4 ways to “Break the Cycle” and leave manual reimbursements in the past

Payments Dive

DECEMBER 11, 2023

Manual travel reimbursements cost companies time and money yet remain common in corporate policies.

Payments Dive

DECEMBER 11, 2023

Manual travel reimbursements cost companies time and money yet remain common in corporate policies.

CFPB Monitor

DECEMBER 11, 2023

Recently, Professor Sovern replied to our blog post that commented on the letter that he and 160 other law academicians submitted to the CFPB in support of the pending Petition for Rulemaking that would prohibit pre-dispute consumer arbitration clauses and permit only post-dispute clauses. In response, we would like to acknowledge that two of Professor Sovern’s statements are accurate. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

DECEMBER 11, 2023

The network is advancing technologies to let consumers and businesses more easily use its cards, after doubling the number of merchants that accept them over the past five years.

CFPB Monitor

DECEMBER 11, 2023

As we reported , the CFPB just released its Fall 2023 rulemaking agenda as part of the Fall 2023 Unified Agenda of Federal Regulatory and Deregulatory Actions. I have been contacted by many clients who have asked me whether we should read any significance into the fact that the anti-arbitration Petition for Rulemaking submitted to the CFPB by a consortium of consumer advocacy groups on September 13 is not mentioned in the new rulemaking agenda. .

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Payments Dive

DECEMBER 11, 2023

Michael G. Rhodes, previously the group head for Canadian personal banking at TD Bank Group, will take the helm at Discover in March.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

DECEMBER 11, 2023

“We’re going to continue to invest whatever we have to invest in order to get the compliance issues behind us,” CFO John Greene said last week.

American Banker

DECEMBER 11, 2023

Proposed capital rules aimed at bigger institutions will force regional and larger community banks to consider ways to grow or seek an exit strategy, bankers and analysts predict.

Commercial Lending USA

DECEMBER 11, 2023

Looking for commercial loans in the USA? Commercial Lending USA specializes in arranging commercial mortgages for businesses and commercial purposes nationwide. Get the funding you need today!

American Banker

DECEMBER 11, 2023

Bank CEOs are eyeing a near-term peak in deposit costs as the Fed perhaps moves closer to cutting interest rates. But the pressures they've faced this year as depositors ask for more compensation may not die down right away.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

BankInovation

DECEMBER 11, 2023

The European Parliament and European Council reached a deal Friday on AI regulation to protect consumers from high-risk uses of the technology while promoting innovation in a controlled environment. The deal could become the international benchmark on AI.

American Banker

DECEMBER 11, 2023

Michael Rhodes, who has spent the last dozen years in various executive roles at TD Bank Group, will become CEO and president of Discover Financial Services. The move comes four months after the unexpected departure of Discover's longtime CEO Roger Hochschild.

BankInovation

DECEMBER 11, 2023

Challenger bank Dave launched its generative AI-driven chatbot last week and is exploring multiple uses of the technology.

American Banker

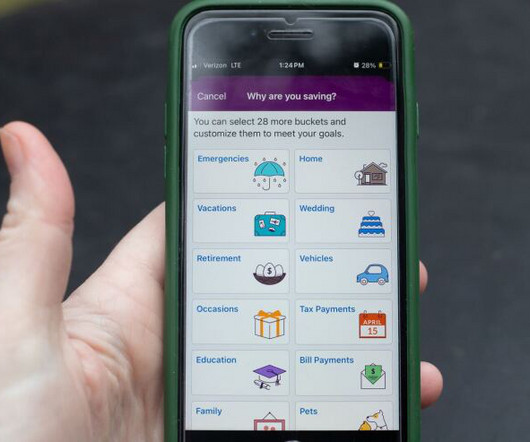

DECEMBER 11, 2023

Mobile banking features that encourage customers to set savings goals can supercharge customer loyalty and attract new primary banking customers. A renewed focus on consumer savings may also help banks offset the decline in deposits reported at many banks in 2023.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

The Paypers

DECEMBER 11, 2023

The Hong Kong government has assigned USD 25.6 billion and has made significant investments to establish Hong Kong as a fintech hub through innovation and technology.

American Banker

DECEMBER 11, 2023

Leaders at the helms of organizations like Georgia United Credit Union, BayPort Credit Union, Blend Labs and more are adapting products such as "soft check" credit scoring, artificial intelligence-powered bots to streamline application reviewal and more.

PopularBank

DECEMBER 11, 2023

Molly Hime, a long-time Division Manager for Popular Association Banking (PAB), a division of Popular Bank , has announced her retirement, effective December 31, 2023. Molly has been with Popular Bank since 2005 and was instrumental in growing PAB into a $2 Billion loan portfolio business and the national platform it is today. Under her leadership, the team has quadrupled in size and has originated more than $5 Billion in association loans as well as more than $1.6 Billion in deposits.

American Banker

DECEMBER 11, 2023

Internet-based banks are siphoning deposits away from urban centers in the U.S. and, unlike brick-and-mortar banks, face no requirement that they loan money back into those communities.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

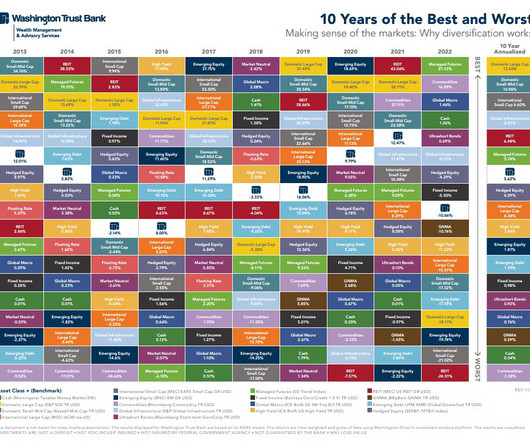

TrustBank

DECEMBER 11, 2023

Investing in the financial market can sometimes feel like sailing through unpredictable seas, especially during times of market stress and volatility. The waves of market uncertainty can make even the most seasoned investors uneasy, or at times even seasick. 2023 has been a time of turbulent markets. The graph below displays the year-to-date investment growth of a 60% equity and 40% fixed income portfolio (as illustrated by the MSCI All Countries World Index for equity and the Bloomberg Intermed

The Paypers

DECEMBER 11, 2023

TikTok has entered into a joint venture with Indonesian tech company GoTo to resume its online shopping operations in the country.

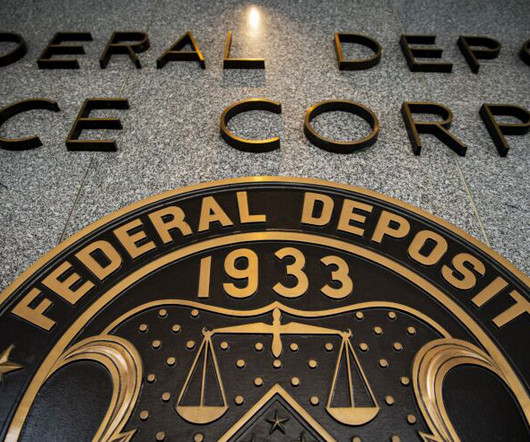

American Banker

DECEMBER 11, 2023

The Federal Deposit Insurance Corp. said Monday it has hired Cleary Gottlieb Steen & Hamilton to conduct an independent review of its workplace culture amid allegations of rampant sexual harassment in the workplace.

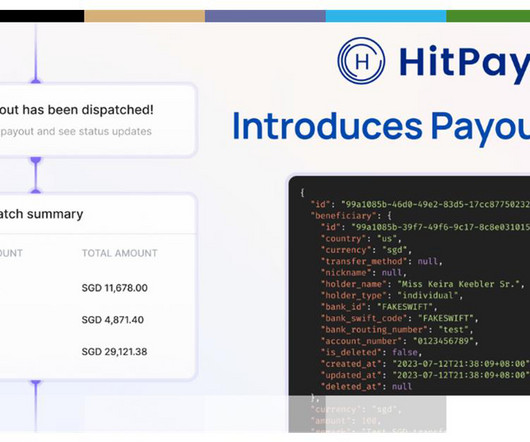

The Paypers

DECEMBER 11, 2023

Payment platform for SMEs HitPay has introduced Payout APIs in the regions of Singapore, Malaysia, and the Philippines, for multiple types of disbursements.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

American Banker

DECEMBER 11, 2023

Citi is among an increasing number of global banks that's now building out desks to finance carbon offset projects, trade credits and advise corporate buyers in the hope of latching on to growth in a market that may reach $1 trillion.

The Paypers

DECEMBER 11, 2023

Swift has tested an interoperability solution with BNY Mellon , Deutsche Bank , and four eBL platforms to promote the adoption of electronic documents for digitising trade.

American Banker

DECEMBER 11, 2023

More than half of those elevated to the senior role were women or people of color, marking the fourth consecutive year that historically underrepresented groups made up the majority of the class.

The Paypers

DECEMBER 11, 2023

AI-powered fraud and risk platform DataVisor has expanded its end-to-end platform capabilities by integrating SMS customer authentication for fraudulent transactions.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content