Mobile, digital banking adoption jumps in Q2

BankInovation

AUGUST 7, 2024

Financial institutions are investing in their mobile and digital experiences as consumers flock to online channels for self-service banking.

BankInovation

AUGUST 7, 2024

Financial institutions are investing in their mobile and digital experiences as consumers flock to online channels for self-service banking.

Payments Dive

AUGUST 7, 2024

The biggest U.S. bank is piloting payments processing for biometric transactions, with plans to use it at the hamburger chain Whataburger, which lets customers pay with a face scan.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

AUGUST 7, 2024

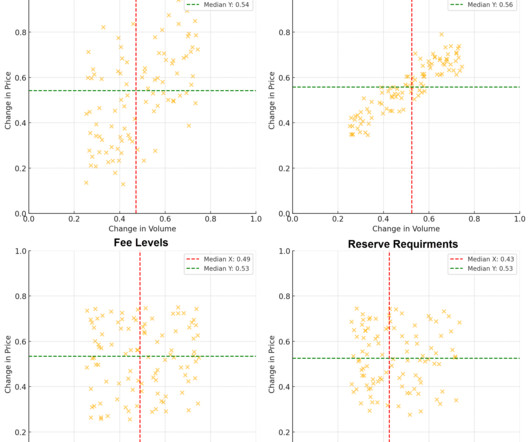

Data analytics combined with artificial intelligence is changing the strategy and tactics around account analysis and the analyzed checking account (which we will call a “transaction account”). In this two-part series, we want to explore the history, structure, and role of account analysis in Part 1 and then some insights and tactics on increasing bank profitability while benefiting the commercial customer.

Payments Dive

AUGUST 7, 2024

The payments service provider is known for working with restaurants, but seeks to make headway with convenience stores, grocery stores and bottle shops.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

American Banker

AUGUST 7, 2024

Industry experts argue that the Federal Deposit Insurance Corp.'s recent brokered deposit proposal, which would expand the classification of brokered deposits and reverse key elements of a 2020 rule, reflects outdated thinking and may discourage banks from holding such deposits.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

AUGUST 7, 2024

Lincoln Savings Bank and Vantage Bank are two new clients of banking-as-a-service provider Unit. They say it improves their ability to 'go direct' rather than hinder it.

The Paypers

AUGUST 7, 2024

CommBank has called on all banks, telcos, and social media companies to join the process of protecting Australian customers from scams, as there is more to do across the market.

American Banker

AUGUST 7, 2024

The Bank of England and the Bank for International Settlements have built a gauge to measure stablecoin reserves, and U.K. challenger bank Monzo is offering a bonus interest rate.

Realwired Appraisal Management Blog

AUGUST 7, 2024

No bank wants the keys to office collateral. How do you reduce special assets/REO/workouts? Consider a strategic response and provide next-level relationship banking. Now’s the time to help your office borrowers with consulting. Your RMs have the time. Sweating Over Office Loans?

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

AUGUST 7, 2024

First National Community Bank CEO Ryan Earnest said his institution would likely use its entry into Paulding County, an Atlanta suburb, as a template for future expansion.

BankUnderground

AUGUST 7, 2024

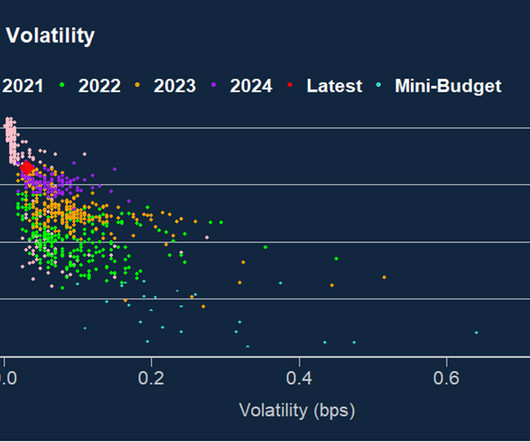

David Glanville and Arif Merali Short term interest rate (STIR) futures are the bedrock of interest rate markets, used to price expectations of central bank policy rates and other UK rate derivative markets such as swaps and options (see Figure 1). They are key for the transmission of monetary policy and provide an avenue for interest rate risk hedging which is important for financial stability.

American Banker

AUGUST 7, 2024

The same creativity and flexibility that community development financial institutions bring to business lending ought to be applied to financing affordable housing.

The Paypers

AUGUST 7, 2024

Revolut has integrated Tikkie , a popular Dutch payment app, to make it available to its Netherlands-based customers.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

AUGUST 7, 2024

The infrastructure fund dubbed BXINFRA targets individuals with at least $5 million of investments

The Paypers

AUGUST 7, 2024

Germany-based B2B BNPL payment provider Mondu BV has announced that it obtained an Electronic Money Institution (EMI) licence from De Nederlandsche Bank (DNB).

The Financial Brand

AUGUST 7, 2024

This article The 5 Use Cases for Adding Generative AI to Your CX Strategy appeared first on The Financial Brand. Discover how to implement AI in customer experience without losing the human touch. Qualtrics' report offers a practical four-step playbook for success. This article The 5 Use Cases for Adding Generative AI to Your CX Strategy appeared first on The Financial Brand.

The Paypers

AUGUST 7, 2024

UK-based Embedded Finance platform Orenda has announced that it selected Tribe to integrate its issuer processing solutions.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Financial Brand

AUGUST 7, 2024

This article Magical Retirement Thinking: Most Americans Want to Retire Early, But Few Have Plans to Get There appeared first on The Financial Brand. Early retirement seems just out of reach for many – and will remain there for most. This article Magical Retirement Thinking: Most Americans Want to Retire Early, But Few Have Plans to Get There appeared first on The Financial Brand.

The Paypers

AUGUST 7, 2024

Pine Labs , an India-based merchant platform that provides payment solutions and Axis Bank have recently launched UPISetu, an UPI-focused payments platform for businesses and developers.

American Banker

AUGUST 7, 2024

A female employee is now suing ICAP and Citigroup, alleging she was subjected to years of unwanted sexual attention and threats by a Citi trader.

The Paypers

AUGUST 7, 2024

Deduce, a patented technology platform together with Datos Insights has released a study showing trends in identity fraud growth within the financial industry.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

AUGUST 7, 2024

J.P. Morgan Payments has announced that it expanded its collaboration with PopID to deploy in-store biometric payments to support merchants across the US.

The Paypers

AUGUST 7, 2024

WorldFirst , a digital payment and financial services platform has partnered with Walmart to help China-based ecommerce sellers collect funds from Walmart Marketplace.

The Paypers

AUGUST 7, 2024

finova Broker , previously known as eKeeper Group and now a part of finova, has announced the integration of Cashflows , a platform that facilitates digital payment acceptance.

The Paypers

AUGUST 7, 2024

Hong Kong-based virtual bank Mox Bank , a subsidiary of Standard Chartered , has launched spot Bitcoin and Ether ETF trading to customers.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content