Connecting Data Governance to an Enterprise Search Tool in Financial Services (Part 3 of 4)

Perficient

JULY 21, 2021

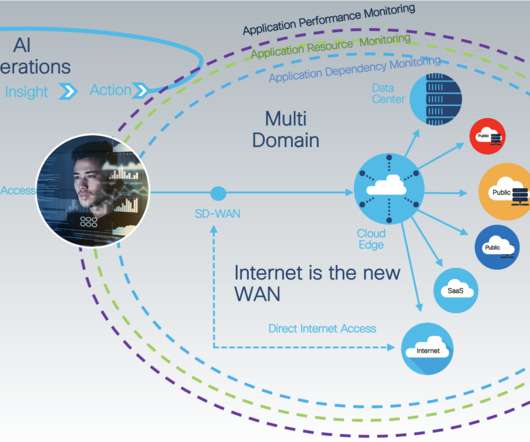

In our last blog post, we shared a proven approach to architecting a metadata search solution. Today, we’ll share a few high-level details about a solution that Perficient built, which can allow all types of financial services companies to jump-start their data democratization programs. Perficient has developed a highly capable abstraction layer called Handshake, which connects a firm’s data governance metadata repositories with a broad range of enterprise search tools.

Let's personalize your content