A Tale of Two Models: How the Pandemic Affected Allowance Levels Under CECL and Incurred Loss Models

Abrigo

JULY 28, 2021

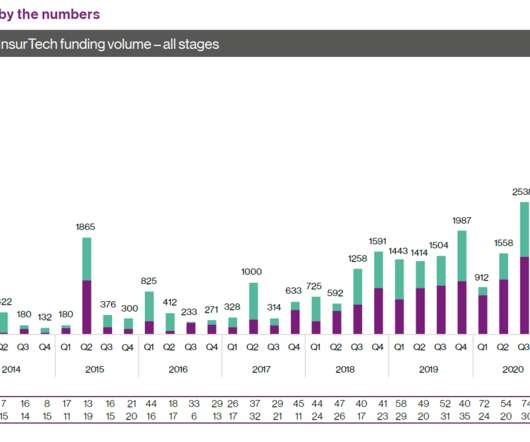

How the pandemic affected the allowance under the two models Abrigo analyzed proprietary loan-level data from FIs operating under the two different models and found contrasting stories of how reserve and provision levels progressed after the pandemic began. Would you like other articles like this in your inbox? Takeaway 1 Allowance levels jumped in Q1 2020 for SEC filers due to the transition to CECL and the start of the pandemic, but FIs began releasing reserves in Q1 2021 as conditions improve

Let's personalize your content