Durbin bashes United Airlines in CCCA fight

Payments Dive

DECEMBER 8, 2023

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

Payments Dive

DECEMBER 8, 2023

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

Accenture

DECEMBER 5, 2023

It’s an open secret in payments that the commercial client experience is often second-class, far surpassed in both innovation and investment by consumer offerings. For years this disparity didn’t reach the bottom lines of incumbent payments providers, but our new research, Reinventing commercial payments for profitable growth, suggests it’s now creating competitive vulnerabilities.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

DECEMBER 6, 2023

In recent years, the Consumer Financial Protection Bureau (CFPB) has significantly broadened its oversight, extending beyond major banks to address concerns in various industries, such as payday loan providers, credit reporting agencies, and most recently, the medical debt collection sector. The CFPB’s Dynamic Approach The CFPB’s modus operandi often involves proactively addressing potential issues through press releases ahead of engaging in enforcement actions.

Abrigo

DECEMBER 5, 2023

Good BSA Officer can be hard to find. Here are a few qualities to look for when you are evaluating candidates for your next BSA Officer. You might also like this resource: "Building a strong future: Succession planning strategies for you AML program." Watch webinar Takeaway 1 BSA Officers are the frontline defenders against financial crimes in banking institutions, and hiring the proper skill set for each BSA position is critical.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Payments Dive

DECEMBER 5, 2023

The AlphV ransomware group claimed responsibility for the attack on Saturday and threatened to extort the business payments company's customers with allegedly stolen data.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

DECEMBER 7, 2023

The Office of the Comptroller of the Currency (OCC) has issued a bulletin (2023-37) that provides guidance on managing risks associated with “buy now, pay later” (BNPL) lending. The BNPL loans addressed in the bulletin are loans that are payable in four or fewer installments and carry no finance charges. The bulletin cautions banks about the risks to banks and consumers associated with BNPL lending. .

BankBazaar

DECEMBER 8, 2023

Do you have a toxic aunty in the family? You know, the one that hints around about finances or keeps asking why you’re not married yet? Yes, you know who we’re talking about! Come to think of it, maybe ‘anti’ is derived from the word ‘aunty’! Who knows? So, this ‘AUNTY-Corruption Day ’, here’s a poem to show you how not to be a shady aunty! On this Anti-Corruption Day, here is a tale, Of Credit Cards and scores , with a humorous trail.

Payments Dive

DECEMBER 6, 2023

The card issuer’s premium designation isn’t compatible with all potential card issuing partners, Amex CEO Steve Squeri said Tuesday.

South State Correspondent

DECEMBER 5, 2023

Most borrowers have a rudimentary understanding of interest rates, the yield curve, forward rates, and forward premiums. Commercial bankers are trusted advisors and have a unique opportunity to understand their client’s specific financial and personal situations, explain the basic concepts of capital markets, and offer prudent and objective advice to help customers reach their goals.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

CFPB Monitor

DECEMBER 6, 2023

The Consumer Financial Protection Bureau has sent a letter to the California Department of Financial Protection and Innovation (DFPI) commenting on the DFPI’s proposal that would require providers of “income-based advances” to register with or obtain a license from the DFPI and comply with the fee and interest rate limits of the California Financing Law (CFL).

Gonzobanker

DECEMBER 7, 2023

It’s time for banks and credit unions to finally execute those C&I lending priority initiatives. Senior bank and credit union executives have ranked commercial and industrial (C&I) loans as a top lending priority over the past several years in Cornerstone Advisors’ annual What’s Going On in Banking research. But further analysis shows the execution is not measuring up.

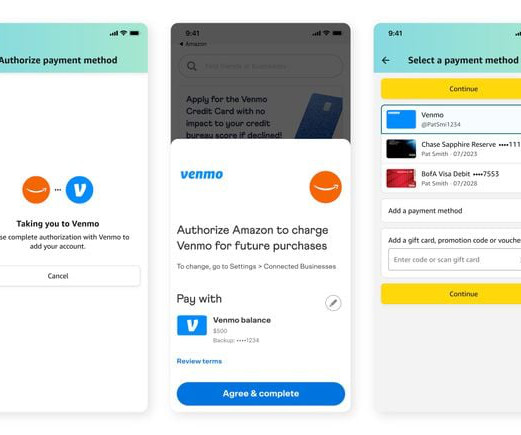

Payments Dive

DECEMBER 7, 2023

Jettisoning Venmo from the retail juggernaut’s marketplace is another strike against PayPal’s recent growth efforts.

ATM Marketplace

DECEMBER 8, 2023

Self-service technology allowed operators to allocate employees to mission-critical tasks while ATMs and cash recyclers handled traditional transactions. Still, the specter of replacing human workers with machines has hung over the self-service trend.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

CFPB Monitor

DECEMBER 6, 2023

We previously reported and released a podcast episode on comments that we and Professor David Sherwyn of Cornell University submitted in opposition to the Petition for Rulemaking filed by a number of consumer advocacy groups urging the CFPB to prohibit pre-dispute consumer arbitration clauses and allow only post-dispute clauses. Among other things, we argued that the rule proposed by the Petitioners would be prohibited by the Congressional Review Act (CRA) because it is substantially the same

Jack Henry

DECEMBER 5, 2023

We heard it often onstage at Jack Henry Connect: Today’s accountholders have a lot of options, and it’s not just banks or credit unions you’re competing against anymore.

Payments Dive

DECEMBER 4, 2023

Leaders are confronting growing challenges across their payment operations.

ATM Marketplace

DECEMBER 7, 2023

In Episode 427 of Breaking Banks Podcast Brett King hosts Mark Aldred about next gen branches and the continued need to adapt. Then Silvia Garzarelli Doria at Banca Carige talks about the launch of its fully digital branches using Auriga's #NextGenBranch solutions.

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Realwired Appraisal Management Blog

DECEMBER 5, 2023

Some Chief Appraisers were thrown into their role. The role carries significant responsibilities, as it directly impacts a bank’s risk assessment and lending decisions. Some lacked an appraisal background which added a steep learning curve. Also, what does success look like for a new Chief Appraiser?

TheGuardian

DECEMBER 4, 2023

A number of community organisations say they were left struggling after bank closed or froze accounts ‘without warning’ Some charities, churches and other community groups have described being thrown into financial disarray after Barclays shut or froze their bank accounts without warning. Several of the organisations affected, which include charities helping young people, and a Methodist church in the midst of significant building works, have banked with Barclays for over 20 years.

Payments Dive

DECEMBER 4, 2023

The fintech, founded in the U.K. and now building up operations in the U.S., expects its pay-by-bank services for bank clients will eventually lure retailers.

ATM Marketplace

DECEMBER 7, 2023

WWS Fill4Me is the solution that extends the bank's operations to unstaffed channels such as self-service devices including ATMs, advanced ATMs and ASSTs.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

CFPB Monitor

DECEMBER 5, 2023

We are very proud to share the news that in a recent analysis by Good2bSocial, which measured reach and engagement, our Consumer Finance Monitor Podcast ranked highest among law firm podcasts devoted exclusively to consumer financial services. Good2bSocial is a consulting firm that advises law firms on how to use social media effectively.

TheGuardian

DECEMBER 8, 2023

With more transactions taking place digitally, cash transit companies warn of reduced services – which experts say risks isolating those who rely on notes and coins Get our morning and afternoon news emails , free app or daily news podcast Heather Lewis has an unusual budgeting method in the age of online banking, but it works for her. When the disability support pensioner gets paid, she heads to her local bank branch in Melbourne, withdraws the cash and places it into plastic pockets according

Payments Dive

DECEMBER 5, 2023

The Federal Trade Commission is scheduled to hear from six industry organizations concerned about a proposed rule that would crack down on automatically renewing subscriptions.

Commercial Lending USA

DECEMBER 5, 2023

Commercial construction loans are a type of financing used to fund the construction of commercial properties such as office buildings, retail centers, industrial facilities and large residential multi units projects.

Advertisement

Community banks seek ways to leverage their technology infrastructure to drive productivity and growth. However, the sheer volume of technology devices, capital constraints, and lack of skilled resources stand in the way. This Strategy Brief explores how a managed device services partner can help bridge this resource gap. Managed device services partners empower community banks to take charge of mission-critical device management activities with: Logistics and installation services to support se

Let's personalize your content