators do more with less.

BankInovation

NOVEMBER 28, 2023

European fintech funding experienced a massive drop in funding and number of deals in the third quarter. In Q3, European fintechs raised $1.

American Banker

NOVEMBER 28, 2023

Financial firms claim a proposal by the Consumer Financial Protection Bureau would restrict lending, raise borrowing costs and result in more denials of credit to consumers.

The Paypers

NOVEMBER 28, 2023

The Paypers has released of the 7th edition of the Open Finance report, titled ‘ The Open Revolution: From Open Banking to Open Finance. The Road to Open Data Continues.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

American Banker

NOVEMBER 28, 2023

The hike was driven by modest home price gains this year, following a larger conforming loan limit boost in 2022 in reaction to then-double-digit home price growth.

The Paypers

NOVEMBER 28, 2023

Visa and Standard Chartered have entered a regional partnership to expedite the delivery of instalment payment options to credit cardholders in APAC using Visa Instalment Solution.

American Banker

NOVEMBER 28, 2023

The pressures and frustrations of daily work lose some of their ability to aggravate when you consider how much real choice you have in the matter.

The Paypers

NOVEMBER 28, 2023

Modular and flexible payment infrastructure provider for marketplaces and platforms Mangopay has partnered with Spain-based B2C delivery platform for artisan products Bigcrafters, powered by Estrella Galicia.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

American Banker

NOVEMBER 28, 2023

The Federal Reserve governor was one of two dissenting votes on the proposed capital changes earlier this year, but he said he would be open to backing the package if operational capital changes were made.

The Paypers

NOVEMBER 28, 2023

Payment services provider Worldline has announced it was granted Payment Institution Authorisation by the Financial Conduct Authority (FCA) in the UK.

American Banker

NOVEMBER 28, 2023

The tech company recently sent a proposal to the bank to exit their contract within approximately 12 to 15 months, the newspaper said.

The Paypers

NOVEMBER 28, 2023

Payment software solutions provider Payment Components has announced its strategic partnership with Fimple in order to offer an improved experience for banks and FIs.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content