Can banks emerge stronger from the pandemic?

Bank Innovation

MARCH 26, 2020

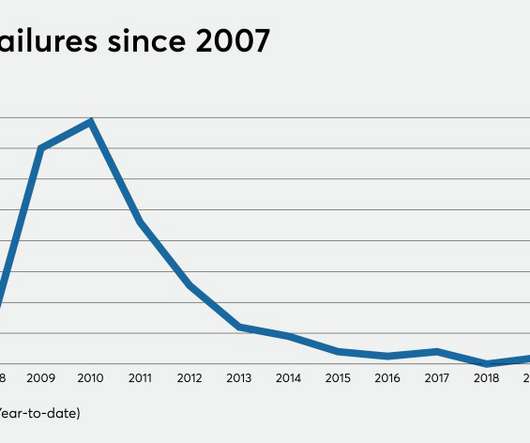

The Coronavirus pandemic is posing significant challenges to the banking sector, forcing financial services providers into contingency mode and already driving cost-cutting initiatives and branch closures. What damage will the coronavirus crisis create in banking? Margins will be squeezed, credit losses will increase and, for banks in an unfavorable position, it could take years to […].

Let's personalize your content