Cash App enforcement action expected this year

Payments Dive

MARCH 4, 2024

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

Payments Dive

MARCH 4, 2024

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

CFPB Monitor

MARCH 4, 2024

On February 27, 2024, the U.S. Supreme Court heard oral argument in Cantero v. Bank of America, N.A. , a case involving the effect of the Dodd-Frank Act on the scope of preemption under the National Bank Act (NBA). The question before the Court is whether, post-Dodd-Frank Act, the NBA preempts a New York statute requiring banks to pay interest on mortgage escrow accounts. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 4, 2024

A Mastercard executive painted Regulation II as potentially harmful to consumers, while Fiserv’s CEO said it was an appropriate update due to the rise of online transactions.

ABA Community Banking

MARCH 4, 2024

The popular app is where Gen Z goes for trends, news and even financial advice. Here’s how some banks are using TikTok and platforms like it for education. The post Time to TikTok? appeared first on ABA Banking Journal.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MARCH 4, 2024

The peer-to-peer payment app provided a performance update, with transactions volume and value both up about 30% from the previous year.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

MARCH 4, 2024

A large language model detects signs of agent burnout and sends stressed-out employees calming videos created by Ariana Huffington's company Thrive Global.

BankInovation

MARCH 4, 2024

Lloyds Bank is looking to invest in cybersecurity and technology related to insurance and regulatory monitoring in 2024 amid uncertain macroeconomic conditions. “I like regtech because it’s important to keep on innovating in that space,” Robin Scher, head of fintech investment at Lloyds Bank, said at FinovateEurope last week.

CFPB Monitor

MARCH 4, 2024

Rhode Island, Minnesota, and Nevada have joined the list of jurisdictions considering proposals to legislatively opt out of federal interest rate preemption established under the federal Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA). Although the legal effect remains unclear, the apparent objective of these proposed laws is to prevent interest rate “exportation” by state-chartered financial institutions.

American Banker

MARCH 4, 2024

Banco San Juan Internacional is suing the Federal Reserve Bank of New York and the Board of Governors in Washington claiming they wrongfully terminated its access to the federal payments system.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

CFPB Monitor

MARCH 4, 2024

After targeting credit card late fees in its proposed rule , the CFPB has set its sights on further attacking credit card pricing through interest rates. The CFPB published a blog late last month stating that credit card interest rate margins are at an all-time high, with an average 14.3% margin in 2023 compared to 9.6% margin in 2013, and have fueled the profitability of revolving balances.

American Banker

MARCH 4, 2024

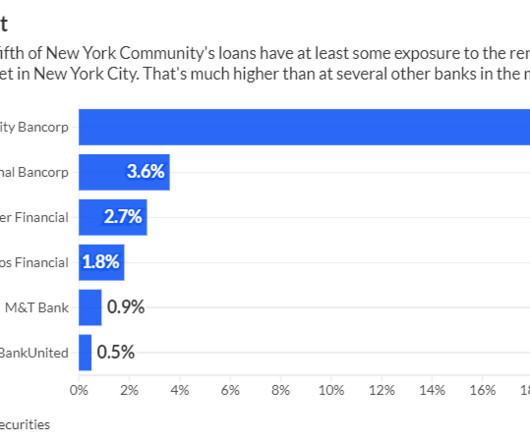

Long Island-based New York Community Bancorp has a large concentration in loans on New York City apartment buildings with rent restrictions. Property values in that sector have tanked amid higher interest rates, inflation and 2019 revisions to state law.

TheGuardian

MARCH 4, 2024

Scion of the famous banking dynasty who was an admired cultural philanthropist in the arts and heritage worlds Jacob Rothschild, Lord Rothschild, who has died aged 87, combined a ruthlessly successful business career, following in the family tradition as a financier in the City of London, with philanthropic projects. These mainly centred on the arts and heritage, including the restoration of the dynasty’s enormous 19th-century replica of a French chateau Waddesdon , in the middle of the Buckingh

BankInovation

MARCH 4, 2024

Citizens Bank takes a measured approach to adopting new technology. The best new products are created with an abundance of identified use cases, Jo Wyper, executive vice president and head of operations at Citizens Commercial Bank, tells Bank Automation News on this episode of “The Buzz” podcast.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

MARCH 4, 2024

Anu Aieyengar, Global head of M&A at JPMorgan discusses her career and her outlook for M&A activity in the year ahead.

The Paypers

MARCH 4, 2024

Nigerian authorities have called for a USD 10 billion penalty against Binance , as the platform caused financial losses within the country by manipulating exchange rates.

American Banker

MARCH 4, 2024

The peer-to-peer network moved $219 billion in the final three months of 2023, with scams and fraud accounting for about 0.1% of all volume, according to Early Warning Services, which operates Zelle and is owned by a consortium of banks.

The Paypers

MARCH 4, 2024

Singapore-based B2B embedded finance startup Fairbanc has received USD 13.3 million in debt financing to expand operations in Indonesia.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

MARCH 4, 2024

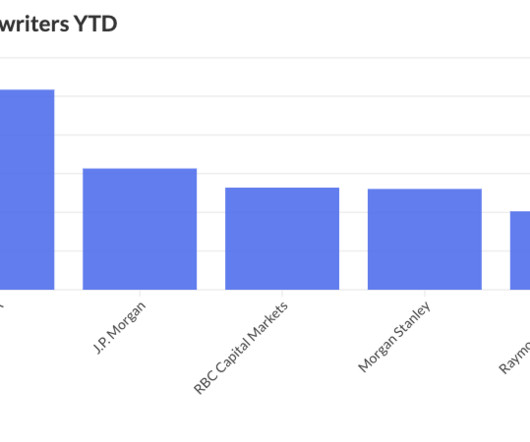

The bank has also hired some analysts to its infrastructure group over the past several weeks as it plans to beef up its muni team.

The Paypers

MARCH 4, 2024

Moneyhub has partnered with Rebcat and Navos in order to develop optimised technology and provide UK-based firms with personalised financial support.

American Banker

MARCH 4, 2024

The Consumer Financial Protection Bureau says it is in favor of consumer choice, but its shifting position on earned wage access calls that commitment into question.

The Paypers

MARCH 4, 2024

Flipkart has announced the launch of a new UPI service in partnership with Axis Bank , aiming to optimise fund transfers and checkout payments for Android users.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Financial Brand

MARCH 4, 2024

This article A ‘Pivotal’ Moment: What’s Next for Commercial Banking? appeared first on The Financial Brand. The commercial banking industry is focusing on liquidity management and preparing for new regulations. Why? Find out here. This article A ‘Pivotal’ Moment: What’s Next for Commercial Banking? appeared first on The Financial Brand.

The Paypers

MARCH 4, 2024

The Financial Intelligence Unit (FIU) from India has announced that it imposed a monetary penalty of approximately USD 662,565 on Paytm Payments Bank.

The Financial Brand

MARCH 4, 2024

This article Bankers Say BaaS Turmoil Primes Future Growth appeared first on The Financial Brand. Bankers now say upheaval in the industry has spurred the refinement needed to bring banking-as-a-service to the front of the table. This article Bankers Say BaaS Turmoil Primes Future Growth appeared first on The Financial Brand.

The Paypers

MARCH 4, 2024

UK-based online-only pension provider PensionBee has partnered with a financial institution based in the US to expand its presence in the country.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content