Managing Financial Risk in a Post-Pandemic Environment

Abrigo

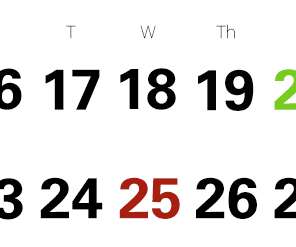

MAY 14, 2021

Align inputs, outputs, and teams for risk optimization. How can financial risk models within the bank or credit union benefit from using the same sheet music? Check out this webinar on Enterprise Risk Management. WATCH ON-DEMAND. Takeaway 1 Enterprise Risk Management is a priority for financial institution leaders but still maturing. Takeaway 2 Key assumptions from financial models can and should be reused for better, performant risk assessments.

Let's personalize your content