The Direct-To-Consumer Challenge: Converting One-Time Buyers Into Repeat Customers

PYMNTS

OCTOBER 16, 2020

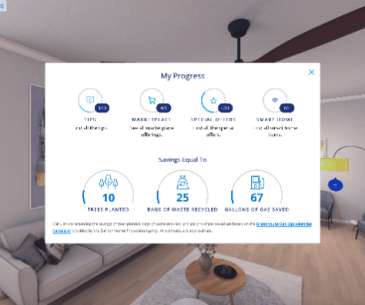

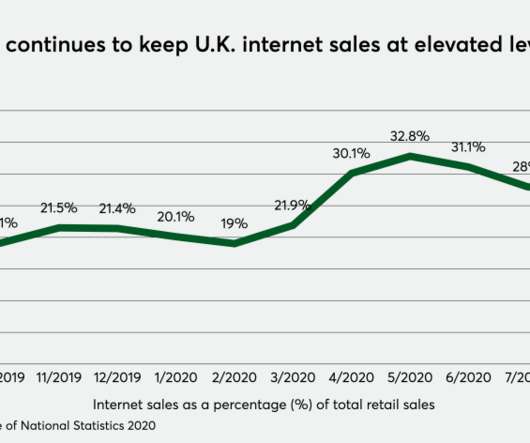

The digital-first shift means there are more options for smaller, direct-to-consumer brands, to find first-time customers from around the country or even the world. But Sticky.io CEO Brian Bogosian tells Karen Webster that the rubber meets the road when it comes time to convert those first-time buyers into loyal, repeat customers. Here’s how some really creative D2C brands are using new tech to do that.

Let's personalize your content