JPMorgan Chase revs up payments lab hiring

Payments Dive

SEPTEMBER 7, 2023

The bank is venturing further into fintech and payments for new product development at its lab in Greece.

Payments Dive

SEPTEMBER 7, 2023

The bank is venturing further into fintech and payments for new product development at its lab in Greece.

Abrigo

SEPTEMBER 7, 2023

Court case: Credit union held liable for ACH fraud losses A construction company argued the financial institution "failed to establish a reasonable routine" for monitoring suspicious activity alerts tied to ACH. Learn strong approaches to identifying, evaluating, and reporting suspicious activity in this BSA Guidebook Download now Takeaway 1 A credit union was recently found liable for fraudulent ACH transactions totaling $559,000.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 7, 2023

The new licenses are aimed at advancing Elon Musk's campaign to expand the social media company formerly known as Twitter into the payments business.

Abrigo

SEPTEMBER 7, 2023

Adapt to a dynamic banking environment with real-time lending & credit data Lender dashboards and reports showing the lending pipeline, pricing trends, emerging risks, workflow bottlenecks, etc. help financial institutions adapt quickly to trends. You might also like this on-demand webinar, "Identifying emerging CRE risks." WATCH NOW Takeaway 1 Financial institutions create a competitive advantage when they are informed about critical factors affecting loan growth.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

SEPTEMBER 7, 2023

Square’s refocused sales team is a “key investment area for us in the future,” Block executive Amrita Ahuja said Wednesday.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

SEPTEMBER 7, 2023

Leeds-based bank may finally be in position to support regional development and net zero climate ambitions It is not every day that the former boss of HSBC is found trudging through the mud of a Cornish mining site. But this was a special occasion. On an overcast day in early August, John Flint, now head of the UK Infrastructure Bank (UKIB), descended on Trelavour Downs in black wellies and a hi-vis jacket, alongside the Treasury minister Andrew Griffith, to mark the government-owned bank’s £24m

American Banker

SEPTEMBER 7, 2023

The Federal Deposit Insurance Corp.'s second-quarter report on the state of banking noted that while banks are enjoying strong profits, they face declining deposits, rising unrealized losses and shrinking net interest margins.

TheGuardian

SEPTEMBER 7, 2023

Startup bank’s deals range from 6.5% to 7.5%, ‘comparable with two-year fixes at the moment’ A new UK mortgage lender is launching home loans that allow people to fix their rate for up to 30 years. It may also let them borrow more money than standard deals. Perenna claimed that by giving people certainty over what they pay for up to three decades, its deals would free borrowers from the interest rate turmoil that has caused many people to be hit with dramatically highermortgage costs this year.

American Banker

SEPTEMBER 7, 2023

After a steep sell-off early in 2023, the sector has recovered ground in summer trading as recession worries ease. But investors remain wary because loan demand is light, deposit costs are high, and net interest margins are under pressure.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

CFPB Monitor

SEPTEMBER 7, 2023

We first review the Fair Credit Reporting Act provisions that establish the different requirements for how a creditor or other furnisher of information to a credit bureau must respond to direct and indirect identify theft disputes involving credit report information reported by the furnisher to a credit bureau. A direct dispute is one made directly by the consumer to the furnisher and an indirect dispute is one made by the consumer to the credit bureau and then submitted to the furnisher by the

American Banker

SEPTEMBER 7, 2023

Affirm is the latest BNPL lender to launch an in-store payment card with multiple financing options, giving consumers more checkout options as regulatory changes loom.

CFPB Monitor

SEPTEMBER 7, 2023

The California Privacy Protection Agency (CPPA) recently published two new sets of draft regulations addressing a range of cutting-edge data protection issues. Although the CPPA has not officially started the formal rulemaking process, the Draft Cybersecurity Audit Regulations and the Draft Risk Assessment Regulations will serve as the foundation for the process moving forward. .

American Banker

SEPTEMBER 7, 2023

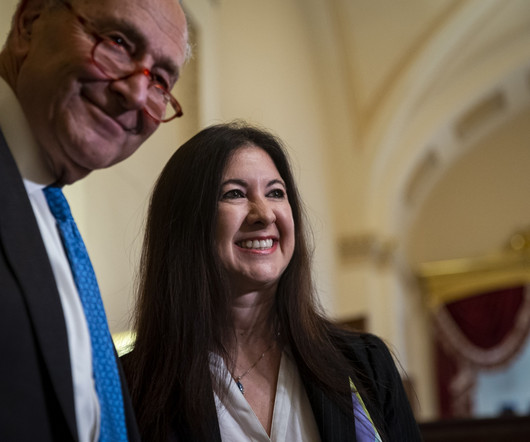

The World Bank director and former top Labor Department economist will become the first Fed governor of Hispanic descent and will give the board a full compliment of members since former vice chair Lael Brainard resigned in February.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

CFPB Monitor

SEPTEMBER 7, 2023

The Federal Deposit Insurance Corporation has announced that it is launching a new Banker Engagement Site (BES) this month through FDIC connect to serve as the primary tool for exchanging examination planning and other information for consumer compliance and Community Reinvestment Act (CRA) activities. (The FDIC examines state-chartered banks that are not members of the Federal Reserve System.) .

The Paypers

SEPTEMBER 7, 2023

UK-based digital payment provider STICPAY has partnered with nearly 40 payment providers to promote financial inclusion across Asia, Africa, and South America.

CFPB Monitor

SEPTEMBER 7, 2023

The U.S. Chamber of Commerce, joined by six other trade groups, filed a lawsuit on September 28, 2022 in a Texas federal district court against the CFPB challenging the CFPB’s recent update to the Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) section of its examination manual to include discrimination. The other plaintiffs are American Bankers Association, Consumer Bankers Association, Independent Bankers Association of Texas, Longview Chamber of Commerce, Texas Association of Busines

American Banker

SEPTEMBER 7, 2023

When 55 banks were asked to provide metrics on the health of their commercial real estate borrowers, some of them gave data that was six months old. The survey by Moody's Investors Service also found that certain borrowers are already struggling, and others could hit trouble soon, since they'll need to refinance at high interest rates.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

BankInovation

SEPTEMBER 7, 2023

Adyen NV has won approval for a UK banking license, replacing its temporary post-Brexit permission to offer embedded finance and other payments services. The Dutch company said the Financial Conduct Authority’s authorization allows it to continue operations in its UK branch.

American Banker

SEPTEMBER 7, 2023

Fraudsters are leveraging advanced artificial intelligence to impersonate customers and deceive financial institutions, but the industry is fighting back with detection systems.

BankInovation

SEPTEMBER 7, 2023

Fifth Third Bank looked to ChatGPT to update its chatbot’s natural language understanding model in order to keep up with growing adoption and advanced customer inquiries.

ABA Community Banking

SEPTEMBER 7, 2023

Now is the time to prepare, as tougher regulatory scrutiny of capital levels is coming. The post Capital in the crosshairs appeared first on ABA Banking Journal.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

BankInovation

SEPTEMBER 7, 2023

LONDON — Financial institution DNB is exploring the risks and benefits of generative AI as the bank tests Boost.ai’s tools.

The Paypers

SEPTEMBER 7, 2023

The United Kingdom branch of Netherlands-based financial technology platform Adyen has obtained a banking authorisation.

American Banker

SEPTEMBER 7, 2023

Rohit Chopra, the director of the Consumer Financial Protection Bureau, wants to ensure that Big Tech firms are not unfairly excluding smaller fintechs from innovating on their platforms.

The Paypers

SEPTEMBER 7, 2023

Mastercard and Fintech Saudi have signed memorandum of understanding (MoU) to advance growth and development in the Saudi Arabia fintech industry.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content