Data Is the Foundation…for Everything in Insurance (Part 4 of 5)

Perficient

AUGUST 23, 2021

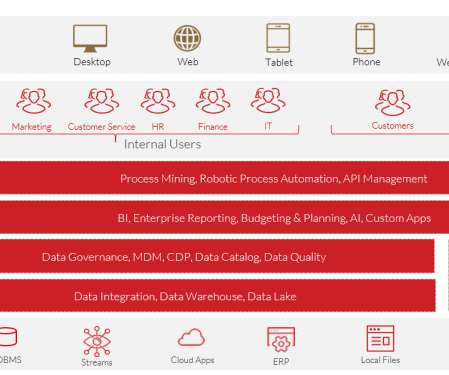

Data fuels the engine of the digital economy. Connected experiences, in the context of the customer relationship, are driven by a robust data set that confidently presents integrated, diverse data to enable actionable insights that can be automated across the customer’s journey. Internally, data creates the foundation for increased analytic application of fraud detection, at-risk customer behavior, and improved cross-functional process management.

Let's personalize your content