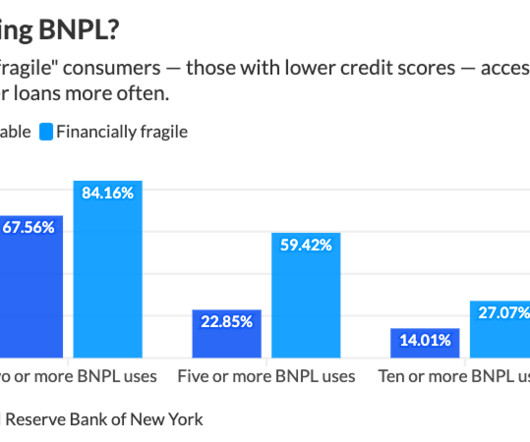

BNPL popularity rises among ‘financially fragile’ consumers

Payments Dive

FEBRUARY 15, 2024

About 60% of that group has used BNPL five or more times in the past year, compared to just over 20% of financially stable consumers, the New York Fed said.

Payments Dive

FEBRUARY 15, 2024

About 60% of that group has used BNPL five or more times in the past year, compared to just over 20% of financially stable consumers, the New York Fed said.

Perficient

FEBRUARY 15, 2024

This blog was co-authored by Perficient Risk and Regulatory CoE Member: Alicia Lawrence The announcement of significant amendments to the New York State Department of Financial Services (NYSDFS) regulations on December 1, 2023, represents a pivotal moment for entities operating within New York’s financial sector. The NYSDFS Part 500 amendments signal a crucial shift in the financial services regulatory landscape and underscore the importance of robust governance, risk management, and compl

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 15, 2024

While there has been industry speculation about the company making an acquisition, CEO Cameron Bready was more ready to talk “pruning” this week.

Perficient

FEBRUARY 15, 2024

This blog was co-authored by Perficient Risk and Regulatory CoE Member: Alicia Lawrence Perficient’s Risk and Regulatory Center of Excellence (CoE) remains at the forefront of evolving financial rules and regulations, ensuring readiness to tackle emerging challenges and safeguard financial institutions and its customers. The announcement of significant amendments to the DFS500 regulations on December 1, 2023, represents a pivotal moment for entities operating within New York’s financial se

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

FEBRUARY 15, 2024

Peer-to-peer transactions also contributed to a 4.8% increase in payments volume for the ACH Network last year over 2022.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

FEBRUARY 15, 2024

Adding a virtual card number feature “is about giving options to consumers when retailers do not support Apple Pay,” Creative Strategies President Carolina Milanesi said.

ATM Marketplace

FEBRUARY 15, 2024

Will cash go away? That is the question that is top of mind for the ATM industry. Two debaters tackled this issue head on.

TheGuardian

FEBRUARY 15, 2024

Pre-tax figure of £6.2bn comes as bank confirms Paul Thwaite will take over permanently as CEO Business live – latest updates NatWest made its biggest annual profit last year since the 2007 financial crisis, helped by high interest rates, as the bank confirmed the interim boss Paul Thwaite would permanently take over as its chief executive before a sale of its government-owned shares.

American Banker

FEBRUARY 15, 2024

For customers who are declined through traditional underwriting models, artificial intelligence models that can take in more data take a wider lens of creditworthiness.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

BankInovation

FEBRUARY 15, 2024

Financial institutions prioritize investment in cybersecurity technology but no matter how much they spend for protection, their systems and data remain vulnerable. “You could never say any organization is 100% secure and they’ll never be hacked,” Ray Kelly, fellow at cybersecurity company Synopsys Software Integrity Group, told Bank Automation News, noting that even the U.S.

American Banker

FEBRUARY 15, 2024

Financial institutions need to reconsider the logic and intuitiveness of their website design. They could also introduce free credit scores and capitalize on generative AI, experts say.

Gonzobanker

FEBRUARY 15, 2024

“The most powerful weapon in chess is to have the next move.” -David Bronstein, chess world finalist Facing off with a vendor to negotiate a multi-year contract is much like a game of chess. Move after move, decisions are made based on information available at the time. Contract negotiations typically have two players, each applying their strategy to obtain desired terms, conditions and pricing.

American Banker

FEBRUARY 15, 2024

Investors have hammered the New Jersey-based lender following the turmoil at New York Community Bancorp. But Valley executives say there are key differences between the two real estate-focused banks, and they express confidence that the bank's underwriting will hold up again this cycle.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

CFPB Monitor

FEBRUARY 15, 2024

Our special guest is Richard (“Rick”) Hackett, former Assistant CFPB Director responsible for auto finance regulation and presently a member of the Board of F&I Sentinel, which supports lender compliance in the auto finance and insurance industry. In December 2023, the FTC announced its Combatting Auto Retail Scams Rule, otherwise known as the “CARS Rule,” which sets new requirements on the sale, financing, and leasing of new and used vehicles by motor vehicle dealers. .

American Banker

FEBRUARY 15, 2024

The top five fintech and payments M&A deals had a combined dollar volume of more than $23 billion.

BankInovation

FEBRUARY 15, 2024

Temenos AG plunged by nearly a third, slashing its market value by $2.1 billion, after Hindenburg Research took a short position and suggested serious flaws in the books of the Swiss provider of software for banks. The Swiss company denied the report, saying it contained “factual inaccuracies and analytical errors, together with false and misleading allegations.

American Banker

FEBRUARY 15, 2024

The proposed implementing rule will squeeze credit for entrepreneurs and small businesses, adding more barriers to their success in an already-tight lending environment.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

BankInovation

FEBRUARY 15, 2024

NCR Atleos reported that its self-service banking business continued to grow in the fourth quarter. NCR added more than 2,000 ATMs in the quarter, making the total number of active units 20,000, Chief Executive Tim Oliver said during NCR’s Q4 earnings call on Feb. 14.

American Banker

FEBRUARY 15, 2024

Wells Fargo clears another hurdle as OCC terminates 2016 order

The Paypers

FEBRUARY 15, 2024

US-based crypto solutions company Ripple has agreed to acquire Standard Custody & Trust Company , an enterprise-grade regulated platform for digital-assets.

ATM Marketplace

FEBRUARY 15, 2024

Euronet (NASDAQ: EEFT), a leading global financial technology solutions and payments provider, today announced the acquisition of Infinitium Holdings Pte. Ltd (Infinitium), a digital payments company and provider of risk management and payments authentication services based in Singapore.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Qudos Bank

FEBRUARY 15, 2024

Whether you’re gathering funds for your first house, a holiday destination, or simply looking to build a substantial nest egg, boosting your savings could often be a challenge. In fact, 48% of Australians admit to having a bank account balance that “could be better” 1 , according to survey results by Finder. However, the right financial habits, planning, and preparation could not only help you reach your savings goals faster – but could also make the experience a more rewarding, rather than stre

American Banker

FEBRUARY 15, 2024

Nearly a dozen states are looking to regulate digital payroll advance products, prompting a fintech trade group to ask the Consumer Financial Protection Bureau to conduct a formal rulemaking.

Qudos Bank

FEBRUARY 15, 2024

If you’ve decided that now’s the time to give your home a makeover, then it’s important to work out what your home renovation budget is, and how much things will cost. Expenses associated with home modifications can easily snowball, so working out what’s worth spending money on and where you can save money can make all the difference. There are other things to consider, like how to cover these costs, as well as common dos and don’ts when renovating your home.

American Banker

FEBRUARY 15, 2024

Financially stressed consumers nearing their credit limit use buy now/pay later loans to finance smaller purchases, while wealthier households want to avoid paying interest or carrying a balance on credit cards for bigger-ticket items, according to the New York Fed.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content