Breaking down common barriers to purpose-driven banking

Accenture

NOVEMBER 22, 2021

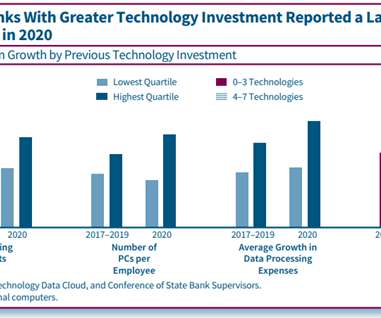

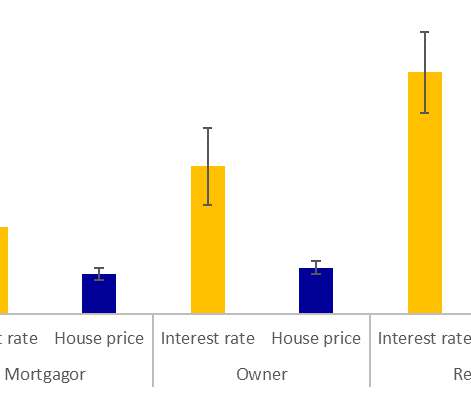

In this series we’ve taken a close look at the business case for embracing purpose in banking. In short, there’s compelling evidence that focusing on customer wellbeing can catalyze growth and digital transformation. Embracing purpose is more than a PR move. It is a powerful opportunity—and a formidable challenge. Today we’re going to unpack four of the….

Let's personalize your content