Treasury APIs | Future-proofing corporate banking

Accenture

OCTOBER 28, 2020

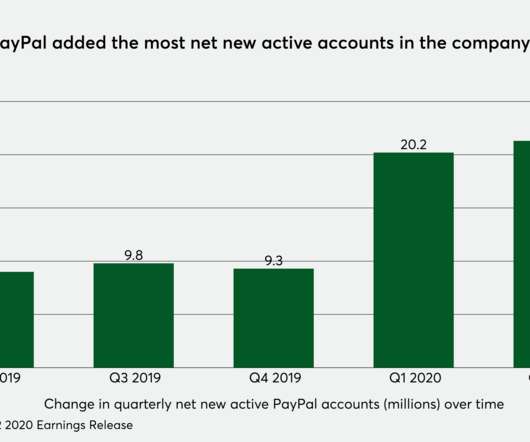

In my previous posts, I covered the potential that Open Banking and treasury application programming interfaces (APIs) offer both banks and their corporate customers and gave examples of some leading industry players. In this post, I’d like to highlight some key observations of how these leaders are navigating the first wave of corporate banking and….

Let's personalize your content