CFPB may take legal action against Block

Payments Dive

FEBRUARY 23, 2024

The bureau has informed the digital payment company it’s weighing legal action related to a Cash App probe.

Payments Dive

FEBRUARY 23, 2024

The bureau has informed the digital payment company it’s weighing legal action related to a Cash App probe.

ATM Marketplace

FEBRUARY 23, 2024

Gold has long remained a stable asset and today that asset is coming to ATMs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 23, 2024

The fee would apply if Discover chooses another buyer or if either board has a change of heart, but not if regulators block the deal.

BankInovation

FEBRUARY 23, 2024

Envestnet data and analytics revenue fell during its fiscal fourth quarter amid rumblings in December of a Yodlee sale. The wealthtech giant’s data and analytics revenue fell 7% year over year to $38.6 million during the quarter, according to its earnings presentation.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

FEBRUARY 23, 2024

“To simplify the app experience, the U.S. version of the standalone Google Pay app will no longer be available,” the tech giant said in a Thursday blog post.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

FEBRUARY 23, 2024

Cosmin Pitigoi’s appointment comes six months after Flywire announced its long-time finance chief would be exiting.

TheGuardian

FEBRUARY 23, 2024

Bill Winters’ pay rises to £7.8m as bank says annual pre-tax profits rose by 19% in 2023 to £4bn • Business live – latest updates Standard Chartered has handed its chief executive his largest pay package in nearly a decade as the lender reported a jump in profits, despite bracing for up to £1bn in potential losses due to China’s property downturn. The profit bump helped push the longstanding chief executive Bill Winters’ pay up 22% to £7.8m – from £6.4m in 2022.

Payments Dive

FEBRUARY 23, 2024

Consumers facing financial hardships turned to buy now, pay later services more last year than stable consumers, according to survey results from the Philadelphia Federal Reserve Bank.

Commercial Lending USA

FEBRUARY 23, 2024

The cost of assisted living can vary greatly depending on various factors, including location, type of care required, facilities supplied, and the individual facility.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

FEBRUARY 23, 2024

After his aggressive cost-cutting raised profits above analysts' expectations, Block's CEO aims to retool several features of Square and Cash App to enable them to operate like a "social bank.

The Paypers

FEBRUARY 23, 2024

The Financial Conduct Authority (FCA) of the UK has initiated an investigation into Lloyds Banking Group ’s Anti-Money Laundering (AML) controls.

American Banker

FEBRUARY 23, 2024

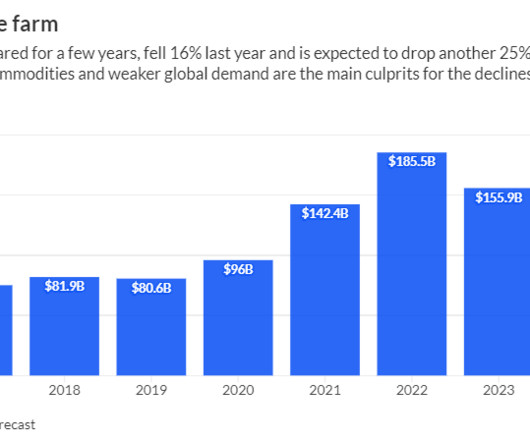

The USDA forecasted farm profits will plunge 26% this year, potentially creating credit quality challenges for lenders.

The Paypers

FEBRUARY 23, 2024

Telecommunications operators Cell C , MTN , and Telkom have welcomed the launch of two universal APIs available in South Arica that combat fraud and digital identity theft.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

CFPB Monitor

FEBRUARY 23, 2024

On February 16, the Financial Crimes Enforcement Center (“FinCEN”) published a Notice of Proposed Rulemaking (“NPRM”) regarding residential real estate. The final version of the NPRM published in the Federal Register is 47 pages long. We have created a separate document which more clearly sets forth the proposed regulations themselves, at 31 C.F.R.

BankInovation

FEBRUARY 23, 2024

Capital One could be excluded from the proposed Credit Card Competition Act of 2023 if its acquisition of Discover Financial Services goes through and the bank creates an in-house processor. Read more on the Capital One, Discover deal The proposed act, introduced in June 2023 by U.S. Sen.

American Banker

FEBRUARY 23, 2024

The quarterly filings ought to include far more detailed breakdowns of banks' commercial real estate loan portfolios, including the crucial distinction between owner-occupied properties and rentals.

The Paypers

FEBRUARY 23, 2024

Egypt-based Commercial International Bank has partnered with Ripple to implement blockchain technology aiming to enhance the efficiency of cross-border payments.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

FEBRUARY 23, 2024

An FDIC enforcement action against Lineage Bank is part of a wave of cases involving banks that have partnered with fintechs in recent years.

The Paypers

FEBRUARY 23, 2024

Google has announced its plans to launch the SoundPod, its portable speaker developed to validate and announce successful payments instantly, to SMEs across India.

American Banker

FEBRUARY 23, 2024

The Department of Justice appoints Jonathan Mayer as its first chief AI officer, HTLF's CEO Bruce Lee plans to retire, Wilmington Trust's Doris Meister will step down in May, and more in the weekly banking news roundup.

The Paypers

FEBRUARY 23, 2024

Prove Identity has announced its partnership with TargetData in order to continue its expansion in Brazil and provide customers with its suite of solutions.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

FEBRUARY 23, 2024

UK-based API-first bank Griffin has launched Foundations, a programme for UK companies to integrate financial products with BaaS solutions.

The Paypers

FEBRUARY 23, 2024

US-based financial institution TD Bank has announced the launch of its `Tap-to-Pay on iPhone` service, aimed at small and micro businesses in the region.

The Paypers

FEBRUARY 23, 2024

iDenfy has announced collaborating with Rawcaster , a social media platform designed for influencers and their fans, aiming to increase influencer security.

The Paypers

FEBRUARY 23, 2024

Digital neobank Saldo Bank has announced its expansion in the region of Sweden and the raise of the interest rates on fixed-term deposits.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content