Why It’s a Good Time for Community Banks to Hire New Talent

The Financial Brand

JANUARY 25, 2024

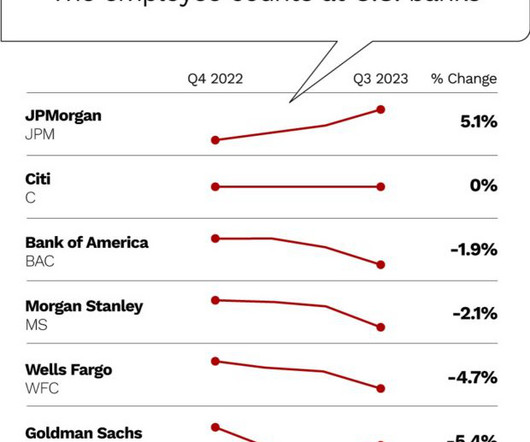

This article Why It’s a Good Time for Community Banks to Hire New Talent appeared first on The Financial Brand. With thousands of employees on the hunt for new roles, layoffs can present an opportunity for smaller banks to recruit talent. This article Why It’s a Good Time for Community Banks to Hire New Talent appeared first on The Financial Brand.

Let's personalize your content