Building to Code in the Beehive State

Jack Henry

AUGUST 20, 2024

That’s a wrap on CU Build 2024! Click for your event recap, highlights, key moments, and to celebrate another successful year of vendor integration and client collaboration.

Jack Henry

AUGUST 20, 2024

That’s a wrap on CU Build 2024! Click for your event recap, highlights, key moments, and to celebrate another successful year of vendor integration and client collaboration.

Accenture

AUGUST 20, 2024

For decades, commercial cards have provided card issuers with high fee income and strong P&Ls. The market is growing and evolving, with virtual cards as the primary driver. Virtual cards, which offer businesses an efficient and secure way to make payments without a physical card, are considered to be a value-added service by businesses who… The post How commercial card issuers can capitalize on the rise of virtual cards appeared first on Accenture Banking Blog.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 20, 2024

The two big banks say they’ll soon connect to the Federal Reserve’s new instant payment system, even as other major banks remain on the sidelines.

TheGuardian

AUGUST 20, 2024

UK tech entrepreneur Mike Lynch and his daughter among those unaccounted for after vessel capsized off Sicily Sicily yacht sinking – latest news Specialist divers have launched a fresh search for six people missing after a superyacht capsized off the coast of Sicily including the British tech entrepreneur Mike Lynch and his teenage daughter. The British-flagged Bayesian, a 56-metre sailboat, was carrying 22 people and anchored just offshore near the port of Porticello when it was hit by a tornad

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

AUGUST 20, 2024

CFPB Director Rohit Chopra said in a blog post that the agency will not fine companies making a good faith effort to follow regulations treating buy now, pay later loans like credit card transactions. His remarks follow significant industry pushback.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

ATM Marketplace

AUGUST 20, 2024

Shawn Nelson, founder and CEO of Lovesac, is a keynote speaker at the ICX Summit taking place Sept. 9-11 in Charlotte, North Carolina. His topic will focus on how sustainability impacts the retail customer experience.

BankInovation

AUGUST 20, 2024

Jonny Fry, head of digital assets strategy at ClearBank and chief executive of TeamBlockchain, will be featured in a fireside chat at Bank Automation Summit Europe 2024 on Monday, Oct. 7, at 2:15 p.m. GMT +1. The summit takes place Oct.

Jack Henry

AUGUST 20, 2024

The Jack Henry™ 2024 Strategy Benchmark highlights the latest risk, fraud, and security trends that can impact your financial institution over the next two years.

American Banker

AUGUST 20, 2024

For half a century, the Shadow Open Market Committee has been one of the Federal Reserve's sharpest critics. After years of seeing its public profile wither, the group is eyeing a return to prominence.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Cisco

AUGUST 20, 2024

New security standards conformance for Catalyst Center highlights our team’s dedication to protecting your network and your data.

American Banker

AUGUST 20, 2024

Banks are boosting their use of new machine learning to improve security risk, but securing international transactions presents a different set of challenges.

BankInovation

AUGUST 20, 2024

Gather Federal Credit Union has selected credit underwriting platform Zest AI to reduce fraudulent activity during the loan origination and decisioning process. AI-driven Zest Protect can help financial institutions fight identity fraud and identify fake documents during the loan procedure, Adam Kleinman, head of strategy and client success at Zest AI, told Bank Automation News.

American Banker

AUGUST 20, 2024

Shan Hanes, the former leader of Heartland Tri-State Bank, previously pleaded guilty to embezzling tens of millions of dollars in a cryptocurrency scheme that caused the Kansas bank's failure.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Cisco

AUGUST 20, 2024

New security standards conformance for Catalyst Center highlights our team’s dedication to protecting your network and your data.

American Banker

AUGUST 20, 2024

California has a pending law that would hold banks liable for three times losses if they had reason to suspect financial exploitation of an older customer and did nothing about it.

The Paypers

AUGUST 20, 2024

Digital consultancy company Zaelab has announced its collaboration with Shopify , intending to merge their solutions and knowledge to offer B2B commerce solutions globally.

Realwired Appraisal Management Blog

AUGUST 20, 2024

There’s a peculiar inertia in the world of valuation. It’s a world governed by ritual, the same HP12C, the same appraisal format and the same education. The valuation space struggles to be motivated towards entrepreneurial attitude, new tech and process.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

AUGUST 20, 2024

The Consumer Financial Protection Bureau has moved to ban medical debt from appearing on credit reports, but its analysis relies on a sliver of consumer data from more than a decade ago.

ABA Community Banking

AUGUST 20, 2024

Smaller banks, including community banks, are indispensable in providing access to financial products and services, especially in remote or rural areas of the U.S., Federal Reserve Governor Michelle Bowman said. The post Fed’s Bowman touts benefits of banks, CDFIs in rural communities appeared first on ABA Banking Journal.

American Banker

AUGUST 20, 2024

A report from the Office of Inspector General disclosed that the Federal Housing Finance Agency issued enforcement actions against two Home Loan banks.

ABA Community Banking

AUGUST 20, 2024

A community conversations case study from KeyBank. The post Keys to engaging communities and driving inclusive economic solutions appeared first on ABA Banking Journal.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

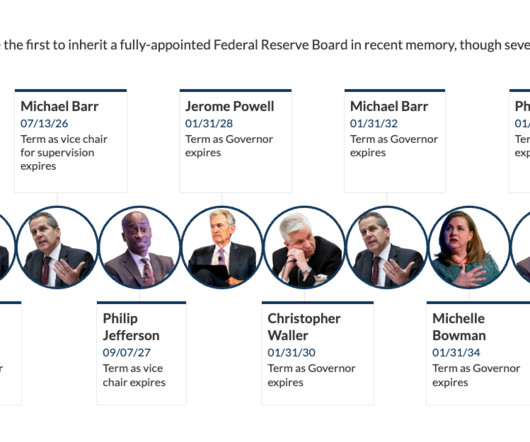

American Banker

AUGUST 20, 2024

The new president will shape the direction of banking policy, but because financial regulators are more insulated from politics than many other areas, that transition will be gradual.

The Paypers

AUGUST 20, 2024

The Supreme People’s Court of the People’s Republic of China (SPC) has reworked its interpretation of the region’s AML laws to include virtual asset transactions.

American Banker

AUGUST 20, 2024

Vice Chair for Supervision Michael Barr says generative AI could present financial-stability risks if certain models are used ubiquitously.

The Paypers

AUGUST 20, 2024

Africa-based paytech Flutterwave has enabled its online merchants in Nigeria to accept American Express payments.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content