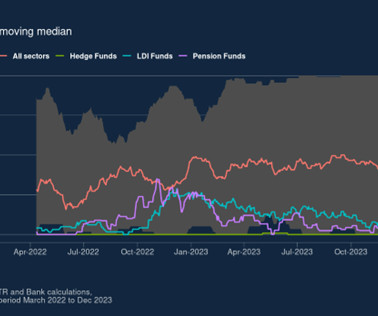

Here is the Cost and Risk of Lending Optionality

South State Correspondent

JULY 7, 2024

Optionality is defined as a state in which choice or discretion is allowed. In finance, optionality is an asset (has value) for the person who an exercise the option, while the person who gave the option has the liability. Selling options for above their value can be a profitable business for banks and brokers, but giving away options is a money losing proposition.

Let's personalize your content