Why community bank stocks could rally in 2024

American Banker

JANUARY 3, 2024

A resilient economy and the potential for interest rate cuts could infuse further bullish sentiment into markets and bolster the shares of small lenders.

American Banker

JANUARY 3, 2024

A resilient economy and the potential for interest rate cuts could infuse further bullish sentiment into markets and bolster the shares of small lenders.

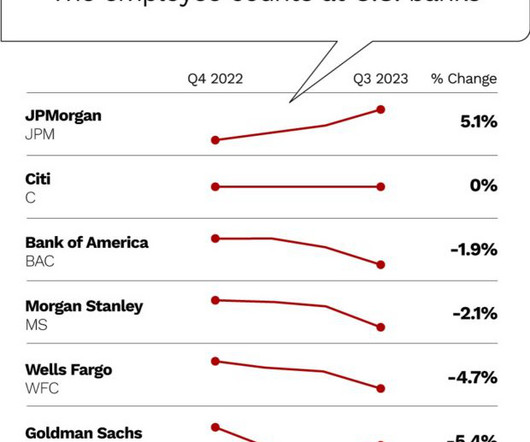

The Financial Brand

JANUARY 25, 2024

This article Why It’s a Good Time for Community Banks to Hire New Talent appeared first on The Financial Brand. With thousands of employees on the hunt for new roles, layoffs can present an opportunity for smaller banks to recruit talent. This article Why It’s a Good Time for Community Banks to Hire New Talent appeared first on The Financial Brand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 9, 2024

Swipe fee battles, real-time payments, fraud prevention and acquisition plans will be among the hot topics pulsing through the industry this year.

BankInovation

JANUARY 2, 2024

Industry experts predict adoption of real-time payments as well as the increased use of FedNow and digital wallets in 2024 as consumer demand for instant payments continues to grow.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

The Financial Brand

JANUARY 9, 2024

This article How Community Banks Can Entice and Recruit Software Engineers appeared first on The Financial Brand. Smaller financial institutions should invest in worker well-being and partner with universities to attract more tech talent. This article How Community Banks Can Entice and Recruit Software Engineers appeared first on The Financial Brand.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

JANUARY 5, 2024

Reading Cooperative Bank and Queensborough National Bank and Trust are among those that see value in being close to fintech startups.

The Financial Brand

JANUARY 31, 2024

This article What’s the Future of the Global Fintech Market? appeared first on The Financial Brand. A recent survey and report by the World Economic Forum found that many global fintechs are finding prosperity and profits in underserved markets. This article What’s the Future of the Global Fintech Market? appeared first on The Financial Brand.

ATM Marketplace

JANUARY 26, 2024

Make it your late New Year's resolution to attend the jointly held Bank Customer Experience and Interactive Customer Experience Summit from Sept. 9 to 11 in Charlotte, North Carolina.

Payments Dive

JANUARY 3, 2024

The state’s new law will force merchants to limit credit card surcharges and more clearly disclose them to consumers. If the businesses don’t, they could face a $500 penalty.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

CFPB Monitor

JANUARY 23, 2024

On September 18, 2023, the Federal Reserve, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency jointly published and sought comments on a proposal to implement new, standardized capital requirements that would, among other things, increase capital requirements for banks with $100 billion or more in total assets.

South State Correspondent

JANUARY 3, 2024

One common question we field is recommendations of books to improve either bank performance or personal performance. Since many bankers likely have a self-improvement goal in their New Year’s resolutions, we wanted to put out our recommendations right from the start. To do this, we teamed up with Jack Hubbard, Managing Partner of the Modern Banker , to bring you our collective favorites.

BankBazaar

JANUARY 31, 2024

While navigating a loan default can be challenging, understanding your rights and available options empowers you to make informed decisions. Here’s everything you need to know if you find yourself in this predicament. Repaying a loan and managing EMIs can sometimes become a challenging endeavour, potentially leading to concerns about defaulting. While defaulting is not an ideal situation, it’s important to recognise that it doesn’t mark the end of the road, nor does it brand you as a

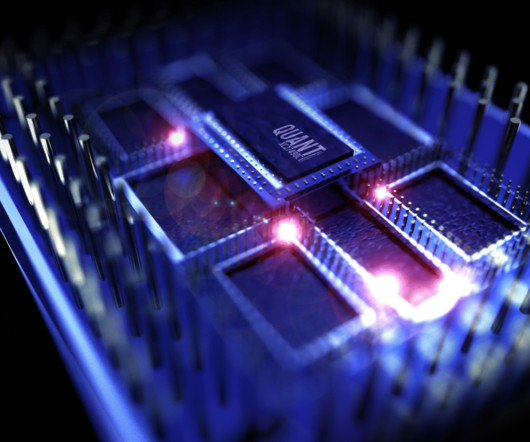

BankUnderground

JANUARY 18, 2024

Ed Hill Once the stuff of science fiction, quantum technologies are advancing fast. Individual quantum computers are finding a range of applications, primarily driven by the immense speed-ups they offer over normal computers. And soon the nascent quantum internet should connect those isolated computers together. This blog post starts to think about what this new interconnected quantum world means for the financial system.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

BankInovation

JANUARY 30, 2024

Graphics processing units on today’s computers can only hold so much capacity — and financial institutions are looking to quantum computing to process ever-growing data sets and turbocharge AI.

Payments Dive

JANUARY 25, 2024

If the payments giant receives a special Georgia charter and gains access to the card networks, it could open the floodgates for other merchant acquirers, attorneys said.

CFPB Monitor

JANUARY 25, 2024

After nearly a decade of litigation, Judge Beryl A. Howell of the U.S. District Court for the District of Columbia has approved the Consumer Financial Protection Bureau’s $6.0 million settlement of class claims of alleged discrimination by the CFPB against 85 Black and Hispanic employees. The class consists of all “minority employees and women who work or worked as Consumer Response Specialists and have been subjected to and harmed by the Bureau’s agency-wide pattern or practice of discriminatio

ATM Marketplace

JANUARY 9, 2024

Skimming, vandalism and physical attacks on ATMs, armored car and cash-in-transit (CIT) personnel, ATM technicians and other ATM crimes are all on the rise throughout the U.S. Here's how to prevent it.

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

ABA Community Banking

JANUARY 30, 2024

Credit unions are swallowing up tax-paying banks at an alarming rate, using the tax break lawmakers granted them to serve people of modest means. Following a record 16 credit union bank buys announced in 2022, credit unions’ share of total bank purchases hit an all-time high last year. The post Bank buys raise questions about the ‘credit union difference’ appeared first on ABA Banking Journal.

BankUnderground

JANUARY 17, 2024

Lennart Brandt, Natalie Burr and Krisztian Gado The Bank of England has a 2% annual inflation rate target in the ONS’ consumer prices in dex. But looking at its 700 item categories, we find that very few prices ever change by 2%. In fact, on a month-on-month basis, only about one fifth of prices change at all. Instead, we observe what economists call ‘sticky prices’: the price of an item will remain fixed for an extended amount of time and then adjust in one large step.

BankInovation

JANUARY 9, 2024

Financial institutions can look to generative AI to reach up to 90% automation, WorkFusion Chief Executive Adam Famularo tells Bank Automation News on this episode of “The Buzz” podcast.

Payments Dive

JANUARY 10, 2024

“I would be surprised if it takes longer than the middle of [2024] to roll out payments,” X owner Elon Musk said during a conversation last month with Ark Invest CEO Cathie Wood.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

CFPB Monitor

JANUARY 16, 2024

On January 11, 2024, the Consumer Financial Protection Bureau (CFPB) issued two new advisory opinions: Fair Credit Reporting; Background Screeni ng and Fair Credit Reporting; File Disclosure. The advisory opinions are part of the CFPB’s ongoing efforts to clean up what the CFPB describes in its press release as allegedly “sloppy” credit reporting practices and ensure credit report accuracy and transparency to consumers.

ATM Marketplace

JANUARY 30, 2024

With AI, ATM operators can identify ahead of time potential device faults and either make the fixes remotely or schedule maintenance. It can also detect potential attacks, either physical or software.

TheGuardian

JANUARY 31, 2024

Shadow chancellor says party aims to be champion of a thriving financial sector if it wins election Business live – latest updates Labour will not reinstate a cap on bankers’ bonuses if it wins the next election, the shadow chancellor has said. Rachel Reeves said she had “no intention” of bringing back the cap, saying she wanted to be the “champion of a thriving financial services industry”.

Realwired Appraisal Management Blog

JANUARY 10, 2024

The world isn’t as it is. The world is as you are. Our valuation industry needs a new roadmap, a new path. More connections, more optimism, more enthusiasm to improve. It’s on you. It’s on me. Let’s get to work.

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

Let's personalize your content