A Return to Marketing Loans: Here’s What You Should Know

Image Works Direct

JUNE 19, 2024

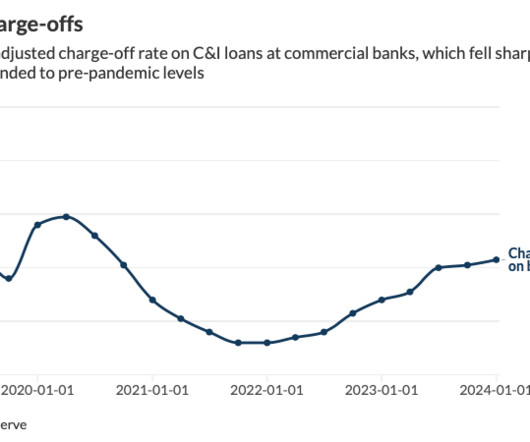

For many financial institutions, the high-rate environment put promoting loans on the backburner. Because we’re now beginning to see loan rates improve and financial institutions return to marketing loans, I asked our Senior National Account Manager, Colin Walsh, for his perspective on all things loan generation.

Let's personalize your content