What’s next after 10 years of banking disruption?

Accenture

DECEMBER 1, 2021

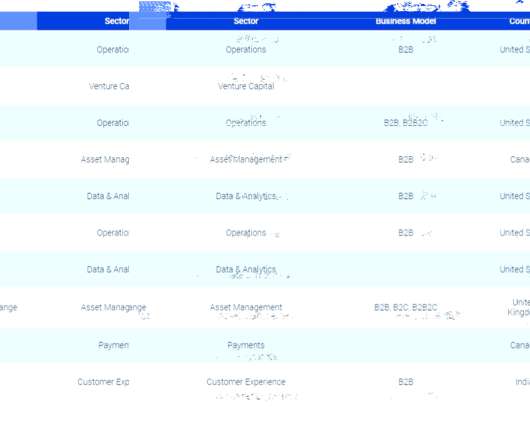

After a decade of disruption, what has changed for commercial banks?? The digital economy has taken off around much of the world over the past 10 years, and the banking sector has been feeling the impact of this transformation and attempting to keep up with it. In fact, the digital transition in financial services began…. The post What’s next after 10 years of banking disruption?

Let's personalize your content