6 payments trends to watch in 2023

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

Abrigo

JANUARY 31, 2023

Regulatory movement expected in the AML/CFT industry Financial institutions should keep an eye on these AML/CFT hot topics while awaiting regulatory guidance. You might also like this upcoming webinar, "BSA officer’s mindset: A comprehensive look at your AML/CFT program." register now Takeaway 1 While the AML/CFT industry seemed to have been in a holding pattern during 2022, regulatory movement is expected for 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

JANUARY 30, 2023

Rising funding costs and decreasing liquidity at community banks are causing managers to change pricing methodology for new credits. This makes some sense, as in other industries, if your input pricing goes up, you often adjust your end pricing. We estimate that 25% to 50% of community banks have a policy requiring minimum yield or credit spreads for new commercial loans.

South State Correspondent

JANUARY 23, 2023

No doubt you have heard other bankers talking about ChatGPT. This AI-powered digital assistant, technically called “generative AI,” has taken banking, and society, by storm. In three months, it has become the primary tool of many bankers, helping make banks more efficient across the organization. Our innovation working group, called Spark, has been playing with the tool for the past several months, and this article details how we use it to jump our productivity by 20%.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

JANUARY 26, 2023

At the card giant’s annual meeting Tuesday, CEO Al Kelly showed no signs of backing off crypto. He also suggested Visa’s management team may change after he exits as CEO.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Accenture

JANUARY 26, 2023

The world of commercial banking faces uncertainty today. As a result, it is difficult to make confident decisions about the medium-to-long term. However, Accenture believes commercial banks have an opportunity to reinvent themselves and reposition for the future. Unlike in the 2008 financial crisis, banks today are well-capitalized and better prepared to withstand economic shocks.… The post Commercial banking top trends in 2023 appeared first on Accenture Banking Blog.

Abrigo

JANUARY 17, 2023

Automating SMB and commercial lending elevates your customer's experience From making it easier to apply to speeding up loan closings, automation can helps make business lending customers and staff happier. You might also like this on-demand webinar, "Strategies to grow your commercial loan portfolio." WATCH . Takeaway 1 Many financial institutions used a customer portal for PPP, but once the program ended, went back to old manual processes, Takeaway 2 Automating lending provides a secure porta

Independent Banker

JANUARY 31, 2023

Photo by Chris Williams [ICBA LIVE is] an opportunity to continue training up the next generation, so I would encourage community bank leaders to join us and bring your rising community continuators with you. The passion I have for community banking was born at ICBA LIVE 2011, which was my first ICBA convention as an adult. I thought I already loved community banking, but I didn’t realize how much until then.

South State Correspondent

JANUARY 3, 2023

Despite reaching the highest profitability in over a decade in 2022, US banks overall trade at a discount to other sectors as measured by P/E or P/Book, and approximately 53% of US banks have earned less than their cost of equity over the last five years. The high profitability for banks in 2022 was propelled by an increase in net interest margin (NIM), primarily due to rising interest rates as the Federal Reserve embarked on the most severe hiking cycle in the last four decades.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

JANUARY 12, 2023

With industry acquisitions ramping up this year, payments analysts have pinpointed a pack of potential payments company targets.

Perficient

JANUARY 24, 2023

In the first blog in this series, Getting Started On Embedded Finance , we defined embedded finance and took a high-level look at the goals and strategy a firm should take at the outset of its modern embedded finance journey. In this blog, we will look at how a non-banking company can offer bank-like perks to its clients and workers. When a non-financial firm offers embedded banking, they offer a branded checking account to hold funds and make payments for the betterment of the company and it

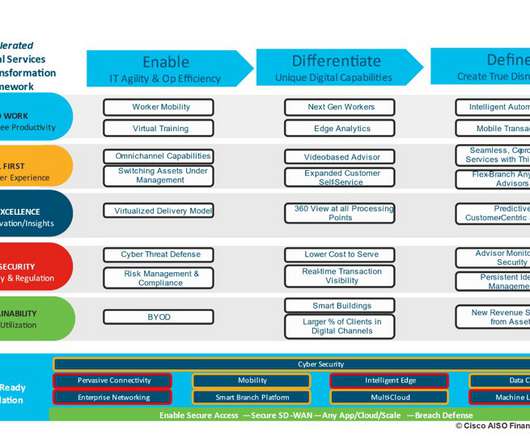

Cisco

JANUARY 10, 2023

As a change agent serving the financial services industry for over 20 years, it is a great privilege to collaborate with Bank, Insurance, and Wealth Management institutions to devise and execute digital transformation strategy, solve complex business problems, and leverage technology to strengthen business results. Ending a chaotic 2022 with the Federal Reserve in their December meeting raising interest rates to control inflation another 50 basis points following four consecutive 75 basis point

Abrigo

JANUARY 11, 2023

Large sporting events like the Super Bowl exacerbate human trafficking Financial institutions may see increased signs of human trafficking during the upcoming Super Bowl. Know the red flags to watch for. . You might like this upcoming webinar, " Human trafficking awareness: Detecting, reporting, and partnering for survivors." Register now. Takeaway 1 A consistent spike in reported incidents around January and February points to the Super Bowl as a hot spot for human trafficking.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

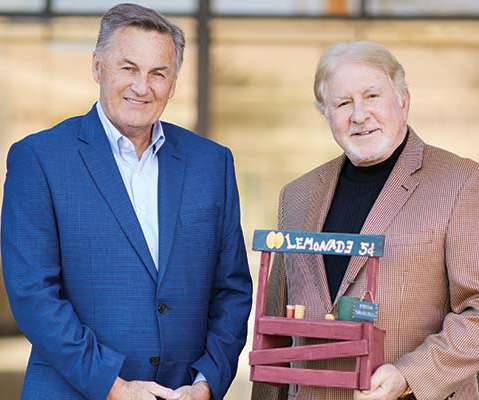

Independent Banker

JANUARY 31, 2023

Inspired by the entrepreneurship of lemonade stands, Scottsdale Community Bank created a microloan program. Photo by Brandon Sullivan De novo Scottsdale Community Bank set out to provide microloans to small and mid-size businesses, family organizations and nonprofits—a project that was inspired by the humble lemonade stand. By William Atkinson Name: Scottsdale Community Bank Assets: $28 million Location: Scottsdale, Ariz.

South State Correspondent

JANUARY 30, 2023

The art and science of optimized deposit gathering is a declining skill set among bankers. Banking schools don’t teach it, conferences don’t showcase it, and internal bank educators no longer train in the discipline. It is ironic as no other banking endeavor can build long-term franchise value like deposit gathering. Further, deposit gathering and its associated pricing strategy are among the most arduous efforts to understand compared to other industries.

Payments Dive

JANUARY 31, 2023

The digital payments pioneer said it’s cutting 2,000 employees as the company seeks to adapt to a new, more competitive environment.

Perficient

JANUARY 16, 2023

Many clients have been asking about embedded finance, and as every schoolteacher knows for every person who asks a question, there are at least 10 others who have a question but are afraid to ask it. For both the questioners and those afraid to question, we at Perficient thought we would provide some background on embedded finance. . What is Embedded Finance?

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

SWBC's LenderHub

JANUARY 26, 2023

As we discussed in Part 1 of Modernizing the Property Valuation Process , the housing market has experienced dramatic changes that have presented many challenges for appraisers. Although the market has shifted, the challenges remain. While initiatives put in place by Practical Applications of Real Estate Appraisal (PAREA) and The Appraiser Diversity Initiative to provide alternative pathways for aspiring appraisers to join the industry and decrease the shortage of appraisers represent a good sta

Abrigo

JANUARY 6, 2023

Check deposit fraud using “walkers” Financial institutions are seeing increased money mule scams using recruited "customers" to deposit stolen checks. You might also like this list of the year's top resources for FinCrime professionals. READ. Takeaway 1 Check fraud is not a new trend, but increased activity should put banks on high alert. Takeaway 2 "Walkers" are used to perpetrate check fraud in person without raising red flags at the bank.

Independent Banker

JANUARY 31, 2023

Photos: Tyler Anderson/ProSport Management First Bank of Alabama partners with Talladega Superspeedway track to host a hands-on educational STEM program event for seventh graders. By Christyna Yang Talladega, Ala., is home to $900 million-asset First Bank of Alabama, but it’s also home to the Talladega Superspeedway, a famous NASCAR racetrack. It’s fitting, then, that Chad Jones, president and CEO, and Mitch Key, executive vice president and COO—both of whom grew up in or near Talladega—have dev

South State Correspondent

JANUARY 22, 2023

In a previous article ( here ), we discussed why commercial loan prepayment protection would be a critical return on asset (ROA) driver for community banks in 2023. We outlined the four main reasons why prepayment provisions increase profitability for banks. We also discussed the four standard prepayment provisions for commercial loans (step-down, lock-out, defeasance, and symmetrical breakeven provision).

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Payments Dive

JANUARY 18, 2023

From buy now, pay later to peer-to-peer payment fraud, there’s no shortage of payments targets for lawmakers and regulators.

CFPB Monitor

JANUARY 17, 2023

The U.S. Department of Housing and Urban Development (HUD) recently issued a draft Mortgagee Letter on reconsideration of value (ROV) policies in connection with appraisals for FHA insured mortgage loans. The draft Mortgagee Letter follows up on action plan items.

Banking Exchange

JANUARY 23, 2023

In separate initiatives, the ABA and CFPB are seeking to add to consumer protection measures related to mortgage lending Mortgage Credit Feature Mortgage Mortgage Compliance Mortgage/CRE Feature3 Compliance/Regulatory Duties

Abrigo

JANUARY 4, 2023

Guidance for banks on the lookout for crypto scams and fraud The turbulent cryptocurrency scene should put bankers on high alert. The FTC's top ten scams to watch for can help. . You might also like this whitepaper, "Understanding cryptocurrency." DOWNLOAD WHITEPAPER. Takeaway 1 Cryptocurrencies are the newest and most popular field in potential financial gains through fraud.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant (or getting "ghosted") if they fail to meet the evolving needs of Gen Z consumers. Credit cards with flexible payment options, especially for young adults with little-to-no credit history, are a particularly important and valuable solution for this generation.

Let's personalize your content