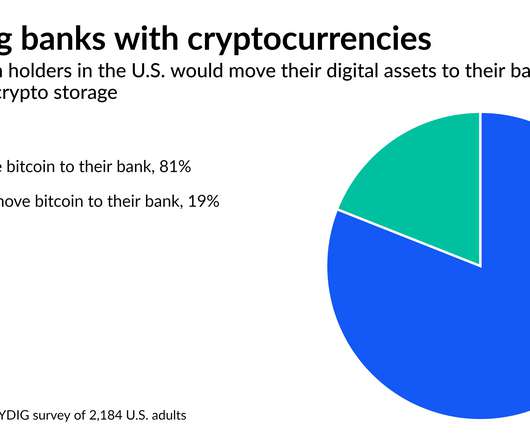

Playing Catch-Up in Crypto, Banks Ask Core Providers for Help

American Banker

JUNE 14, 2021

Core systems Bitcoin Digital transformation - The Simplification of the Tech Stack Cryptocurrencies

American Banker

JUNE 14, 2021

Core systems Bitcoin Digital transformation - The Simplification of the Tech Stack Cryptocurrencies

ATM Marketplace

JUNE 15, 2021

Banks are rushing to create better branch experiences in the wake of changing customer expectations post pandemic. But how can they make the transformation successful? Here are a few trends to keep in mind to help with that

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Cisco

JUNE 14, 2021

Earlier this year Cisco completed its acquisition of imimobile, adding an enterprise-grade CPaaS platform to Cisco’s industry-leading collaboration and contact center solution portfolio. The Cisco Financial Services team welcomes imimobile’s Jay Patel – VP & CEO of imimobile as our guest blogger this week.

Abrigo

JUNE 14, 2021

Create an effective sanctions program Considering the current economic and political environment, it is crucial that financial institutions maintain a strong sanctions compliance program (SCP). Would you like others articles like this in your inbox? Takeaway 1 OFAC has issued new guidance on the essential components of a strong compliance program. Takeaway 2 Financial institutions must train front-line staff to identify behavioral red flags that could indicate elder financial abuse.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Accenture

JUNE 18, 2021

Banking’s push to digital during the pandemic has placed tech in the spotlight. The power of the cloud has never been so clear. Accenture research shows that 49% of banks have moved a significant portion of their workloads to the cloud, compared with 33% of businesses across all industries. It’s safe to say that nearly…. The post People will help banks win the race to the cloud appeared first on Accenture Banking Blog.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

SWBC's LenderHub

JUNE 17, 2021

The municipal bond market took a wild ride in the first half of the year to near-historic levels of richness versus Treasuries that is rarely seen, and the environment is ripe for the second half of the year to take it even further. The outperformance of municipals in the first half can be attributed to many factors, such as inflation, rising tax rates and an imbalance of supply and demand.

BankUnderground

JUNE 16, 2021

Catherine R. Schenk. In partnership with the Data Analytics for Finance and Macro Research Centre at King’s Business School and the Qatar Centre for Global Banking and Finance at King’s Business School, the Bank of England organised a ‘ History and Policy Making Conference ‘ in late 2020. This post contributes to our occasional series of guest posts by external researchers who presented their research at this conference.

Accenture

JUNE 14, 2021

The Efma-Accenture Banking Innovation Awards have been a catalyst for innovation in banking since their inception in 2013. Since then, I look forward to them every year as the industry rewards and celebrates innovation. After a pause in 2020 due to COVID-19, this year’s ceremony brings even more anticipation. I have discussed Growth Markets and…. The post Setting the stage for the best banking innovations of 2021 appeared first on Accenture Banking Blog.

ATM Marketplace

JUNE 18, 2021

Customers' expectations have changed dramatically these past few years. They now expect seamless experiences across all channels. Can your ATM keep up with this demand?

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

SWBC's LenderHub

JUNE 14, 2021

Last Week: Treasury yields were front and center last week as equities and corporate bonds quietly ground higher and tighter. All through last week, longer-dated Treasury notes and bonds rallied and the yield curve flattened 11 basis points despite large funding operations and the May CPI coming out higher than expected. The reasons for the rally sit squarely with the flow of funds.

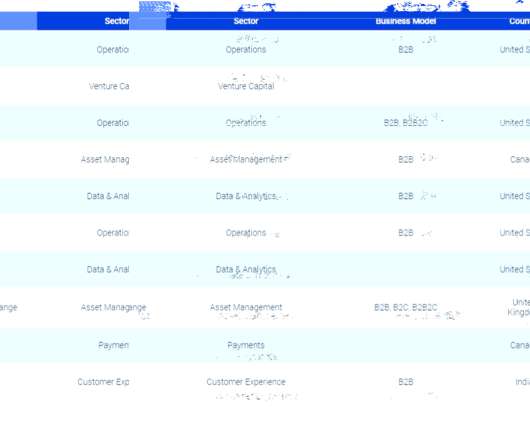

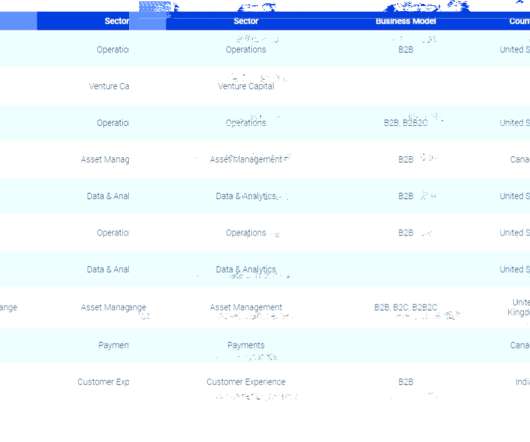

CB Insights

JUNE 17, 2021

The adoption of fintech apps has skyrocketed throughout the Covid-19 pandemic, spurring further growth and investor interest in this category. Fintech had one of the most successful quarters in history in Q1’21 , with record deals, funding, exits, and mega-rounds. . Eager to turn the ongoing fintech boom into an advantage, big tech companies (Facebook, Apple, Google, Amazon) have been taking a number of strategic steps to grow their market share in financial services.

ATM Marketplace

JUNE 16, 2021

Go beyond surveys to build a modern CX strategy. Stratifyd for CX and Voice of the Customer is designed for the business you have today and the changes of tomorrow. With so much changing, don’t get caught flat-footed thanks to legacy technology and static dashboards that don’t grow along with you. Read this eBook to learn more.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

TheGuardian

JUNE 18, 2021

Accounting firm embraces ultra-flexible working with staff able to choose if they come into the office at all Deloitte will allow its 20,000 UK employees to choose how often they come into the office, if at all, after the pandemic, making it the latest firm to throw out the rulebook and embrace ultra-flexible working. The accounting firm said it would let staff decide “when, where and how they work” following the success of remote working during the Covid crisis.

American Banker

JUNE 17, 2021

BankInovation

JUNE 18, 2021

A Swedish hedge fund that returned roughly four times the industry average last year using artificial intelligence won’t touch Bitcoin, based on an assessment that the cryptocurrency doesn’t lend itself to sensible analysis. Patrik Safvenblad, the chief investment officer of Volt Capital Management AB, says the problem with Bitcoin and other crypto assets is that […].

Qudos Bank

JUNE 15, 2021

Most people have been surprised by an unexpected bill before, whether it’s an expensive car repair or a higher-than-expected energy bill during a hot Summer. If you haven’t planned for them, these costs can easily sneak up on you and cause a financial headache.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

FICO

JUNE 15, 2021

It’s June, a special month for honoring loved ones, especially parents and grandparents by raising Elder Abuse Awareness. World Elder Abuse Awareness Day is officially June 15th and it’s an ideal time to educate oneself on how to protect elders from becoming victims of financial abuse. All too often, elders today are the targets of residential real estate fraud and scams.

TheGuardian

JUNE 18, 2021

Banks and building societies fight for customers as house prices rise in frenzied market HSBC has become the latest lender to offer a mortgage deal with an interest rate of less than 1% in the latest sally of an intensifying mortgage rate war. Banks and building societies are fighting for customers in a frenzied property market, described by the Bank of England’s chief economist as “on fire” as the government’s stamp duty holiday combines with big deposits saved during lockdown to ramp up demand

BankInovation

JUNE 17, 2021

The design of a potential U.S. central bank digital currency (CBDC) remains a topic of debate, as made clear at a Tuesday hearing of the U.S. House Committee on Financial Services?Task Force on Financial Technology. Witnesses at the virtual hearing discussed the need for a CBDC and noted the automation possibilities that might accompany a digital dollar issued by the Federal Reserve.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Jack Henry

JUNE 17, 2021

To say we’re living in unprecedented times would be an understatement. Thanks to a global pandemic, it seems like just about everything has changed, from social norms to travel to where and how we work. While we’re not out of the woods yet, we do seem to be settling into new ways: a post-pandemic world, if you will. And thanks to the latest technology, many businesses, including banks and credit unions, have the tools to adapt and even thrive in a remote world.

TheGuardian

JUNE 15, 2021

Chief executive sends ‘very strong’ message to US staff where many workers are vaccinated against Covid The chief executive of Morgan Stanley has become the latest US banking boss to call for an end to remote working, telling his New York staff that anyone who feels safe going out to a restaurant should return to the office. James Gorman admitted that the bank would take a different approach in countries such as India or the UK – where fewer than 25% of its 5,000 London staff have been going to

BankInovation

JUNE 17, 2021

Banking application Dave announced its plan to go public via a special purpose acquisition merger last week, a transaction that values the neobank at $4 billion. But while the app touts overdraft fee avoidance as its flagship feature, it’s unclear whether this is enough to make customers switch accounts. Backed by investors like Tiger Global […].

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content