Lending in 2021 – Find Your Why

Jack Henry

JANUARY 8, 2021

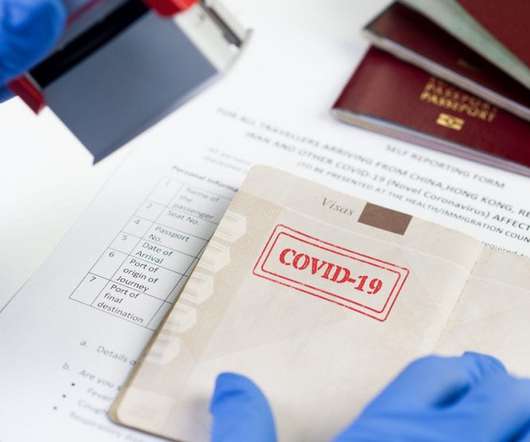

As we look back upon 2020 it’s easy to feel as though we’ve stepped into an alternate universe. Who might have guessed, heading into the year that a health crisis would emerge and reverberate through the economic and social fabric of our world? And, while we’ll be forever changed by the experiences of this year, we must also look toward the future, and the promise of recovery the new year brings.

Let's personalize your content