How to Build Future-Ready, Intelligent Operations That Drive Customer Experience and Faster Growth

Accenture

MAY 18, 2021

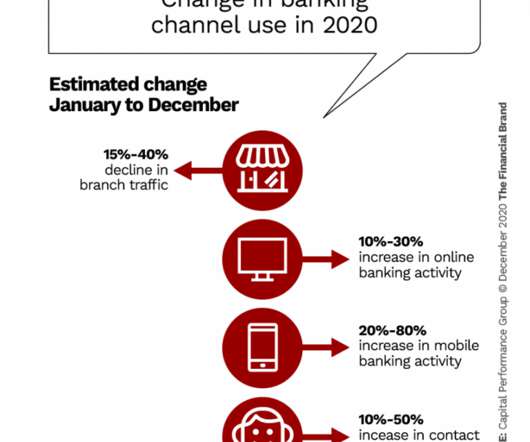

In my first blog on the future of banking operations in a post COVID-19 world, I examined why banks must reduce their operational costs dramatically just to stand still. In this follow-up post, I zero in on how to achieve the scale of cost reduction required – while also building the intelligent, growth-enhancing operations function….

Let's personalize your content