Block cuts employees

Payments Dive

OCTOBER 6, 2023

Jack Dorsey-led Block is the latest payments company to make staff cuts and pull back on hiring as it pursues profitable growth.

Payments Dive

OCTOBER 6, 2023

Jack Dorsey-led Block is the latest payments company to make staff cuts and pull back on hiring as it pursues profitable growth.

ATM Marketplace

OCTOBER 6, 2023

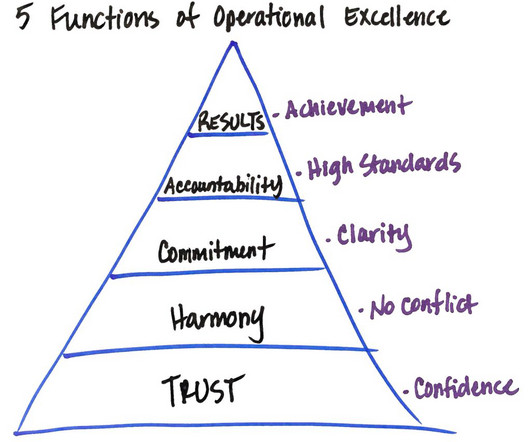

How can you build an end-to-end customer experience that works for your organization? The closing keynote at the Bank Customer Experience Summit took a closer look at this topic.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 6, 2023

The debit card allows patients to swipe first, then pick a payment plan later, PayZen CEO Itzik Cohen said.

Realwired Appraisal Management Blog

OCTOBER 6, 2023

Chief Appraisers are under increasing pressure to demonstrate not only the accuracy and reliability of their valuations but also the efficiency and cost-effectiveness of their operations. One of the tools that is revolutionizing the appraisal industry and offering a tangible return on investment (ROI) is appraisal management software.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

OCTOBER 6, 2023

Online mobile spending will surpass computers for the first time and shoppers will turn more to buy now, pay later services, according to the report.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

OCTOBER 6, 2023

Credit cards and auto loans both showed weakness in the second quarter, leading to an uptick in delinquencies and charge-offs for U.S. credit unions.

BankInovation

OCTOBER 6, 2023

Financial institutions are implementing AI throughout their organizations at a steady pace. However, even with investments made and use cases identified, AI can only accomplish so much without users on board. “If the businesses [within a bank] don’t care to use it, it’s just not going to change anything,” Inwha Huh, managing director at $1.

American Banker

OCTOBER 6, 2023

Speaking at the Brookings Institution Friday morning, Consumer Financial Protection Bureau director Rohit Chopra warned that, absent intervention, the U.S. payments system could evolve to resemble that of China, where commerce and payments are deeply intertwined.

BankInovation

OCTOBER 6, 2023

Citi Ventures, the venture capital arm of $1.7 trillion Citigroup, is changing its investment strategy amid turbulent macro-economic conditions.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

OCTOBER 6, 2023

Federal Reserve Gov. Christopher Waller said during a payments conference at the Brookings Institution Friday that the FedNow payments system has already enlisted "well over 100" depository institutions for the service and expects that number to grow.

Commercial Lending USA

OCTOBER 6, 2023

Stated income commercial mortgage loans. Also known as "no-doc" or "lite-doc" loans. Allow borrowers to declare their income on their loan application.

The Paypers

OCTOBER 6, 2023

Intuit Mailchimp , an email marketing and automation tool, and Wix , a global SaaS platform, have announced a multi-year bilateral partnership.

American Banker

OCTOBER 6, 2023

Regulatory scrutiny of bank-fintech partnerships has steadily increased, putting more pressure on companies like Synapse.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

OCTOBER 6, 2023

US-based Forter has joined the Shopify Plus Certified App Programme to extend its fraud management solutions to Shopify Plus merchants.

TheGuardian

OCTOBER 6, 2023

Lender’s stock hit all-time low after news it was exploring selling off up to 40% of mortgage book Metro Bank shares rebounded from all-time lows on Friday , amid reports that the embattled lender was sitting on a £600m offer from bondholders that could cover its looming funding pressures. Regulators have been keeping a close eye on developments at the high street lender, which needs fresh investor funding, and is exploring selling off up to 40% of its mortgage book, in order to shore up its bal

ABA Community Banking

OCTOBER 6, 2023

Given the need for additional funds and the lack of attractive alternatives, bank use of FHLB advances is very likely to grow and should not necessarily be interpreted as a sign of banking stress. The post The outlook for FHLB advances appeared first on ABA Banking Journal.

The Paypers

OCTOBER 6, 2023

Wagestream has announced its acquisition of the UK-based challenger credit card startup Keebo to optimise the financial wellbeing of frontline workers.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

OCTOBER 6, 2023

First Citizens extends its brand to CIT business lines, Discover launches TV campaign for debit account, Southern Michigan Bancorp announces leadership transition and more in the weekly banking news roundup.

The Paypers

OCTOBER 6, 2023

Germany-based startup Kodex AI has announced it raised EUR 1.6 million in a funding round led by Signals VC to empower financial professionals with its AI solution.

The Financial Brand

OCTOBER 6, 2023

This article Digital Marketing Tactics, Trends and Tips to Know About for 2024 appeared first on The Financial Brand. How can banks and credit unions make their digital marketing more effective? Get insight from three marketing agencies on the trends they're seeing. This article Digital Marketing Tactics, Trends and Tips to Know About for 2024 appeared first on The Financial Brand.

The Paypers

OCTOBER 6, 2023

Corporate payment specialist AirPlus International has launched its new AirPlus Intelligence platform in order to enable clients to analyse and manage their spending.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Tomorrow's Transactions

OCTOBER 6, 2023

The Metropolitan Transportation Authority (MTA) has taken a giant leap forward in modernizing the way New Yorkers and visitors pay for their daily commutes with the introduction of OMNY (One Metro New York). OMNY, a contactless fare payment system, is not just another technological upgrade; it’s a game-changer that promises to revolutionize the way people… Continue reading Open Payments – A Big Hit in the Big Apple The post Open Payments – A Big Hit in the Big Apple first appeared o

The Paypers

OCTOBER 6, 2023

Finland-based HMD Global has updated its Nokia 2660 flip phones to support UPI Scan and Pay in a bid to make digital transactions easier and more secure.

American Banker

OCTOBER 6, 2023

If the industry keeps consolidating at its current rate, there will be roughly 500 banks in 20 years. That will likely mean the loss of competition and choice for customers in some markets.

The Paypers

OCTOBER 6, 2023

South Africa-based Bank Zero has announced it offers commercial banking to businesses of any size.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content