Why community bank stocks could rally in 2024

American Banker

JANUARY 3, 2024

A resilient economy and the potential for interest rate cuts could infuse further bullish sentiment into markets and bolster the shares of small lenders.

American Banker

JANUARY 3, 2024

A resilient economy and the potential for interest rate cuts could infuse further bullish sentiment into markets and bolster the shares of small lenders.

The Financial Brand

JANUARY 25, 2024

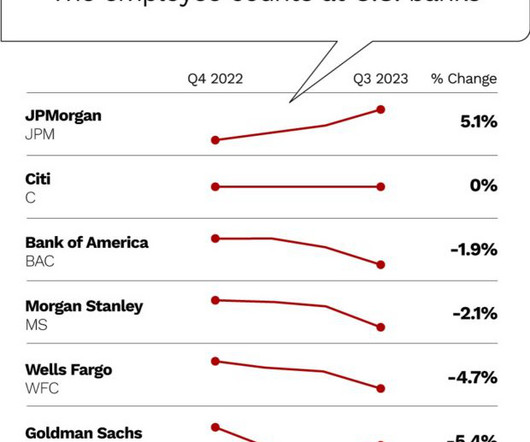

This article Why It’s a Good Time for Community Banks to Hire New Talent appeared first on The Financial Brand. With thousands of employees on the hunt for new roles, layoffs can present an opportunity for smaller banks to recruit talent. This article Why It’s a Good Time for Community Banks to Hire New Talent appeared first on The Financial Brand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 9, 2024

Swipe fee battles, real-time payments, fraud prevention and acquisition plans will be among the hot topics pulsing through the industry this year.

BankInovation

JANUARY 2, 2024

Industry experts predict adoption of real-time payments as well as the increased use of FedNow and digital wallets in 2024 as consumer demand for instant payments continues to grow.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

The Financial Brand

JANUARY 9, 2024

This article How Community Banks Can Entice and Recruit Software Engineers appeared first on The Financial Brand. Smaller financial institutions should invest in worker well-being and partner with universities to attract more tech talent. This article How Community Banks Can Entice and Recruit Software Engineers appeared first on The Financial Brand.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

JANUARY 5, 2024

Reading Cooperative Bank and Queensborough National Bank and Trust are among those that see value in being close to fintech startups.

Gonzobanker

JANUARY 4, 2024

In 2024, Smarter Banks will go on offense and differentiate with the customer experience. When it comes to client experience in banking, the last three years have been a long, reactionary grind of responding to COVID, a white-hot labor market driving up turnover, and rapidly shifting competitive dynamics. In the spirit of New Year’s resolutions, here are three ways “Smarter Banks” will flip the customer experience (CX) script in 2024. #1 Assign “unambiguous ownership” The customer experience for

The Financial Brand

JANUARY 31, 2024

This article What’s the Future of the Global Fintech Market? appeared first on The Financial Brand. A recent survey and report by the World Economic Forum found that many global fintechs are finding prosperity and profits in underserved markets. This article What’s the Future of the Global Fintech Market? appeared first on The Financial Brand.

ATM Marketplace

JANUARY 26, 2024

Make it your late New Year's resolution to attend the jointly held Bank Customer Experience and Interactive Customer Experience Summit from Sept. 9 to 11 in Charlotte, North Carolina.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

JANUARY 12, 2024

The designation would allow the payment processor to own transactions from end-to-end, removing the need for a bank partner.

South State Correspondent

JANUARY 3, 2024

One common question we field is recommendations of books to improve either bank performance or personal performance. Since many bankers likely have a self-improvement goal in their New Year’s resolutions, we wanted to put out our recommendations right from the start. To do this, we teamed up with Jack Hubbard, Managing Partner of the Modern Banker , to bring you our collective favorites.

Perficient

JANUARY 4, 2024

As we step into 2024, the transformative impact of Artificial Intelligence (AI) and generative AI on enterprise-level organizations has reshaped the business landscape in profound ways. The continual evolution of these technologies has empowered businesses to leverage advanced algorithms, predictive modeling, and generative capabilities, driving unprecedented innovation and efficiency.

Abrigo

JANUARY 17, 2024

Human trafficking red flags, strategies, and support Human trafficking is more prevalent than most realize, and banks and credit unions can help prevent it. Know the red flags to watch for. You might like this upcoming webinar, " Unveiling human trafficking: Perspectives, realities, and strategies." LISTEN NOW Takeaway 1 Human trafficking is prevalent in the U.S. and worldwide.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

CFPB Monitor

JANUARY 23, 2024

On September 18, 2023, the Federal Reserve, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency jointly published and sought comments on a proposal to implement new, standardized capital requirements that would, among other things, increase capital requirements for banks with $100 billion or more in total assets.

BankBazaar

JANUARY 31, 2024

While navigating a loan default can be challenging, understanding your rights and available options empowers you to make informed decisions. Here’s everything you need to know if you find yourself in this predicament. Repaying a loan and managing EMIs can sometimes become a challenging endeavour, potentially leading to concerns about defaulting. While defaulting is not an ideal situation, it’s important to recognise that it doesn’t mark the end of the road, nor does it brand you as a

Payments Dive

JANUARY 3, 2024

The state’s new law will force merchants to limit credit card surcharges and more clearly disclose them to consumers. If the businesses don’t, they could face a $500 penalty.

South State Correspondent

JANUARY 30, 2024

Times are tough. Banks are under pressure to find ways to increase earnings against a backdrop of slower increases in earning assets and quickly rising deposit and credit costs. As such, bank budgets have come under scrutiny. We recently conducted a small sample poll, and out of 21 banks, budgets were down an average of 14% for this year. Marketing and technology (IT) are two budgets that have taken the most significant hit.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Perficient

JANUARY 5, 2024

Software is at the core of the modern business model, making quality and performance top priorities to stay competitive. Organizations rely on continuous automation and testing (CAT) services to build business applications faster, with higher quality, and at scale to meet increasing market demands. Organizations looking to modernize testing capabilities with new technologies or fill skill gaps among internal teams seek external testing services providers for support.

Abrigo

JANUARY 24, 2024

Prevent fraud when adopting FedNow Credit unions can prevent fraud as they connect to FedNow. Use this guide to understand available tools and the steps AML and fraud teams should take. You might also like this FedNow implementation guide with details on appropriate AML/CFT and fraud considerations. DOWNLOAD Takeaway 1 Preventing fraud is a top concern of credit unions considering adopting FedNow, the new instant payments infrastructure from the Federal Reserve.

CFPB Monitor

JANUARY 25, 2024

After nearly a decade of litigation, Judge Beryl A. Howell of the U.S. District Court for the District of Columbia has approved the Consumer Financial Protection Bureau’s $6.0 million settlement of class claims of alleged discrimination by the CFPB against 85 Black and Hispanic employees. The class consists of all “minority employees and women who work or worked as Consumer Response Specialists and have been subjected to and harmed by the Bureau’s agency-wide pattern or practice of discriminatio

BankUnderground

JANUARY 18, 2024

Ed Hill Once the stuff of science fiction, quantum technologies are advancing fast. Individual quantum computers are finding a range of applications, primarily driven by the immense speed-ups they offer over normal computers. And soon the nascent quantum internet should connect those isolated computers together. This blog post starts to think about what this new interconnected quantum world means for the financial system.

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Payments Dive

JANUARY 5, 2024

Lawmakers in the state are considering legislation that would require merchants to accept cash payments.

South State Correspondent

JANUARY 30, 2024

A typical current strategy for community banks when originating commercial real estate loans is to offer floating-rate loans or shorter-term adjustable structures. Borrowers are waiting for the Fed to lower short-term interest rates, hopefully translating into a refinancing opportunity for the borrower at a lower loan rate. Unfortunately, this strategy has all the underpinnings of a credit problem case study, and we do not have to search for a hypothetical example.

Perficient

JANUARY 30, 2024

Our success at Perficient emanates from the dedication of our team. We take immense pride in recognizing that our committed individuals propel innovation and drive change within our industry. Every voice within our organization holds significance, none more so than Carolyn Lee , a Project Manager (PM) in our Financial Services business unit and a leader in Perficient’s Risk and Regulatory Center of Excellence (CoE).

Abrigo

JANUARY 22, 2024

6 Steps t o mitigate fraud risk tied to new products Your AML and fraud teams' input is key when it comes to offering new bank products. These tips can help ensure compliance while improving your offerings. You might also like this infographic, "Beyond immediate fraud losses: How the costs and impacts of fraud snowball." download NOW Takeaway 1 Fraud losses totaled $485.6 billion globally last year.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

Let's personalize your content