How digital wallets are reshaping the payments landscape

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

South State Correspondent

MAY 15, 2024

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BankInovation

MAY 15, 2024

AI and generative AI applications continue to dominate conversations within the financial services industry, but implementing generative AI is near impossible if bank data isn’t standardized and accessible. What makes good data?

TheGuardian

MAY 12, 2024

Among world’s top 60 banks those in US are biggest fossil fuel financiers, while Barclays leads way in Europe The world’s big banks have handed nearly $7tn (£5.6tn) in funding to the fossil fuel industry since the Paris agreement to limit carbon emissions, according to research. In 2016, after talks in Paris, 196 countries signed an agreement to limit global heating as a result of carbon emissions to at most 2C above preindustrial levels, with an ideal limit of 1.5C to prevent the worst impacts

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

MAY 16, 2024

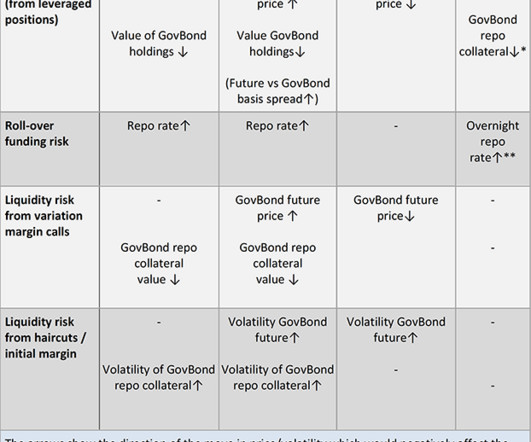

Adam Brinley Codd, Daniel Krause, Pierre Ortlieb and Alex Briers We both drive cars, but the US drives on the right while the UK drives on the left. We both walk, but we do so on sidewalks in the US and pavements in the UK. We both have asset managers, who want to take leveraged positions in interest rates. US asset managers had around US$650 billion of long treasury futures in June 2023.

ATM Marketplace

MAY 17, 2024

The future of ATMs lies not as machines that just dispense cash, but rather as multifunctional banking kiosks,

Payments Dive

MAY 14, 2024

The retailer will add terminals to 3,000 of its Speedway locations and test services like cryptocurrency purchases with ATM solution provider FCTI.

BankInovation

MAY 17, 2024

Small business clients looking to make data-driven business decisions within their operations don’t always know how to tap into their data, but JPMorgan Chase has created a solution to deliver these insights.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

TheGuardian

MAY 13, 2024

Younger homebuyers are turning to ultra-long loans, prompting fears over the risk to their finances and the wider economy For a long time the traditional length of a UK mortgage has been 25 years, but runaway house prices and, more recently, dramatically higher borrowing costs are prompting more and more people to “go long” on their home loans. On Monday, the former pensions minister Steve Webb revealed that younger homebuyers were increasingly being forced to gamble with their retirement prospe

ATM Marketplace

MAY 14, 2024

Cardless ATMs are paving the way for a more convenient banking experience by enabling Google and Apple Pay transactions.

Payments Dive

MAY 15, 2024

The payments processing company plans to incorporate Revel’s point-of-sale capabilities into its SkyTab POS system, Shift4 CEO Jared Isaacson said.

Gonzobanker

MAY 16, 2024

Digital metrics at banks and credit unions are not all trending up and to the right. But there are some bright spots. A new report on digital banking metrics and the impact that digital banking is having on banks reveals some positive developments, but also a host of troubling trends that should give bank executives cause for concern. The fourth edition of the Digital Banking Performance Metrics study from Cornerstone Advisors, commissioned by Alkami, captures digital banking metrics from banks

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

TheGuardian

MAY 16, 2024

Thirty-three constituencies, including two in London, will not have a single bank branch by the end of the year, says Which? The number of UK bank branches that have shut their doors for good over the last nine years will pass 6,000 on Friday, and by the end of the year the pace of closures may leave 33 parliamentary constituencies – including two in London – without a single branch.

Cisco

MAY 15, 2024

The Digital Operational Resilience Act (DORA) offers financial service institutions the chance to enhance operational resilience and competitive advantage through compliance, with Cisco providing a comprehensive suite of solutions to support FSIs in meeting these new regulatory requirements.

Payments Dive

MAY 14, 2024

The Federal Reserve Board said it has received some 2,500 comment letters regarding its Regulation II proposal to cut the fees that merchants are charged when they accept debit cards.

Commercial Lending USA

MAY 17, 2024

One of the largest companies that offers business loans is Commercial Lending USA. You can get money from them to help your business grow and stay ahead of the competition.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

MAY 14, 2024

Global provider of financial software applications Finastra has announced the completion of testing and certification for ISO 20022.

American Banker

MAY 15, 2024

As part of a sweeping digital enhancement of its consumer payment cards, Visa will enable banks to issue an account as a credit, debit, virtual or Pay in 4 installment loan, based on the user's preference at the time of purchase.

Payments Dive

MAY 13, 2024

The 5th Circuit Court of Appeals blocked the Consumer Financial Protection Bureau’s $8 late fee cap on Friday, but the federal agency said it will continue to “defend” the rule.

Commercial Lending USA

MAY 14, 2024

Businesses can get low-interest commercial loans to help them with things like growing, buying tools, or keeping track of their inventory.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

William Mills

MAY 14, 2024

In a constantly evolving world and financial landscape, understanding today’s trends will guide future decision making and allow banks and credit unions to prepare their financial institution for the future.

American Banker

MAY 14, 2024

Part of the Consumer Financial Protection Bureau's mandate is to educate consumers by providing reliable information. With its credit card late fee "report" and the associated rulemaking, it has failed to live up to that responsibility.

Payments Dive

MAY 17, 2024

The Consumer Financial Protection Bureau should revisit its rule affecting digital wallets, peer-to-peer payments and prepaid cards, writes one fintech group leader.

Commercial Lending USA

MAY 13, 2024

Explore Alternative Commercial Lenders with Commercial Lending USA. Fast approvals, flexible options, expert guidance. Contact us now!

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

Let's personalize your content