2 Reasons Cashless May Be a Bit Overblown

ATM Marketplace

JUNE 29, 2021

If you look up "cashless" on Google, you will inevitably find articles that argue the future is cashless and cash is old news. But…that isn't entirely true

ATM Marketplace

JUNE 29, 2021

If you look up "cashless" on Google, you will inevitably find articles that argue the future is cashless and cash is old news. But…that isn't entirely true

FICO

JUNE 30, 2021

In this series on the must-have components of a financial platform, I have explored the data-related capabilities. Data is the fuel of the financial platforms, how it’s processed and made ready for use is where the banks start to see the value of the data. Microservices are the very first component where we transform data into business decisions. In other words, microservices tell the platform what actions need to be taken with data.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

JULY 1, 2021

Identify Human Trafficking via Transactions Banking professionals run across many types of transactions pointing to human trafficking. Here are tips to spot them from Love Never Fails Founder Vanessa Russell. You might also like this webinar: "Human Trafficking - Close to Home" WATCH . Takeaway 1 Some financial transactions flag human trafficking because they are from websites notorious for this behavior.

Accenture

JUNE 28, 2021

I’ve asked Michael Monday to co-author this blog post on ransomware. He specializes in cybersecurity in financial services as Accenture Security’s North America Banking Lead. Having begun his career in the US Air Force, Michael knows all about precision, rigor and why offense is often the best defense against bad actors. The threat of cybersecurity….

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

CFPB Monitor

JULY 2, 2021

Phil Yannella, Ballard Spahr litigation partner and Practice Leader of Ballard’s Privacy & Data Security Group, recently authored a treatise on data breach and privacy litigation. The book, Cyber Litigation: Data Brach, Data Privacy & Digital Rights, is published by Thomson Reuters and is available now for purchase. The publication of CyberLitigation comes at an important moment as the U.S. is in the midst of a huge surge in data breaches, particularly ransomware attacks.

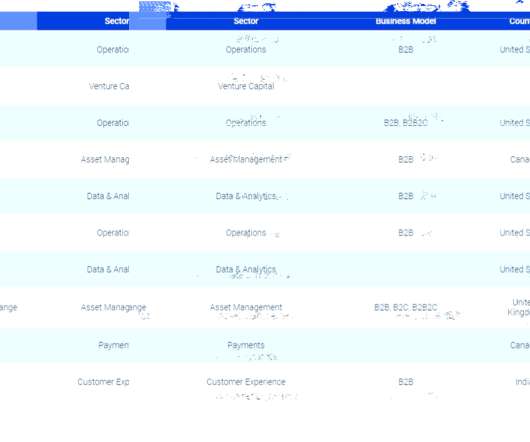

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

JULY 2, 2021

John Lewis, Andrea Šiško and Misa Tanaka. The Covid pandemic has led to a large enforced shift towards working from home (WFH) as a result of ‘stay-at-home’ policies in many countries. This led to a resurgence in interest in, and new reignited discussion about, the consequences of greater WFH. In this briefing we review the literature on the impact of WFH on productivity.

Accenture

JULY 1, 2021

The power of the cloud is not new for banks. But we are rapidly approaching a tipping point in the industry’s adoption of the cloud, spurred partly by the digital acceleration caused by the pandemic. Nearly every bank has adopted the cloud in some form, or are planning to get there soon. The reason for…. The post How the cloud can transform people practices in banking appeared first on Accenture Banking Blog.

CFPB Monitor

JULY 1, 2021

On June 29, Florida Governor DeSantis signed into law CS/SB 1120 which amends Florida law to impose new limits on the use of “automatic dialers.” The law is effective today, July 1. The new law prohibits the use of an “automated system” to make “telephonic sales call” without the prior express written consent of the “called party.” A “telephonic sales call” is defined as “a telephone call, text message, or voicemail transmission to a consumer for the purpose of soliciting a sale of any consum

Independent Banker

JUNE 30, 2021

Photo by Robert Severi. While we can’t predict what the future holds, we can continue to shape the narrative with our customers and potential customers. Recently at the dinner table, my family had a fascinating conversation about the merits of short stories versus novels. My daughter, an avid reader, made the case that the novel is the superior form of storytelling because it allows the piece to deepen and evolve.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

Banking Exchange

JUNE 28, 2021

Older savers are more likely to shun interaction with AI chatbots compared to younger counterparts Technology Retail Banking Feature3 Feature Financial Trends People Fintech.

Accenture

JUNE 29, 2021

At the beginning of 2020, the mindset around cloud adoption in banking and capital markets was in a very different. Much of the industry had settled into a steady but slow migration path to the cloud that was often cautious and incremental. But with the arrival of the global pandemic, all of that changed. Almost…. The post Cloud empowerment: Enabling growth in the new appeared first on Accenture Banking Blog.

BankInovation

JULY 1, 2021

Financial institutions that leverage artificial intelligence (AI) and machine learning (ML) are not in favor of new regulations determining how the techniques can be used. The Federal Reserve and the Office of the Comptroller of the Currency (OCC) together with the Federal Deposit Insurance Corporation (FDIC), Consumer Financial Protection Bureau and the National Credit Union […].

FluentBanking

JULY 1, 2021

IFIC is the country's 1st public-private partnership bank. The bank is a unique embodiment of reality, stability, and the highest level of professionalism in the financial sector. Through a continuous innovative process, since 1976, we built the best-in-class platform of people, process, technology, products and service proposition. We are ready to become one of the largest and most distinguished banks, both nationally and internationally.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

Cisco

JUNE 29, 2021

For the office to have a future, it must offer employees added value. Collaboration software and a laptop are no longer enough to be effective and productive in and out of the office. It has to be completely rethought. Over the past year, many have seen the office move to the kitchen table at home from one day to the next. What was initially unfamiliar has now become part of everyday life – many people no longer want to do without the flexibility and freedom of choice that the home offic

ABA Community Banking

JULY 1, 2021

Banking has always been about people and no bank is better than its employees—so it’s incumbent on all of us to recruit the best and brightest. The post The Imperative of Developing the Next Generation of Bankers appeared first on ABA Banking Journal.

BankInovation

JULY 1, 2021

Chainalysis and other cryptocurrency risk and compliance firms like Elliptic and CipherTrace are benefiting from accelerated cybercurrency enforcement actions by U.S. regulators related to anti-money laundering (AML) concerns and national security. With banks beginning to offer cryptocurrency to customers and cryptocurrency “going mainstream,” federal regulators will continue to increase enforcement efforts and the need for companies such […].

CFPB Monitor

JULY 2, 2021

Pursuant to the authority set forth in Section 205 of Senate Bill 1202, Connecticut’s Banking Commissioner signed an order that permits individuals engaged in certain licensable activity on behalf of certain consumer credit licensees to work from remote office locations not licensed as branch office locations. The order, available here , extends the previous no-action position of the Commissioner and is effective July 1, 2021.

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Jack Henry

JULY 1, 2021

It might take you a second to remember what life was like prior to COVID-19. Travel was booming , people were vacationing around the world, and the hospitality sector was flourishing. In 2019 alone, direct spending by resident and domestic travelers in the United States was around $3.1 billion per day, supporting a total of 15.8 million American jobs.

Banking Exchange

JUNE 30, 2021

Randal Quarles “skeptical” of the proposed benefits of a Federal Reserve-backed digital currency Risk Management Technology Payments Feature3 Feature Bitcoin Cryptocurrency Blockchain.

BankInovation

JUNE 29, 2021

Organizations, including those in financial services, are struggling to realize the full value of automation, in part because they’re tentative about fully rolling it out. That’s left nearly half of process automation deployments at the proof-of-concept stage or team scale, although process automation received a high satisfaction rating in a recent survey by Emergence Partners, […].

CFPB Monitor

JULY 1, 2021

The final step in the demise of the OCC’s true lender rule occurred yesterday with President Biden signing the resolution under the Congressional Review Act (CRA) overturning the rule that was passed by the House and Senate. On August 9, 2021, from 12:00 p.m. to 1:00 p.m. ET, Ballard Spahr will hold a webinar, “Congress Overrides the OCC’s True Lender Rule: What Are the Risks for Banks and Their Loan Program Nonbank Partners?

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Jack Henry

JUNE 29, 2021

Talent management is one of the most important elements in driving a healthy financial services industry. Because banking is no longer viewed as one of the most “attractive” industries, financial service organizations are now competing both inside and outside of the industry when recruiting employees.

Banking Exchange

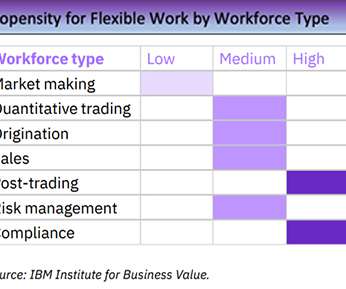

JUNE 28, 2021

A new trading desk platform is emerging that will benefit both the financial services industry and its workforce Risk Management Technology Feature3 Human Resources Feature Financial Trends Management.

BankInovation

JUNE 30, 2021

German authorities thwarted a cyberattack on a data service provider used by federal agencies and pushed back on a report that a broad assault targeted critical infrastructure and banks. The attempt was quickly dealt with and impact on service was “very marginal,” Interior Ministry spokesman Steve Alter told reporters on Wednesday, adding that it was […].

CFPB Monitor

JULY 1, 2021

After announcing several years ago that it intended to pick up with fair lending enforcement in the indirect auto finance market where the CFPB left off, the New York Department of Financial Services has announced two consent orders with smaller, New York-chartered banks based on the allegation that allowing auto dealers to negotiate the retail prices of retail installment contracts resulted in a disparate impact on the basis of race and national origin.

Advertisement

Community banks seek ways to leverage their technology infrastructure to drive productivity and growth. However, the sheer volume of technology devices, capital constraints, and lack of skilled resources stand in the way. This Strategy Brief explores how a managed device services partner can help bridge this resource gap. Managed device services partners empower community banks to take charge of mission-critical device management activities with: Logistics and installation services to support se

Let's personalize your content