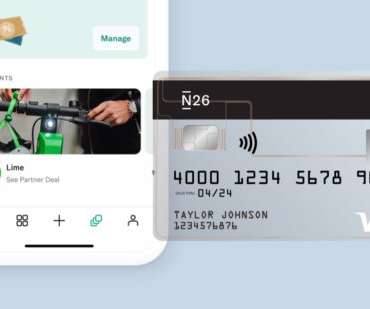

Bank of the West to launch account for eco-friendly customers

Bank Innovation

DECEMBER 23, 2019

Bank of the West is currying favor among customers who care about environmental sustainability. The bank, which is a U.S. subsidiary of BNP Paribas, is launching a new checking account in early 2020 called 1% for the Planet that will show customers the carbon footprint of their purchases. The product launch is appealing to consumers […].

Let's personalize your content