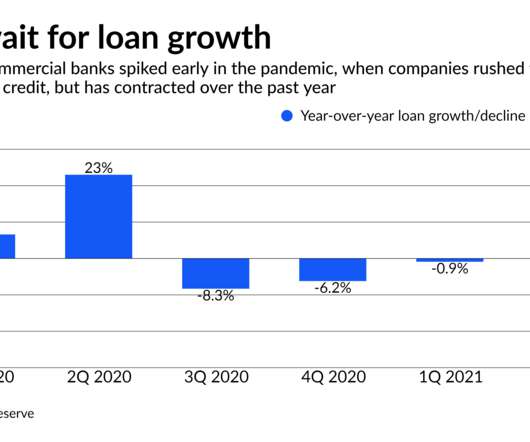

Spotlight on Loan Growth — or Lack of it — as Earnings Season Kicks Off

American Banker

JULY 12, 2021

Consumer lending Earnings Commercial lending Credit quality

American Banker

JULY 12, 2021

Consumer lending Earnings Commercial lending Credit quality

Accenture

JULY 11, 2021

Auto and equipment buyers are no longer satisfied with simply financing an asset, the traditional way of paying for such things. Instead, they want maintenance and service included, and they expect more flexible payment plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

JULY 16, 2021

FinCEN Releases 8 AML/CFT Priorities These priorities were published June 30, 2021, highlighting several areas of heightened risk for the U.S. financial system. Would you like others articles like this in your inbox? Takeaway 1 FinCEN published its first list of priorities for AML/CFT policy, as required by the Anti-Money Laundering Act of 2020 (AMLA).

Cisco

JULY 12, 2021

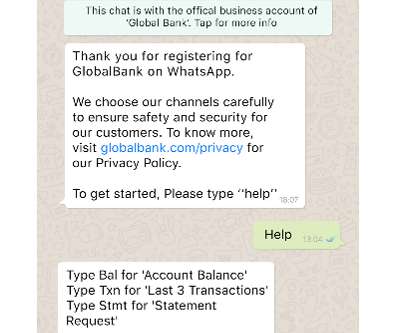

Earlier this year Cisco completed its acquisition of imimobile, adding an enterprise-grade CPaaS platform to Cisco’s industry-leading collaboration and contact center solution portfolio. The Cisco Financial Services team welcomes imimobile’s Alex Cambell , SVP Sales at imi mobile, as our guest blogger this week. Changing consumer behavior and digital disruptors within the banking industry have redefined how we interact with financial service providers.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

CFPB Monitor

JULY 16, 2021

The Federal Housing Financing Agency (FHFA) announced on July 16, 2021 that effective August 1, 2021 it is eliminating the 50 basis point Adverse Market Refinance Fee for refinance mortgage loans. The FHFA notes that the fee imposed on lenders originally was designed to cover losses projected as a result of the COVID-19 pandemic. However, the FHFA states that “[t]he success of FHFA and [Fannie Mae and Freddie Mac] COVID-19 policies reduced the impact of the pandemic and were effective enough t

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Abrigo

JULY 12, 2021

Q Factors under CECL and How They Will Compare Understanding the quantitative side of the CECL calculation is the start to applying qualitative adjustments under CECL. Would you like other articles on CECL and Q Factors in your inbox? Takeaway 1 Banks and credit unions moving to CECL in 2023 understandably want to know how Q factors will compare with current practices.

Banking Exchange

JULY 11, 2021

For some reason, the term digital still strikes many as new and futuristic. In reality, it’s been with us for decades Community Banking Technology Financial Trends Feature Digital Mobile Tech Management Online.

BankUnderground

JULY 16, 2021

J ames Hurley, Sudipto Karmakar, Elena Markoska, Eryk Walczak and Danny Walker. Compass on old map. This post is the second of a series of posts about the Covid-19 pandemic and its impact on business activity. Covid-19 led to a sharp reduction in economic activity in the UK. As the shock was playing out, small and medium-sized businesses (SMEs) were expected to be more exposed than larger businesses.

ATM Marketplace

JULY 13, 2021

ATMs went through a challenging year in 2020, but as the industry comes out of the pandemic, a question emerges: What's on the horizon?

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Abrigo

JULY 12, 2021

The Financial Action Task Force (FATF) addressed areas of AML global concern. The agency recently completed their three-day June plenary. They addressed some of the most pressing illicit financial issues the world faces today. . Would you like others articles like this in your inbox? Takeaway 1 Following the three-day plenary, FATF released expanded guidance in several areas of AML/CFT global conerns.

TheGuardian

JULY 14, 2021

When Doug Fishbone came across an abandoned apartment complex in Cork, he decided to recreate it in a gallery – to highlight everything that’s wrong with our property-fuelled financial system A grim concrete wall greets visitors to the Crawford Art Gallery in Cork. It fills the full height of the space, hemmed in by a corrugated steel fence. You might think you’d walked into a room still under construction – until you notice the street lamp.

BankUnderground

JULY 12, 2021

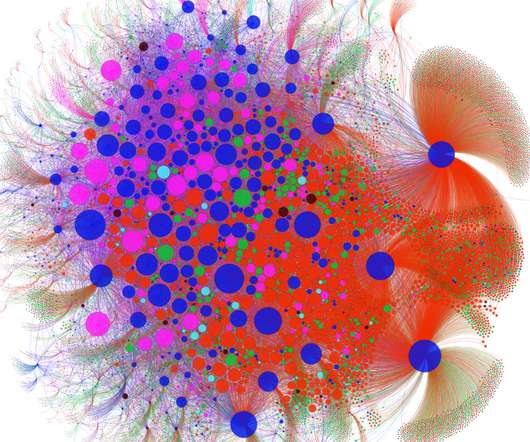

Giovanni Covi, Mattia Montagna and Gabriele Torri. Systemic risk in the bank sector is often associated with long periods of economic downturn and large social costs. In a new paper , we develop a microstructural contagion model to disentangle and quantify the different sources of systemic risk for the euro-area banking system. Calibrated to granular euro-area data, we estimate that the probability of a systemic banking crisis was around 3.6% in 2018.

ATM Marketplace

JULY 16, 2021

Between COVID-19 closing down bank branches, and changing customer expectations, it can be a challenge for financial institutions, independent ATM providers and other companies to strategize their path forward. The Bank Customer Experience Summit, held on Sept. 13-15 in Chicago, will provide crucial guidance.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

BankInovation

JULY 16, 2021

U.K.-based neobanks, otherwise known as “challenger banks,” continued to court investors with significant funding rounds this week. London-based company Revolut may now be the most valuable fintech in the U.K. and one of the most valuable fintech startups in Europe. Bank Automation News looks at this week’s highlights. Revolut Neobank Revolut on Thursday announced a […].

MerhantsBanks

JULY 16, 2021

Tirzah Warren has been promoted to Assistant Vice President/Teller Administrator at Merchants Bank, according to Sue Hovell, Director of Retail Banking Performance. “Over her 20-year career, Tirzah has consistently demonstrated her commitment to serving our customers and her leadership ensures they are taken care of professionally and compassionately by our teller team,” said Hovell.

FICO

JULY 15, 2021

A core pillar of promoting and sustaining widespread access to credit is ensuring high levels of financial literacy. Unfortunately, the U.S. lags behind many other countries in financial literacy, meaning millions of Americans lack the resources they need to chart a healthier financial future. But thanks to nonprofit organizations like Operation HOPE — which collaborates with financial institutions, corporations, municipal agencies, and community organizations to help low- and mid-income America

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

BankInovation

JULY 16, 2021

In this week’s episode of “The Buzz,”?Bank Automation News?discusses the growing presence of Erica-based capabilities at Bank of America. A virtual assistant powered by artificial intelligence, Erica has graduated from dealing with customer enquiries to assisting financial advisors at Bank of America’s Merrill Lynch division. The $3.02 trillion financial institution has also been using (AI) […].

ABA Community Banking

JULY 13, 2021

With more than 100 institutions now offering Bank On-certified checking accounts—and more in the pipeline—what can banks of all sizes learn from the experience of their certified peers? The post Raising the Standard appeared first on ABA Banking Journal.

TheGuardian

JULY 15, 2021

It comes after banking app raised $800m from new investors Tiger Global Management and SoftBank The banking and payments app Revolut has become the most valuable British fintech firm on record after a fresh funding round pushed its valuation to $33bn. The company, founded by the former Lehman Brothers trader Nik Storonsky in 2015, announced on Thursday that it had raised $800m (£579m) from new investors Tiger Global Management and the major Japanese investment group SoftBank, which now hold a ne

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

BankInovation

JULY 16, 2021

Fifth Third Bank is migrating from a custom-core legacy system to FIS Modern Banking Platform, a managed-as-a-service core banking solution, the companies announced earlier this week. The migration will allow the $203.8 billion bank to reduce its development time and deploy new products to weeks, rather than months, Ed Loyd, Fifth Third director of public […].

Qudos Bank

JULY 11, 2021

When you’re looking for a new home, it’s unlikely that you end up buying the very first one you see. Instead, most people attend a few open homes to learn about the local market and understand what good value looks like, before making their purchase decision. Choosing your home loan should be the same - shopping around and comparing your options before you apply can help you find a better deal and save you serious money in the long run.

TheGuardian

JULY 13, 2021

Investment banking arms of two Wall Street firms benefit from global glut of mergers and acquisitions Goldman Sachs and JP Morgan have reported bumper profits for the second quarter as their investment banking divisions continued to ride the global boom in mergers and takeover deals. The two US banks have been capitalising on the surge in merger and acquisitions activity, which broke records for the second straight quarter in the three months to June, according to Refinitiv data, and helped make

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content