5 major trends impacting the financial services industry

BankInovation

FEBRUARY 9, 2022

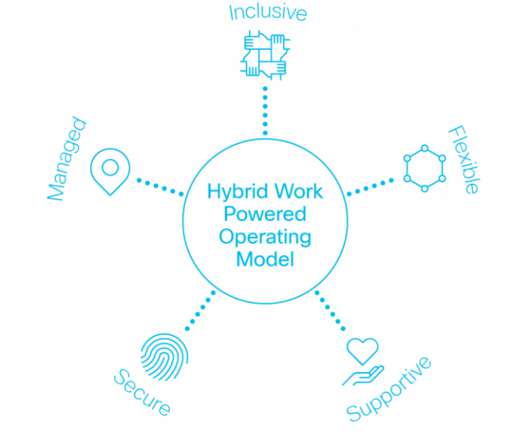

The COVID-19 health crisis has forced organizations to pivot to new ways of working. Companies and government agencies are fighting to maintain business continuity while helping their customers, employees and other stakeholders cope with the stress of a health crisis. For banks and financial services institutions, the pandemic has had a major impact on both […].

Let's personalize your content