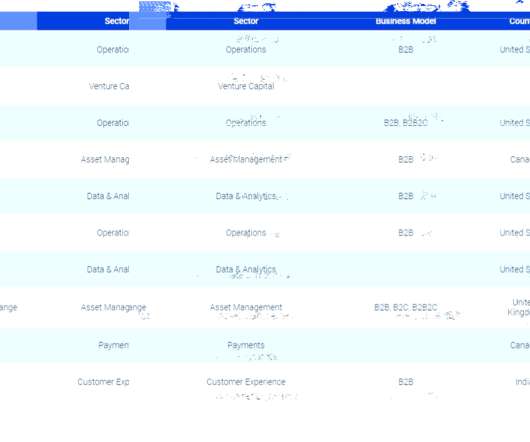

Q2 2021 US card issuer earnings commentary

Accenture

OCTOBER 11, 2021

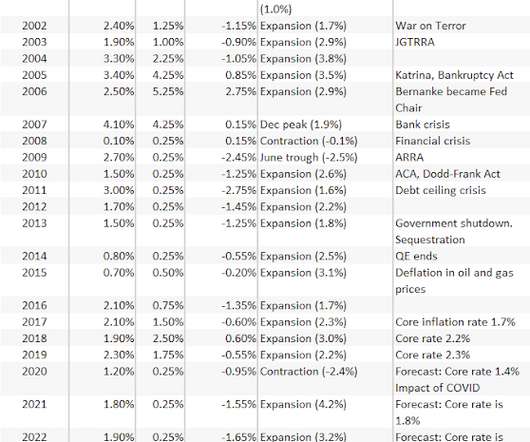

Credit Card Receivables & Purchase Volume YoY Growth: 2Q21 Earning call commentary Growth “We’ve ramped up our acquisition engine. We’re pleased to see overall acquisitions of proprietary cards, which include our co-brands, increased to 2.4 million new cards acquired in the quarter.”– American Express “Spending accelerated as COVID vaccinations increase, business reopen, and domestic….

Let's personalize your content