Connecticut moves to regulate EWA

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

Perficient

SEPTEMBER 19, 2023

The world’s largest gathering of insurance innovation, InsureTech Connect (ITC) , is right around the corner. And our team of industry experts is excited to connect, collaborate, and address the most pressing business needs of national and regional carriers. Following last year’s conference, Perficient Insurance Principal Brian Bell shared three key takeaways from the 2022 event: First, data and analytics investments still topped many insurers’ list of operational priorities.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 19, 2023

Brex, which got its start by offering corporate credit cards to startups, is one of many software vendors racing to bet on artificial intelligence.

CFPB Monitor

SEPTEMBER 19, 2023

California continues to be at vanguard of data privacy rights. The latest effort by California legislators to protect consumer privacy rights focuses on data brokers, who under the proposed California Senate Bill 362 , aka the “Delete Act,” would be required to recognize and honor opt-out signals from Californians. The law seeks to expand on the deletion and opt-out rights provided under the CCPA, which currently requires a Californians to submit their deletion and opt-out requests on a compa

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

SEPTEMBER 19, 2023

The service uses blockchain technology to convert clients’ deposits into digital tokens that can be used for instant, cross-border payments 24/7, the bank said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

SEPTEMBER 19, 2023

FCA review gained attention after closure of former Ukip leader’s account by Coutts Business live – latest updates The UK’s financial regulator is expected to say it found no evidence that customers are being denied bank accounts or other financial services because of their political views, after launching a review after the Nigel Farage debanking row.

Realwired Appraisal Management Blog

SEPTEMBER 19, 2023

What would you do differently if you were starting over with your bank? Would you build your team, vendors and technology differently? Do you still have passion for the valuation industry? This is a tale rooted in Zen philosophy, offering insights into the pursuit of personal excellence.

American Banker

SEPTEMBER 19, 2023

The Consumer Financial Protection Bureau issued guidance on the use of artificial intelligence in credit underwriting, saying that creditors are relying too heavily on a CFPB checklist and sample forms when they should provide specificity to explain why a consumer is denied credit.

The Paypers

SEPTEMBER 19, 2023

A group of banks such as JP Morgan and Bank of America have revealed their plans to launch a mobile wallet named Paze in a bid to compete with Big Tech companies.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

TheGuardian

SEPTEMBER 19, 2023

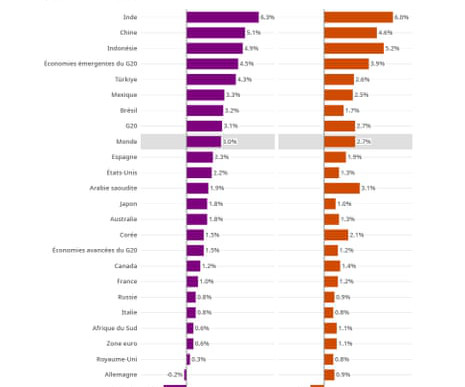

Rolling coverage of the latest economic and financial news, as Brent crude hits 10-month high and eurozone price pressures ease Farage row: no evidence of politicians being debanked, watchdog set to find Newsflash: inflation across the eurozone fell last month. Consumer prices across the single currency area rose by 5.2% in the year to August, down from 5.3% in July, and lower than the 5.3% initially estimated for August.

American Banker

SEPTEMBER 19, 2023

A proposal by Sen. Josh Hawley to cap credit card interest rates deserves to be taken seriously, but requires far more detail than the legislative language provides.

CFPB Monitor

SEPTEMBER 19, 2023

American Bankers Association (ABA), Association of Credit and Collection Professionals (ACA International), U.S. Chamber of Commerce (Chamber), Synchrony Bank (Synchrony), and National Consumer Law Center (NCLC) submitted comment letters in response to the Consumer Financial Protection Bureau’s request for information, about medical credit cards and other lending products used to pay for health care expenses.

American Banker

SEPTEMBER 19, 2023

The service was created to meet institutional clients' needs for real-time payments.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

BankInovation

SEPTEMBER 19, 2023

Silicon Valley Bank’s integration with First Citizens Bank is going “better than expected.

American Banker

SEPTEMBER 19, 2023

As Apple and Android enable smartphones to accept payments with little setup, an exec at the bank's Elavon unit contends countertop devices have a lot of life left.

BankInovation

SEPTEMBER 19, 2023

TORONTO — Bank of America announced the addition of AI capabilities to its CashPro Chat function at Sibos 2023 Monday, bringing an enhanced user experience to its corporate and commercial clients. The $3.

American Banker

SEPTEMBER 19, 2023

Dawson Her Many Horses, a commercial banker at Wells Fargo, is a pivotal player in an effort among tribal leaders, the federal government and the private sector to improve the availability of economic data about Native American communities to encourage outside investment there.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

SEPTEMBER 19, 2023

Revolut has launched RevTags, a global payments solution addressed to businesses with the goal of disrupting SWIFT.

American Banker

SEPTEMBER 19, 2023

Denver-based InBank will expand into Georgia and Arizona, part of a wider plan to seize market share and build what one executive called a top-tier SBA lender.

PopularBank

SEPTEMBER 19, 2023

Beware of the latest bank phone call scam, which involves scammers impersonating bank call centers and fraud departments. These scammers will try to trick you into telling them your personal data so that they can hack into your accounts. How to spot the red flags of a bank phone call scam. The scammer claims to be calling from your bank. The caller ID may even look like it’s coming from your bank.

American Banker

SEPTEMBER 19, 2023

The $223 billion-asset bank said it will train its commercial bankers to work with clients to develop decarbonization transition plans. It also committed to reaching carbon neutrality within 12 years.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

ABA Community Banking

SEPTEMBER 19, 2023

Whether sponsoring large-scale events or supporting local-level initiatives, banks can strengthen their brand presence and attract new customers while demonstrating a genuine commitment to the well-being of their communities. The post Taking your brand on the road appeared first on ABA Banking Journal.

The Paypers

SEPTEMBER 19, 2023

UK-based Trade Ledger has announced its plans to launch a new solution integrating Microsoft Azure OpenAI Service.

American Banker

SEPTEMBER 19, 2023

The combination would create a company with $27 billion of total assets, $18 billion of loans and $22.6 billion of deposits.

The Paypers

SEPTEMBER 19, 2023

Fabrick has collaborated with MIND DXM to provide an environment where companies can exchange data, foster innovation, and enhance information-sharing capabilities.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content