Achieving Real-Time Fraud Prevention Across Your Teams

Jack Henry

NOVEMBER 29, 2023

Discover how innovative technologies are reshaping processes and safeguarding against fraudulent activities in our latest FinTalk blog.

Jack Henry

NOVEMBER 29, 2023

Discover how innovative technologies are reshaping processes and safeguarding against fraudulent activities in our latest FinTalk blog.

Payments Dive

NOVEMBER 29, 2023

PayPal is attacking illegitimate customer returns with new policies after a rise in e-commerce activity has fueled that type of fraud across the industry.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

NOVEMBER 29, 2023

One of the lessons that was driven home at the recent American Banker Small Business Banking Conference in Nashville was the difference in marketing between large national banks and community banks, particularly deposit marketing. Most national and regional banks allocate marketing resources to recently acquired customers to get them to build deposit balances and purchase other products, while most community banks do not.

Payments Dive

NOVEMBER 29, 2023

The proposed winddown would entail the entire consumer partnership, including the savings account that was rolled out this year, sources told The Wall Street Journal.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

South State Correspondent

NOVEMBER 29, 2023

Community banks are striving to increase loan yield and maintain their cost of funding (COF). Unfortunately, pressure on COF is expected to remain, and loans will reprice slower than expected as borrowers with below-market rates will wait until the last maturity day to refinance their credits. We have created and used a novel structure to take advantage of the inverted yield curve to allow community banks to increase net interest margin (NIM) and fee income on these existing fixed-rate loans.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

NOVEMBER 29, 2023

Throughout the past few years, the CFPB has sought input from a range of stakeholders, including community-based organizations and financial institutions, for feedback about how it can improve consumer financial products and services for consumers with limited English proficiency (LEP). As a part of these efforts, the CFPB has taken the following actions: in 2020, it published a Request for Information regarding challenges faced by LEP consumers and hosted a roundtable to discuss these challenge

Payments Dive

NOVEMBER 29, 2023

As consumers feel the pinch of inflation, some are turning to installment payment services to stretch their budgets.

CFPB Monitor

NOVEMBER 29, 2023

The U.S. Department of Housing and Urban Development (HUD) recently announced the 2024 loan limits for FHA insured forward mortgage loans and FHA insured Home Equity Conversion Mortgages (HECMs). The announcements were made in Mortgagee Letter 2023-21 and Mortgagee Letter 2023-22 , respectively. For forward mortgage loans in non-high cost areas, the amount for a single unit home increased from $472,030 in 2023 to $498,257 in 2024.

ATM Marketplace

NOVEMBER 29, 2023

Are banks communicating effectively? How are they reaching underserved populations? Mack Turner, president and owner of Mack Turner Consulting and Insights, discussed this in detail in today's podcast.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

Jack Henry

NOVEMBER 29, 2023

Jack Henry™ Connect 2023 Takeaways Determining how to improve back-office and branch operations is similar to making racing decisions for the Indy 500.

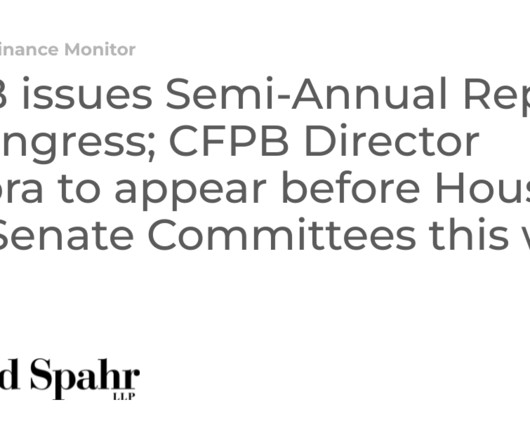

CFPB Monitor

NOVEMBER 29, 2023

Last week, the CFPB issued its Semi-Annual Report to Congress covering the period beginning October 1, 2022 and ending March 31, 2023. Today, CFPB Director Chopra appeared before the House Financial Services Committee for a hearing, “The Semi-Annual Report of the Consumer Financial Protection Bureau.” Tomorrow, he is scheduled to appear before the Senate Banking Committee for a hearing, “The Consumer Financial Protection Bureau’s Semi-Annual Report to Congress.”.

American Banker

NOVEMBER 29, 2023

The Port Angeles, Washington-based bank said it has already invested "significant resources" into enhancing its compliance management for fintech partnerships, after self-reporting a problem last year.

BankInovation

NOVEMBER 29, 2023

Technology providers Alkami, Finastra and Temenos all brought on new financial institution customers in the third quarter as demand for cloud-based solutions and digital banking rose. “Digital banking is an essential product now for a financial institution.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

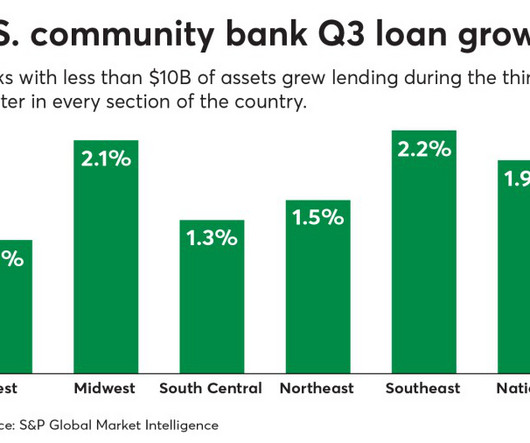

American Banker

NOVEMBER 29, 2023

Total loans at U.S. banks with less than $10 billion of assets grew by 1.9% in the third quarter, according to S&P Global Market Intelligence data. That was a slowdown from the previous quarter, and concerns about the viability of commercial real estate lending could dampen activity further.

BankInovation

NOVEMBER 29, 2023

Apple and Goldman Sachs are parting ways on the Apple Card and the tech giant will be in the market for a new issuer — and whether that’s a traditional financial institution or card-issuing fintech is the question now.

American Banker

NOVEMBER 29, 2023

Morais, who leads the auto lender's consumer and commercial banking divisions, is preparing to leave as Ally Financial conducts a search for its next chief executive officer. She had been seen as a potential candidate to replace outgoing CEO Jeffrey Brown.

The Paypers

NOVEMBER 29, 2023

Australia-based regtech and onboarding provider LAB Group has entered the SMSF administration vertical by partnering with SuperGuardian for automated digital onboarding.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

American Banker

NOVEMBER 29, 2023

Net income at banks fell 4.6% year over year in the third quarter, though it remained above pre-pandemic levels, according to the latest Quarterly Banking Profile. FDIC Chairman Gruenberg cautioned about deteriorating commercial real estate loans and unrealized losses on securities in a high interest rate enviroment.

The Paypers

NOVEMBER 29, 2023

UK-based Paysend has announced the raise of a USD 65 million in funding round, aimed at its development process and improvement of cross-border payments tools.

American Banker

NOVEMBER 29, 2023

Small towns, in which community banks are disappearing, have increasingly little to offer nascent businesses in the way of reliable credit.

The Paypers

NOVEMBER 29, 2023

Switzerland-based Brighty App has launched Brighty Business, its European B2B payment platform, to simplify financial operations management for businesses.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

American Banker

NOVEMBER 29, 2023

Two years after acquiring the installment lender Afterpay, Block, which also owns Square, is seeing the payoff of a strategy that focuses on the sale of specialty items.

The Paypers

NOVEMBER 29, 2023

Corporate mobility payments platform XXImo has announced that it is going all-in on Amazon Web Services as an EU Visa card issuer to process payments entirely through the AWS Cloud in Q1 2024.

American Banker

NOVEMBER 29, 2023

The Berkshire Hathaway legacy of Warren Buffett's longtime business partner includes large checks written to national banks as well as curt remarks about the industry's shortcomings. Munger died on Tuesday, a few weeks before of his 100th birthday.

The Paypers

NOVEMBER 29, 2023

UK-based TrueLayer has partnered with Lendable to integrate its Account Information Services (AIS) and Variable Recurring Payments (VRP) products into the latter’s financial ecosystem.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content