Justice for Victims of Human Trafficking – One Transaction at a Time

Abrigo

JULY 1, 2021

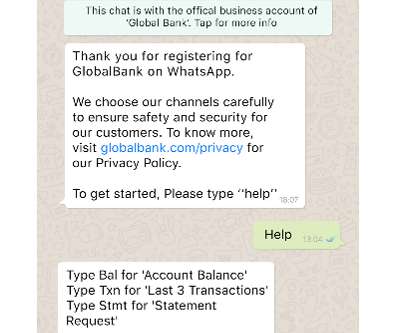

Identify Human Trafficking via Transactions Banking professionals run across many types of transactions pointing to human trafficking. Here are tips to spot them from Love Never Fails Founder Vanessa Russell. You might also like this webinar: "Human Trafficking - Close to Home" WATCH . Takeaway 1 Some financial transactions flag human trafficking because they are from websites notorious for this behavior.

Let's personalize your content