Cross-border payment plays rev up

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Abrigo

OCTOBER 17, 2022

Abrigo announced the retirement of Chief Executive Officer Wayne Roberts and the company’s search for its next CEO. . Roberts, who joined the company in 2016, is stepping back to focus more time on personal interests and passions. In addition to dedicating himself to growing the company over the past 6 years, Wayne served as the primary caregiver to his wife, Shannon, during her battle with glioblastoma brain cancer.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Independent Banker

OCTOBER 31, 2022

Photo by Chris Williams. “FedNow can be another positive differentiator for our nation’s community banks, but we must be ready for this real-time service and its 24/7/365 requirements.”. We’ve been working toward a faster payments future for a decade now, and we’re finally seeing the fruits of our labor: the launch of FedNow. Our efforts to encourage the Fed to offer an instant payments solution have led to this result; it was our voices that expedited FedNow’s time to market, with the Fed updat

Bobsguide

OCTOBER 5, 2022

Intix is proud to launch xCOMPLY to help financial institutions deal with compliance operations more efficiently. Regulatory requirements are becoming more and more complex, and financial institutions know that access to transaction data has become a must. However, the evolution of the regulatory landscape means that transparency on the business context of transactions has become vital. xCOMPLY achieves this by helping financial institutions to know their transaction (KYT) in a holistic and deep

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

CFPB Monitor

OCTOBER 31, 2022

Recently, the Federal Housing Finance Agency (FHFA) announced the approval of two new credit scoring models, the FICO 10T and the VantageScore 4.0 for use by Fannie Mae and Freddie Mac (the GSEs or Enterprises). Lenders will have a few years to implement use of the new models before being expected to report both scores on loans sold to the GSEs. Currently, and for the past 20 years, the Enterprises have relied on Classic FICO credit scores.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

OCTOBER 5, 2022

The Block-owned buy now-pay later provider is growing beyond its “pay in 4” plans by adding a financing option for pricier purchases.

Cisco

OCTOBER 4, 2022

The Federal Financial Institutions Evaluation Council (FFIEC) is a governmental body that provides interagency regulatory guidance for financial institutions. This provides a consistent framework for different regulatory bodies, and applies to the OCC, Federal Reserve, CSRB, and others. In June 2021, following large cyber attacks on the United States and the resulting Executive order on Cyber security, the FFIEC released the largest update in guidance in over a decade to help financial auditors

ATM Marketplace

OCTOBER 18, 2022

In an age where customers are more willing than ever to switch banking providers, banks need to step up their game when it comes to mobile apps.

Bobsguide

OCTOBER 9, 2022

Leading fintech company AutoRek is delighted to have been recognised at the Scottish Financial Technology Awards 2022 , held on Thursday, 6 October, where it won in the ‘Payments Innovation’ category. The judges said AutoRek demonstrated clear market fit and praised both its level of innovation and laser-focused commitment to solving a specific but widespread problem in the industry.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

CFPB Monitor

OCTOBER 30, 2022

On October 20, 2022, the Federal Trade Commission (“FTC”) announced that it is issuing an Advance Notice of Proposed Rulemaking (“ANPR” or “Notice”) to address “junk fees,” a term used in the Notice to refer to “unfair or deceptive fees that are charged for goods and services that have little or no added value to the consumer.”. In announcing the Notice, the FTC said it is seeking public comment on “the harms stemming from junk fees and associated junk fee practices and on whether a new rule wou

BankUnderground

OCTOBER 13, 2022

John Lewis. Cryptoassets and the crypto ecosystem as a whole has to face many of the same challenges as conventional assets and the regular financial system do. The same classic problems which are staple of economics textbooks (and history books), such as maturity mismatch, liquidity shortages, credibility, and collateral feedback loops. But whereas the conventional system has learned from the past and evolved to deal with them, much of the crypto ecosystem seems to have overlooked them.

Payments Dive

OCTOBER 4, 2022

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

TheGuardian

OCTOBER 31, 2022

Oleg Tinkov, who has previously spoken out against the conflict, says he won’t be associated with a ‘fascist country’ The billionaire banker and entrepreneur Oleg Tinkov has renounced his Russian citizenship because of the conflict in Ukraine, which he has previously criticised. “I have taken the decision to exit my Russian citizenship. I can’t and won’t be associated with a fascist country that started a war with their peaceful neighbour and killing innocent people daily,” Tinkov said.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

ABA Community Banking

OCTOBER 31, 2022

Asset-liability managers haven’t seen a rate environment like this in a generation. Experts provide tips on how to pivot. The post Asset liability management best practices in a rising-rate environment appeared first on ABA Banking Journal.

BankInovation

OCTOBER 28, 2022

Global economic instability has made rough waters, and balancing the books nowadays is a tough job, to say the least. Conventional advice on how organizations should behave in a tumultuous economic environment has been to do everything possible to cut costs across departments and ride out the storm. However, paying little attention to furthering investments […].

CFPB Monitor

OCTOBER 27, 2022

Two recently-passed bills in California, Assembly Bill 2311 (“AB 2311”) and Senate Bill 1311 (”SB 1311”), were signed into law by Governor Gavin Newsom on September 13 and September 27, respectively, placing new restrictions on the sale of Guaranteed Asset Protection (“GAP”) waivers in California. The new laws limit the price of GAP waivers, add new disclosure requirements, ban GAP waiver sales in certain instances, and prohibit financing of GAP insurance in auto loans to servicemembers.

BankUnderground

OCTOBER 18, 2022

David Swallow and Chris Faint. Policymakers have been investing heavily, to an accelerated timeline, to better understand the financial risks from climate change and to ensure that the financial system is resilient to those risks. Against that background, some commentators have observed that the most carbon-intensive sectors may be subject to the greatest increase in transition risk.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Payments Dive

OCTOBER 21, 2022

The bank said it invested in the regulated gaming company Sightline Payments this week, following an agreement earlier this year to be the firm’s primary merchant acquirer.

TheGuardian

OCTOBER 17, 2022

New chancellor made no mention of policy in economic update, but Treasury sources confirm he will go ahead with controversial move Hunt rips up most of Kwarteng’s mini-budget UK politics: all today’s developments – live The new chancellor, Jeremy Hunt, is pressing on with plans to scrap the bankers’ bonus cap, protecting one of the most divisive policies from his predecessor’s disastrous mini-budget.

ABA Community Banking

OCTOBER 18, 2022

The relief effort is part of the $3.1 billion allocated by the Inflation Reduction Act for distressed borrowers of USDA loans. The post USDA provides nearly $800 million in loan relief, more aid to come appeared first on ABA Banking Journal.

BankInovation

OCTOBER 10, 2022

Think of this less like one of those WikiHow articles you pilfer through when you don’t know how to dance at a wedding or fix a flat tire (although these skills are very, very important) and more like an Atul Gawande checklist to building a modern Treasury Services department at a bank. Do you use […].

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

CFPB Monitor

OCTOBER 20, 2022

With the dark cloud over the CFPB that was the constitutional challenge to the for-cause limit on removal of its Director having mostly lifted, a new and even darker cloud has descended in the form of another constitutional challenge. Yesterday, a unanimous three-judge panel of the U.S. Court of Appeals for the Fifth Circuit ruled that the Consumer Financial Protection Bureau’s funding mechanism violates the U.S.

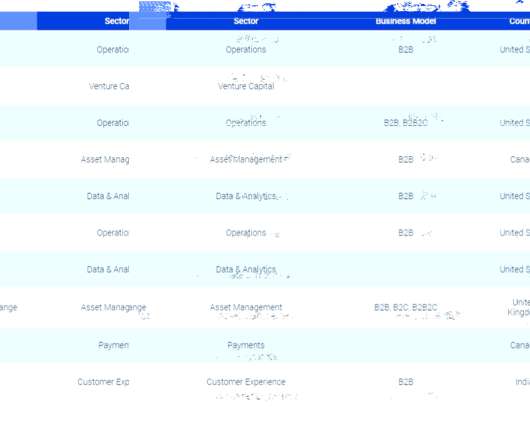

The Paypers

OCTOBER 18, 2022

US-based Open Banking operator Plaid has published The Fintech Effect report that shows 84% of UK consumers use fintech for money management in 2022.

Payments Dive

OCTOBER 18, 2022

“In addition to cross-border payments, the benefits of FedNow must be widely available to Americans through competitive, diverse providers — including nonbanks,” writes a U.S.-based Wise executive.

TheGuardian

OCTOBER 13, 2022

There is ‘no justification for lifting the cap’ on bonuses, said general secretary Frances O’Grady Bankers’ bonuses have doubled since the 2008 financial crash, according to research by the TUC, which accuses the government of enriching City financiers while “holding down” the pay of key workers. The unions’ umbrella body said bonuses in finance and the insurance sector have reached a record £20,000 a year on average – which it says is almost one-and-a-half times the average pay collected by tea

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Let's personalize your content