Remember the global financial crisis? Well, high-risk securities are back

TheGuardian

NOVEMBER 23, 2024

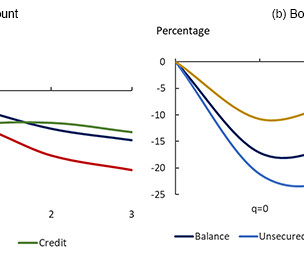

The shadow banking sector is trying its hand at trading in debt-based products such as collateralised loan obligations When Margot Robbie made a surprise cameo in the 2015 film adaptation of Michael Lewis’s book The Big Short , she did more to educate the general population about the risks of securitisation than most financial experts. The Australian actor’s brief monologue, notoriously delivered from a champagne bubble bath, explained how banks were bundling up their growing cache of risky sub-

Let's personalize your content